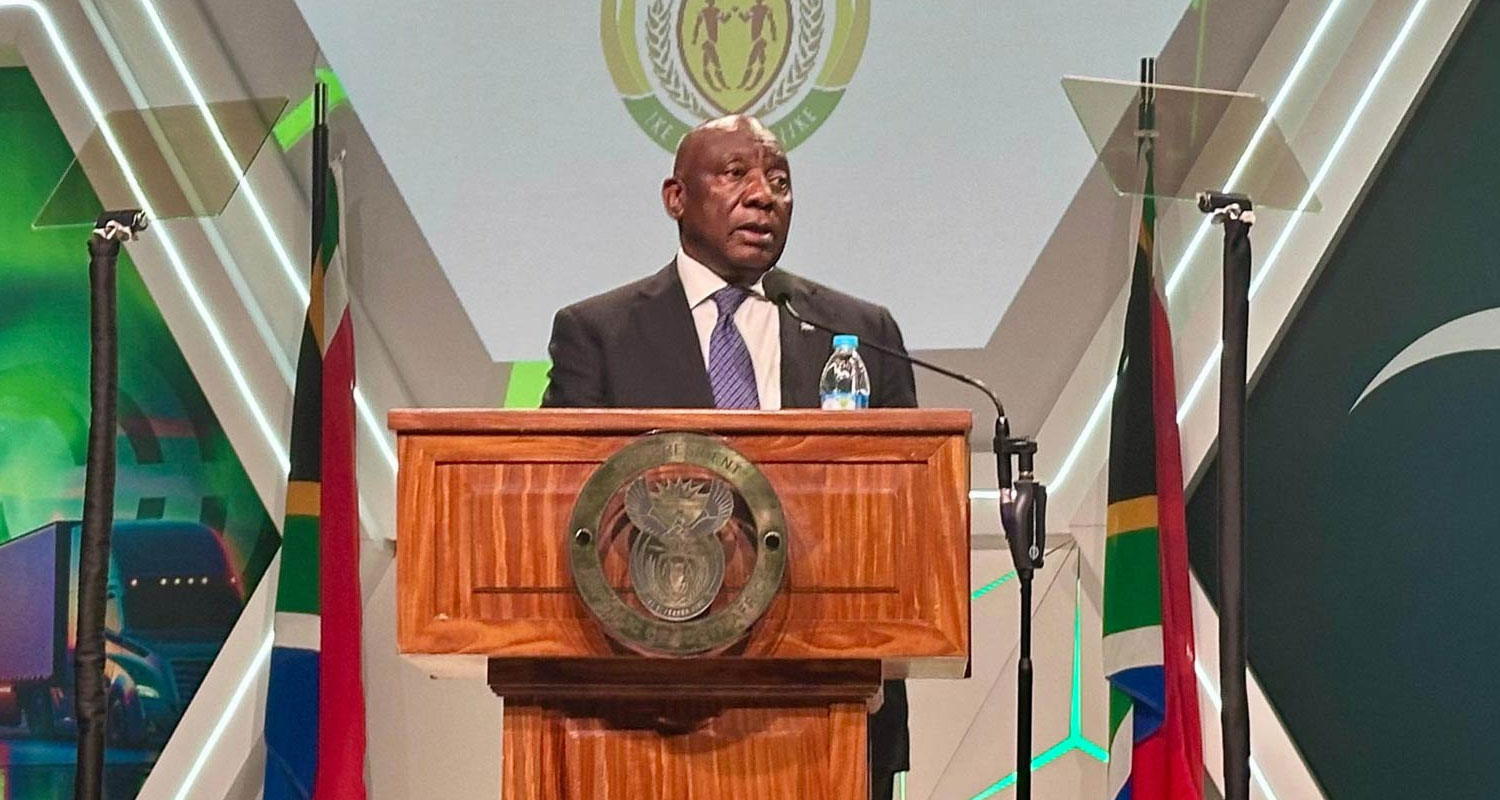

President Cyril Ramaphosa’s announcement last Thursday that South Africa is considering tax rebates or subsidies to encourage the adoption of electric cars has been widely welcomed.

Ramaphosa made the announcement at South African Auto Week 2024 in Cape Town, a gathering of industry leaders and other role players in the automotive sector organised by Naamsa | The Automotive Business Council.

The president’s plan is in addition to the planned incentives announced in February aimed at encouraging automotive brands with local manufacturing plants – they include the likes of Ford, Volkswagen, BMW and Mercedes-Benz – to build so-called new-energy vehicles in the country.

