MTN Group increased its fintech transaction volumes by a third in its latest financial year, as it closes a deal with Mastercard that values the business at nearly R100-billion.

MTN Group increased its fintech transaction volumes by a third in its latest financial year, as it closes a deal with Mastercard that values the business at nearly R100-billion.

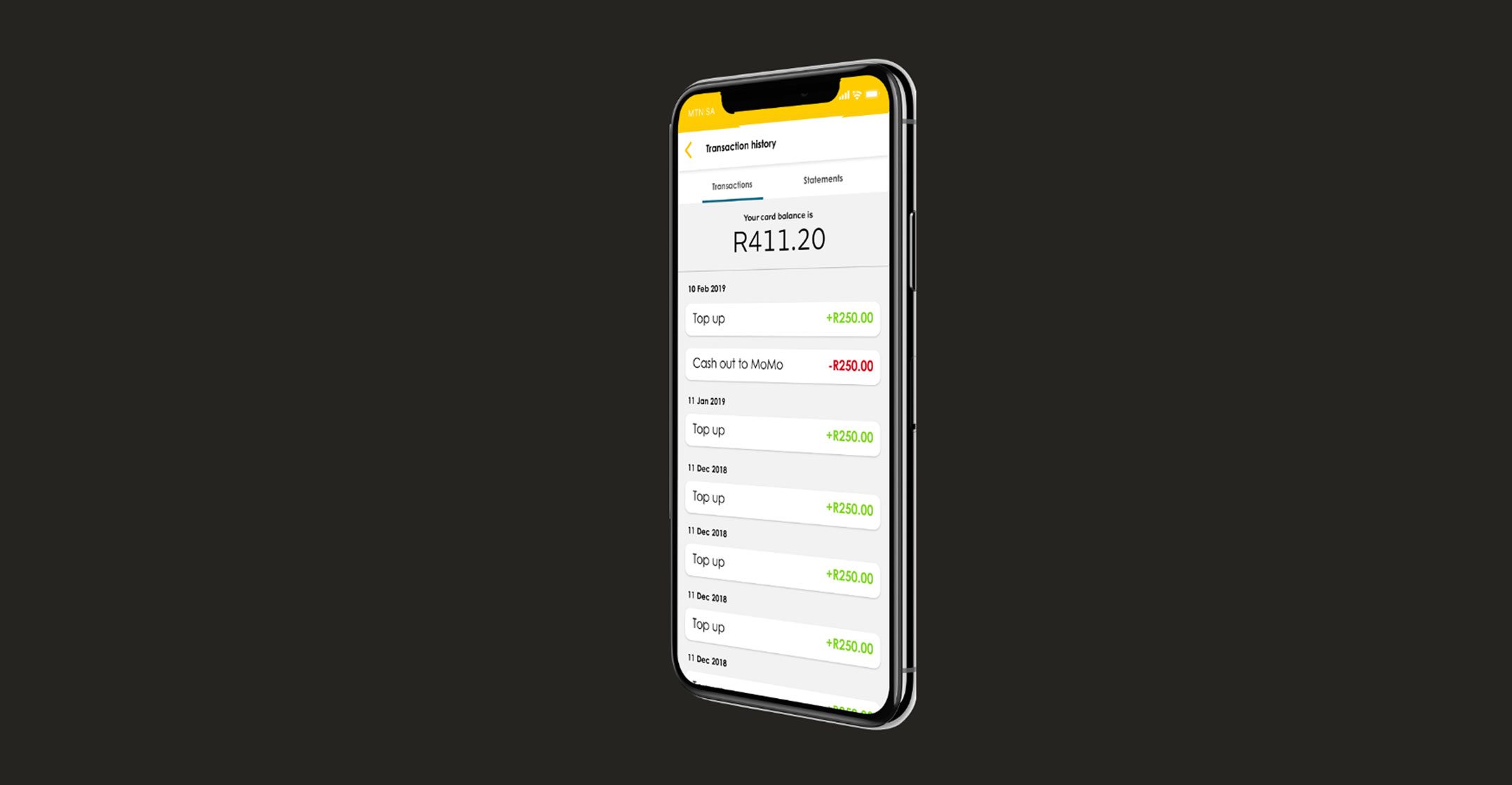

The African operator now has 72.5 million active users of its Mobile Money services, known as MoMo, it said in a statement released on Monday.

“The momentum in volume and value of MoMo transactions remained strong and were up by 32.2%,” it said.

Africa’s young, tech-savvy population is increasingly using mobile phones to bridge gaps in services including banking. This has opened a lucrative and fast-growing space in the fintech sector for wireless carriers.

MTN rivals including Airtel Africa, Nairobi-based Safaricom and South Africa’s Vodacom Group are all at various stages of transforming from basic voice and text mobile use to digitalisation, with a broad aim of separating and monetising the businesses in the longer term. Airtel Africa is mulling a listing for its mobile money business.

MTN said group service revenue growth slowed, increasing 6.8% to R210.1-billion in the 12 months to December, as its total number of subscribers climbed 2% to 294.8 million, according to its statement. MTN declared a final dividend of R3.30/share, less than analysts’ estimates.

Terrestrial cable

The company said it’s also started work on a terrestrial cable to connect 10 African countries. Many nations on the continent are currently struggling with a break in internet connectivity caused by damage to undersea cables.

MTN spent R41-billion in the past year enhancing network capabilities across its 19 markets, R10.1-billion of which was spent in South Africa — in part to deal with the country’s rolling power cuts imposed by state-owned monopoly electricity provider Eskom.

Inflation and the devaluation of the naira in its biggest market, Nigeria, resulted in much of MTN’s profit for the year being wiped out. — (c) 2024 Bloomberg LP