Tencent allowed users of its main WeChat social media service to link to rivals’ content, taking initial steps to comply with Beijing’s calls to end walled gardens.

Browsing: Tencent

Tencent Holdings is set to lose its place among the world’s 10 largest companies by market value, leaving no Chinese names in the list.

Tencent and NetEase shed more than $60-billion of value on Thursday as investor fears grow that Chinese regulators are preparing to tighten their grip dramatically on the world’s largest gaming industry.

Chinese gaming and media stocks including Tencent and NetEase fell on Thursday, a day after authorities summoned them to ensure they implemented new rules for the sector.

Tencent investor Prosus – the spinoff of JSE-listed technology and media conglomerate Naspers – is placing its bet on India as the next big technology market.

China’s new rules forbidding under-18s from playing videogames for more than three hours a week knocked shares in Tencent, while young players took to social media to express their outrage.

Technology investor Prosus said on Tuesday it had agreed to buy Indian payments platform BillDesk for $4.7-billion to complement its own PayU business.

China will forbid minors from gaming more than three hours most weeks of the year, imposing their strictest controls yet in a blow to the world’s largest mobile gaming arena.

Chinese regulators are seeking to implement far-reaching rules about the algorithms technology companies use to recommend videos and other content.

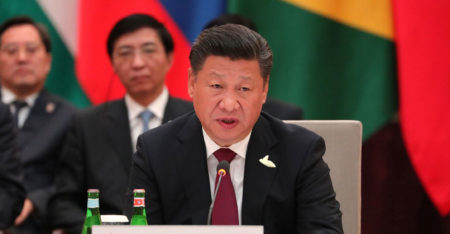

President Xi Jinping has increasingly emphasised the idea of “common prosperity” as the Communist Party tries to address the country’s wealth gap.