Greg Cress, principal director of automotive and e-mobility at professional services firm Accenture, described Ramaphosa’s announcement as a “very positive move” for the industry – and for consumers.

“It’s what the industry has been waiting to hear, and the fact that it has been made at the highest level hopefully gives a strong signal of intent that government is listening to the industry,” Cress told TechCentral.

What the EV subsidies and rebates might look like, or even when they’ll be introduced, is unclear at this stage, but industry players have expressed their optimism that it could trigger an upswing in EV sales in a country where ICE (internal combustion engine) cars still make up more than 99% of the new vehicle market. Indeed, although sales of pure-electric cars almost doubled in 2023 to 931 units, this was a drop in the ocean compared to the more than 530 000 ICE vehicles sold.

Luxury tax

Even before tax rebates and subsidies, there are some moves national treasury could make to ease the burden on the price of a new EV for a consumer, said Cress.

“Firstly, there could be an adjustment to the minimum threshold of the ad valorem luxury tax scale, to move, for example, cars that cost less than R500 000 out of the luxury range, irrespective of the drivetrain,” he said.

“Secondly, an adjustment to the import duties applied to EVs could be considered, to at least bring this in line with ICE vehicles, to 18%, instead of the 25% it’s set at now. But I cannot speculate as to whether this will change because of the president’s announcement.”

Read: South Africa weighs subsidies and rebates to boost electric car sales

Beyond these two tax levers, for consumers, a tax rebate of say R30 000 or R50 000 – to be deducted from taxable income, much in the same way as the solar panel rebate was applied – “might be what we see here”.

“This could be for a limited time – say, three to five years – and monitored by Sars and adjusted upwards or downwards, or removed completely, depending on the impact it makes on EV sales in South Africa, Cress said.

“We also need to learn from other markets where rebates have been applied, in order to protect the residual value of second-hand EVs that will come back into the market in future.”

“We also need to learn from other markets where rebates have been applied, in order to protect the residual value of second-hand EVs that will come back into the market in future.”

Hideki Machida, automotive industry leader at KPMG, described Ramaphosa’s speech at South African Auto Week as “significant”. It was delivered to an audience that included trade, industry & competition minister Parks Tau, who has responsibility for developing industrial policy.

“Looking back over the past few years, the perceived support from the government for the automotive sector has been anything but stellar, but I am hoping that this will be a new trend we will see from government acknowledging the importance of the sector in South Africa,” he said.

Asked how he believes the tax rebates and subsidies for consumers might work, Machida said they should be applied in two areas.

“One could be linked to the current incentive schemes such as the ‘Production Rebate Credit’, which can continue to provide additional support to the automotive manufacturers while linking it to ways of reducing the ad valorem taxes on vehicles imported,” he explained.

“The other would be the reduction in taxes at the point of sale of the vehicles, which can be applied for a limited time to create the short-term stimulating effect needed for battery EV sales to take off. By the time momentum is established, we can expect vehicle prices to continue to decline, which hopefully will give us leeway up to the inflection point to allow for organic growth to take over.”

Government fleets

Machida said there are “other levers” government could use to stimulate EV demand – like converting government fleets to electric.

Accenture’s Cress said it’s ultimately about “finding the balance between the supply side and the demand side of EVs in South Africa”.

“One cannot exist without the other. I believe the demand side should be prioritised, as a healthy, growing domestic demand for new energy vehicles in South Africa will send the right signals to the head offices of the OEMs (original equipment manufacturers) that have already invested in manufacturing operations in South Africa that the time is now to consider new energy vehicle production here (some have already done so), and leverage the manufacturing-side incentives to upgrade their plants to be ready to produce EVs for both domestic consumption and export.”

In a statement responding to Ramaphosa’s speech at South African Auto Week, Naamsa said it welcomed the president’s announcement on the finalisation of comprehensive policy guidelines for new-energy vehicles and that they will include hybrids and plug-in hybrids.

Alongside incentives for manufacturers and subsidies for consumers, Ramaphosa’s announcement last week is a “crucial step towards the widespread adoption of cleaner, more sustainable vehicles”, Naamsa said.

“These measures will ensure that South Africa remains part of the global supply chain as major trading partners shift towards EVs. We look forward to working with the new minister of trade, industry & competition, Parks Tau, and his two deputy ministers and other government departments on the implementing these policies to ensure our industry remains future-focused and globally competitive.” — © 2024 NewsCentral Media

Get breaking news from TechCentral on WhatsApp. Sign up here.

Don’t miss:

We drove five electric cars across South Africa – a photo essay