My car is 11 years old this year. I’ve looked after it well, serviced it regularly, and only ever had one major mechanical issue. However, I use it very little. Since I work from home, I have clocked only a little over 6 000km in each of the last few years.

My car is 11 years old this year. I’ve looked after it well, serviced it regularly, and only ever had one major mechanical issue. However, I use it very little. Since I work from home, I have clocked only a little over 6 000km in each of the last few years.

Given that I still have to pay the full amount on my car insurance and the cost of an annual service, I began to wonder if it makes economic sense to keep the vehicle. Living in Cape Town means I can use Uber anywhere I need to go.

So, I set myself a task. I wanted to calculate whether it would be cheaper to keep the car, or to sell it and use the ride-sharing app to get wherever I might need to go.

For next year, Uber has raised its rate per kilometre to R8. That sets the benchmark.

The first and simplest calculation is to compare that against the rate per kilometre that the Automobile Association quotes on my car. The association provides a vehicle rate certificate specific to your vehicle, giving you a fair sense of what it costs to run that particular car.

The AA’s calculation, which also takes into account how much I use the vehicle, is that the total rate of running my car is R8.87/km. That is marginally more expensive than using Uber, so the first found goes to the ride-sharing app.

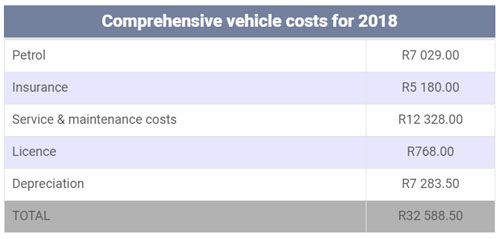

However, I also wanted to get a specific calculation for how much it was actually costing me to keep the vehicle. I keep track of all my car expenses for tax purposes, so I know exactly how much I have spent over the last year.

The one factor that isn’t definitive is depreciation. I assumed 20% depreciation on the value of the vehicle in the first year, and then 10% every year thereafter.

The table below consolidates all costs incurred so far this year (just 10 days short of a full 12 months):

That’s a fairly considerable figure for a car that I use so little. However, it works out to be R5.43/kilometre, which, even at Uber’s current rate of R7.50/kilometre, is noticeably cheaper than using the ride-sharing app. In total, if I had used Uber for 6 000km this year, it would have cost me R45 000.

That’s a fairly considerable figure for a car that I use so little. However, it works out to be R5.43/kilometre, which, even at Uber’s current rate of R7.50/kilometre, is noticeably cheaper than using the ride-sharing app. In total, if I had used Uber for 6 000km this year, it would have cost me R45 000.

It’s also worth considering that the car was due for a major service this year, which considerably increased the maintenance costs from 2017. I also replaced the battery. Next year, I would anticipate total service and maintenance to therefore be lower.

There is, however, always the risk that something unforeseen happens. Having to replace a gearbox or overhaul the engine could suddenly make paying for Uber seem like a more appealing option.

The other consideration, of course, is that if I sold the car I would have that cash. The vehicle is not worth much, but I have received an offer of R60 000.

That’s where this gets interesting, because if I invested that money the return I earn would be cancelling out some of the difference. At a theoretical 10%/year, compounded monthly, I would earn R6 282.78 in the first year. That would still place me at around R6 250 under water by using Uber.

By year eight, however, I would be seeing a return of over R12 500/year. At current costs, I would therefore be breaking even. From that point onward I would be saving more by using Uber.

This is, of course, using the assumption that the difference in cost between owning my own car and using Uber would stay constant over this period. It’s difficult to know how accurate that assumption might be, given that future costs are unknowable. However, it doesn’t seem to be a wildly unfair position to take given that an ageing car would also likely become increasingly expensive to maintain.

Conundrum

This all makes for a very interesting conundrum — even more so when one also looks at non-financial considerations, particularly the question of convenience. How much is it worth to have a vehicle available to take my dogs to the vet or go on holiday? Conversely, how much is it worth to have someone drive you everywhere and not have the stress of dealing with Cape Town traffic and inconsiderate road users?

Do those cancel each other out? It’s difficult to know.

For now, I’m keeping the car. The next time it costs me money, however, I might rethink that position.

- This article was originally published on Moneyweb and is used here with permission