Ever since Donald Trump fired the first shot in the US trade war with China, one technology company has been sitting in the middle, trying to avoid the crossfire.

Browsing: Intel

Regulators are moving to let US companies participate in technology standards-setting bodies alongside Huawei Technologies, despite the Chinese firm being blacklisted in the US over security concerns.

Apple is planning to start selling Mac computers with its own processors by next year, relying on designs that helped popularise the iPhone and iPad, according to people familiar with the matter.

The coronavirus pandemic has pressured nearly every corner of the global economy, but analysts continue to see sunny days ahead for cloud computing and the ecosystem that surrounds the technology.

Intel is trying to sell its new laptop chips in an old way – by emphasising their speed. It’s touting the clock speed of its new H line of processors, citing their ability to process data at more than 5GHz.

Huawei Technologies, the Chinese technology giant barred from doing business with US suppliers, is finding a way around the strict limits imposed by the Trump administration.

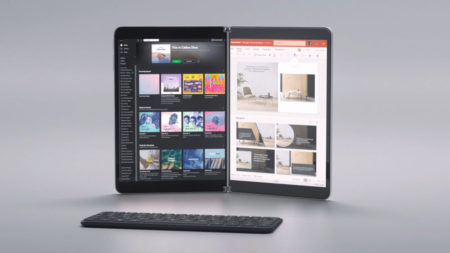

Microsoft has become the latest technology giant to reduce its quarterly outlook based on the outbreak of a novel coronavirus that’s slowing production of computers.

Researchers were able to trick a Tesla vehicle into speeding by putting a strip of electrical tape over a speed limit sign, spotlighting the kinds of potential vulnerabilities facing automated driving systems.

The wireless industry scrapped its biggest annual showcase after the coronavirus outbreak sparked an exodus of participants, roiling telecommunications companies just as they’re preparing to roll out new 5G services.

Intel has become the latest high-profile technology company to withdraw from upcoming trade show Mobile World Congress over concerns about the spread of coronavirus.