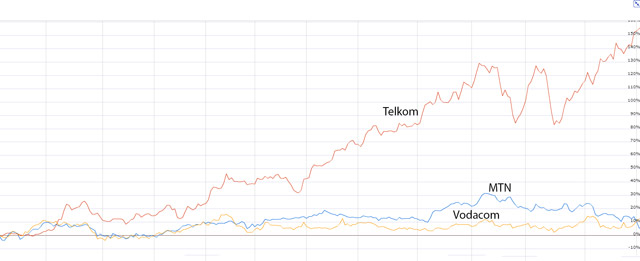

The strong rally in Telkom’s share price has continued, with the counter touching a fresh five-year high of R70 in early trading on the JSE on Tuesday. Since its low point 18 months ago, Telkom’s share price has now climbed by just shy of 500%.

A R10 000 investment in Telkom on 6 May May 2013, when its share bottomed at R11,93/share, would today be worth R48 676.

The last time Telkom’s share price traded at such levels was before it disposed of its 50% stake in Vodacom in May 2009. Telkom sold 15% of its stake in Vodacom to the UK’s Vodafone and disposed of the remaining 35% it held in the mobile operator to shareholders.

Instead, Telkom decided to build its own mobile network. The current management team has admitted that disposing of Vodacom was a strategic mistake.

However, renewed enthusiasm by shareholders — brought about by changes being implemented by the executive management team under CEO Sipho Maseko and chief operating officer Brian Armstrong — has lit a fire under the shares.

Its market capitalisation, though still far short of mobile rivals MTN (R407bn) and Vodacom (R198bn), has climbed significantly to reach R36bn on Tuesday. At its low point, its market cap had fallen to just R6bn. Its price-to-earnings multiple — a measure of how cheap or expensive a stock has become — has also risen sharply to 17, above MTN’s 14 and Vodacom’s 15.

In the past 12 months, Telkom’s share price has gained 155%. In the past 90 days alone, it has added 40% on growing investor confidence that management will be successful in engineering a turnaround.

The improvements have come despite continued challenges in Telkom’s core fixed-line business.

The number of fixed-line in service fell to just 3,5m at the end of September, from 3,7m a year ago.

“We still face significant challenges in our fixed-line voice revenue as fixed-to-mobile substitution continues. Fixed-line data revenue continues to be impacted by lower pricing driven by competition,” Telkom said last month when it released its interim results for the six months to September.

Group operating revenue decreased by 0,5% to R15,9bn, driven lower by the “continuous decline in fixed-line voice revenue and lower data leased-line revenue resulting from self-provisioning by other licensed operators, partly offset by higher mobile revenue”.

Fixed-line voice usage revenue fell by a sharp 12% to R3,6bn due to a 6,1% decline in voice minutes, resulting from fixed-to-mobile substitution, and a 4,9% decline in the number of lines. The decrease was predominantly in residential lines, but business lines also decreased due to the consolidation of business activities and cost-saving initiatives, Telkom said.

Fixed-line subscriptions revenue grew 0,7% to R3,9bn following line rental tariff increases of about 6% during the past year.

For its mobile business, the picture is looking rosier. The number of active mobile subscribers rose by 26,7% to reach 2m by the end of September.

The mobile unit’s loss (measured before interest, tax, depreciation and amortisation) decreased by 50,7% due to higher service and subscriptions revenue (excluding equipment sales) that was 48% up. Mobile data revenue rose by 39,3%.

Mobile voice and subscriber revenue increased by 54,7% to R348m (from R225m) thanks to a 26,7% increase in the number of active mobile subscribers and a 22,4% increase in the average revenue per user.

Negotiations with MTN, first announced in March, are continuing. The two companies hope to expand their existing roaming agreement to include bilateral roaming and the outsourcing of the operation of Telkom’s radio access network. This has cheered investors as it should help Telkom reduce losses in its mobile division.

Capital expenditure on mobile in the six months to September decreased by a massive 79,9% to R164m (R815m before) due to the shift to a more concentrated roll-out in major metropolitan areas. “The current focus on the radio access network is to complete existing projects and to provide capacity to relieve congestion in identified growth areas.”

The group recorded a profit after tax of R1,2bn for the six-month period, down from R3bn in 2013, though the year-ago figure was influenced by a one-off R2,2bn net gain recognised on the curtailment of its post-retirement medical aid liability and retrenchment, voluntary early retirement and severance package costs of R325m for 406 employees in the 2014 interim reporting period.

On a normalised basis, Telkom reported a profit after tax of R1,4bn from R791m in the same period last year. Earnings before interest, tax, depreciation and amortisation was R4,4bn (from R3,9bn), resulting in a 14,9% increase in headline earnings per share.

Group capital expenditure was also given the bullet, decreasing by 42,8% to R1,8bn (from R3,2bn), representing 11,4% of group operating revenue from 19,8% a year ago. — © 2014 NewsCentral Media