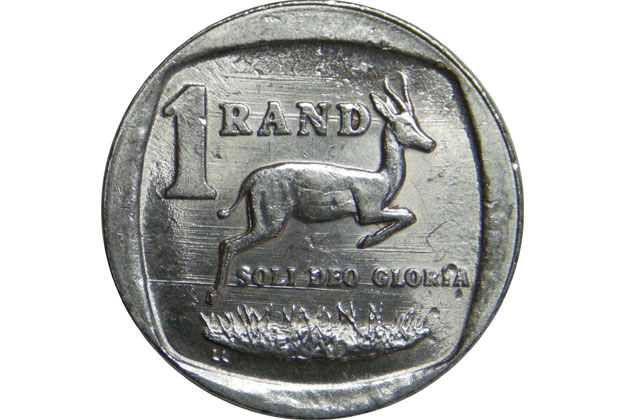

Finance minister Pravin Gordhan’s response to the Hawks directive helped the rand ease off its decline, but analysts said if he is arrested or fired the currency is heading for trouble.

Gordhan said on Wednesday he would not adhere to a Hawks request to present himself for a warning letter over corruption charges they have come up with, because these are “wholly unfounded on any version of the facts”.

“I have a job to do in a difficult economic environment and serve South Africa as best I can,” he said. “Let me do my job.”

The rand was down 1,8% against the dollar at R14,15/US$ at 8.30am on Thursday, slightly lower than when the JSE closed on Wednesday.

Umkhulu Consulting’s Adam Phillips said some rand operators thought there could be really big moves on Thursday.

However, he said “with Gordhan playing the latest chess move against the Hawks, it is back to them to make the next move”.

“While the president may not be officially involved in the game, it remains to be seen whether he makes his move before the end of the week.

“If he removed Gordhan, there would be a monumental weakness in the rand, but he also needs to watch his back.

“There was just as much talk yesterday of an early ANC national conference and Gwede Mantashe is possibly the key here.

“What is also clear is that the ANC is not united and plenty of former cabinet ministers are freely having their say.

“I am not sure how long the chess game will go on for, but the shock news now has everyone on tenterhooks and we have to gear ourselves up for some sort of announcement which will heavily affect the rand.

“Even if things calm down, the news out of South Africa has made yield players very concerned generally for playing in emerging market currencies and they could all suffer in the last quarter of the year once the holidays are over in the northern hemisphere.”

RMB analyst John Cairns said the market “is rating the latest political news as similar to that of February and May, the dates when the Hawks probe became public and when Gordhan responded.

“But it could be a lot more — quite possibly the end game for Gordhan. Certainly, the probability appears to be high enough that the market should build in a bigger risk premium.”

Political analyst Prince Mashele yesterday argued that the next week will be crucial. This is the period, he contends, in which the ANC heavyweights and society at large have to force President Zuma to get the Hawks to back down.

“Failing this, Gordhan could face arrest within weeks, providing grounds for a cabinet reshuffle and the appointment of new finance and deputy finance ministers.

“Mashele’s view is that Gordhan will ultimately be forced out of office. Former finance minister Trevor Manuel argued that this ‘will destroy the economy’, not literally of course, but you get the drift. We are busy canvassing more political analysts’ views on the matter,” said Cairns.

Andre Botha, dealer at TreasuryOne, said the market is suffering from “stuff-up fatigue”.

This is where market players are wondering what will be stuffed up next and hardly breaking a sweat any more when things go haywire, he said.

“This could be the case in the rand and although we saw an initial spike things are calming down, as the overwhelming feeling is that of déjà vu and the markets have not put the cart before the horses,” he said.

“This could mean that if worst comes to worst and Pravin Gordhan leaves his post as finance minister, the reaction will be swift and more to levels than we initially thought when the news first broke.

“It will also be interesting how the markets and the Hawks see the act of defiance of Mr Gordhan to not report to the Hawks, as he succinctly told the Hawks to leave him alone and let him carry on doing his job.

“The local storm could brew into something very ugly and the rand could bear the brunt of the feuding parties, and will be the main driver in the short term of the rand.

“As is normal in South African culture, we harp on about the worst possible outcome, but there is still the possibility that some civil agreement could come from this, and the rand return to previous levels. 2016 has been the year of surprises, so maybe the sensationalism has gone overboard and clearer heads will prevail.

“Today we could see the rand testing R14,20/$ again, but it could be very volatile as more news hits the airwaves. The R186 bond that was so heavily bought in the past months lost 50 basis points as the sentiment has switched against South Africa.”

In the US, the Jackson Hole symposium will start on Thursday, with the keynote address of the event on coming on Friday evening in the form of chair Janet Yellen.

“The market will scrutinise every single word for implied meaning of the thinking the Fed and when the rates will be hiked,” he said. “Will the Fed leave the market with more questions than answers? Most probably.”