State-owned ports manager Transnet’s inefficient management of South Africa’s maritime infrastructure is distorting the country’s technology goods market.

Delays at port have negatively impacted some retailers’ ability to meet demand, experts have said.

“In the past six weeks, we’ve seen container turnaround time depreciate by 300%. On an anecdotal level, we have missed critical deadlines for Black Friday for large bricks-and-mortar retailers. We are going to lose those opportunities,” said Tim Humphreys-Davies, CEO of Pinnacle ICT, a local technology distributor and part of the Alviva Holdings stable.

Pinnacle distributes electronic equipment ranging from computers, laptops and televisions to point-of-sale terminals, networking routers and switches as well as CCTV components. While smaller items such as laptops (and smartphones) can avoid the maritime ports completely by being flown in, Humphreys-Davies said seasonal planning for Black Friday and the festive season is usually done three to four months in advance.

Also, for larger, heavier items such as desktops, large-screen TVs and white goods, shipping is the only viable option. “You can’t fly desktops in; we need to see lanes open and they need to be efficient,” said Humphreys-Davies.

The congestion crisis facing South Africa’s ports may come as a surprise to some but is in some sense a predictable outcome of a ports management function that has been deteriorating for years. Two consecutive World Bank reports have ranked South Africa’s terminals as among the worst performing in the world. The most recent rankings place Port Elizabeth at 291, Durban at 341 and Cape Town at 344 – out of 370 measured. That was before the current crisis.

‘Vital link’

“Poorly functioning or inefficient ports can hinder trade growth. The port, along with the access infrastructure (such as inland waterways, railways or roads) to the hinterland, is a vital link to the global marketplace and needs to operate efficiently,” said a World Bank blog post in May.

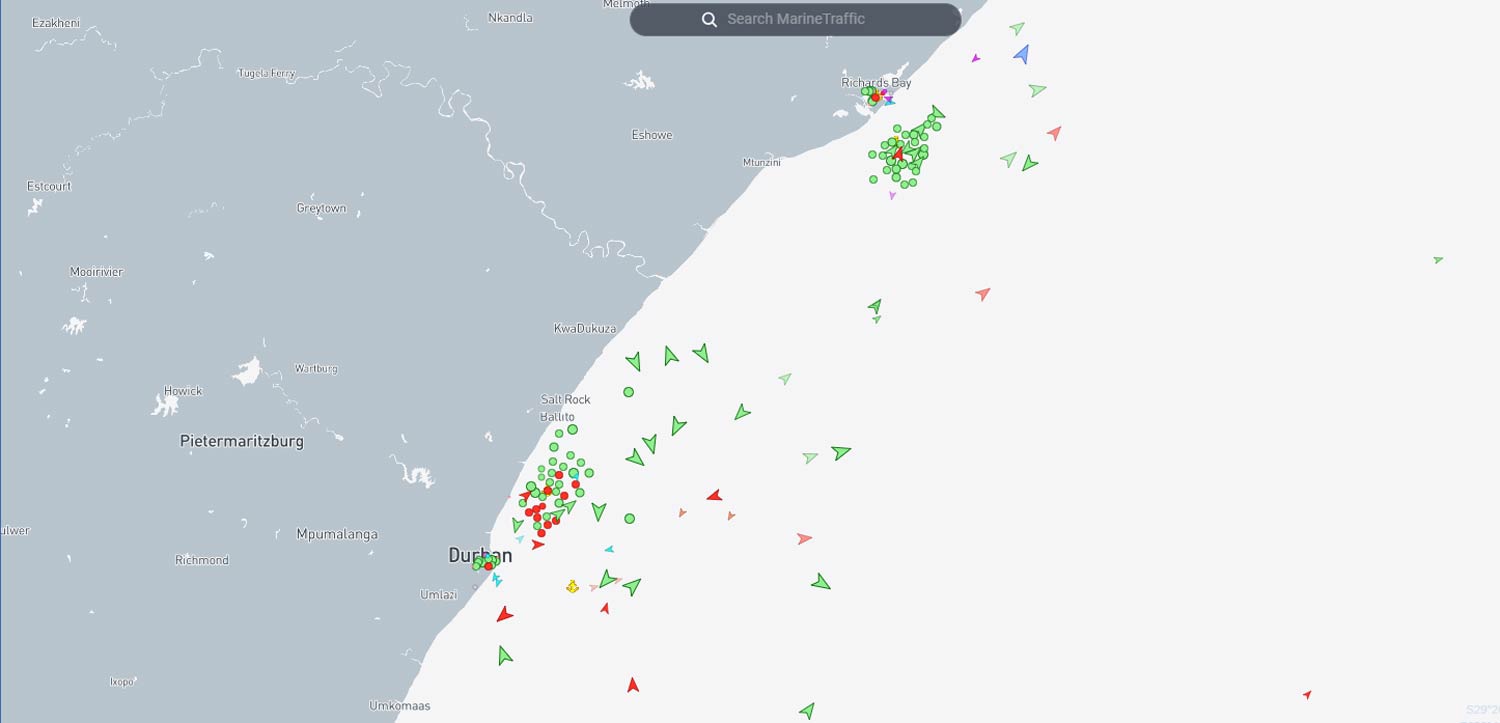

South Africa’s inefficiencies are evidenced by long queues of ships out at sea waiting to dock as well as more visible queues of trucks inland either waiting to deliver or collect goods from the harbours. The “idle” time increases the amount of fuel spent to get goods to retailers and consumers.

Read: Transnet mess is killing South Africa’s economy

“We have already seen 15% increase in costs, which is typically normal, but we modelled on ‘x’ and not ‘x+15’. So now the question is, do we have the capacity to pass those on [to customers] or do we erode margins?” said Humphreys-Davies.

To get around the delays, some shipping lines have tried going to port in neighbouring countries and then driving the goods into South Africa, but this solution has its own problems, he said. “Some are looking at Maputo but there is a 40km truck backlog on the Mozambican border.”

Some sectors of the technology ecosystem have not been as hard hit as others. In the renewable energy space, prior overestimations of demand might now serve suppliers well as port delays increase the likelihood of shortages in the coming quarter. “South Africa is sitting with a fairly big oversupply of panels and batteries, but inverters might run out first,” said David Neale, CEO of solar installations specialist Metrowatt.

But those suppliers currently sitting with extra inventory may soon see their cushions erode if port delays are not resolved soon.

“We have a plan,” said President Cyril Ramaphosa on a visit to the Richards Bay port at the weekend, but industry observers have doubts about how soon the situation can be turned around. – © 2023 NewsCentral Media