In November, at the half-year stage, I highlighted that Telkom was facing crises on a few fronts and that only one part of its business — mobile — was firing on all cylinders (read: Telkom: the good, bad and ugly).

With full-year numbers available, certain trends are clearer. Some look better, while others have worsened.

The very good

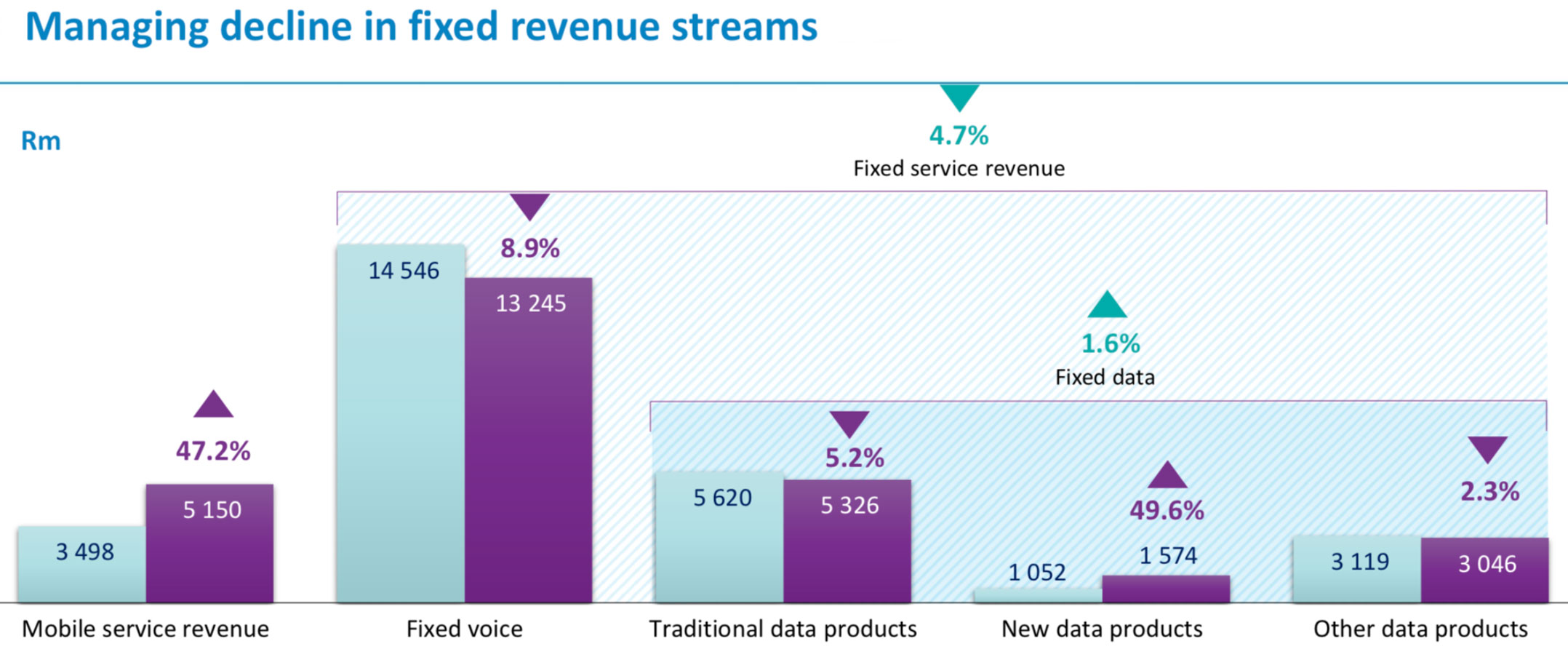

Still good — actually great — is the performance from its mobile business. Service revenue — data and calls (excluding any device sales) — is up 47% to R5.1bn. This is nearly as much as it generates from so-called “traditional” fixed-line data products (read: ADSL). Importantly, the rate of growth is increasing year on year. Subscribers are up healthily, even though churn in the prepaid base remains stubbornly high, and mobile data is the engine of that growth. One way of looking at it is that Telkom has more mobile subscribers using data only (through dongles and routers) than it has ADSL subscribers (874 000 versus 865 000, respectively). Over half a million of these are high-speed LTE customers.

The not all bad

The burning platform — transitioning ADSL customers to its own fibre services — is still on fire. It is making headway, but it is still losing DSL lines at a faster rate than it is connecting fibre lines to customers. In the year since April 2017, it lost 91 005 ADSL customers (excluding internal lines), but in that same period only added 69 696 fibre connections. For every 100 ADSL lines it lost last year, it only gained 77 fibre ones. This situation is exacerbated by the fact that, for now at least, ADSL customers are more profitable than fibre ones. The race to ensure that ADSL customers switch to its fibre network (instead of abandoning Telkom for other providers) is still on. While the “attachment” rate — connected customers out of the total number of passed homes — has improved to 30.7% (from 18% last year), it can improve further. It could be worse.

The not bad…

It is holding its own in its Internet service provider business, which provides bandwidth (or uncapped connectivity) to ADSL or fibre customers. In March 2016, only 53% of ADSL (including higher-speed VDSL) customers used Telkom as their ISP. With smarter and more aggressive bundling, the packages became far more compelling. By March 2017, that number was at 69%, which it has held as of March 2018. On the fibre side, it achieved a similar rate (27 000, or 68%) by March last year on a relatively small base of connectivity customers (about 40 000). That has dropped this year to 57% of its 109 336 active fibre lines.

The ugly

Fixed-line voice traffic continues its steep decline. In the 2018 financial year, Telkom carried 11% fewer voice minutes on its network than in the previous year. A drop from 13.6m to 12m minutes is significant. In just five years, this number has shrunk by a third, from 18.4m in 2013. But these lines are incredibly lucrative. Each fixed voice line generates average revenue of R361/month. While not a direct comparison, the average revenue per user (Arpu) for its mobile contract customers is just more than half of that (R191.90).

Telkom has 2.68m fixed access lines, a drop of 9.3% year on year. The problem is that the rate of decline is increasing, not slowing.

Continuing to manage the decline from traditional revenue to new technologies actively is critical. Telkom itself makes the point that margins in next-generation services are lower: “In some products and services, we need to grow volumes by 2x to 2.5x to compensate for the variance in pricing”.

Beyond the easy cuts

All the “easy” cuts have been made. Staff numbers in Telkom are far more realistic. A dogged focus on getting the mobile business to work is paying off. Imagine what this group would look like without a profitable and growing mobile unit!

But the acquisition of BCX in 2015, which allowed Telkom to compete in the enterprise space, hasn’t yet delivered. Remember that without BCX, Telkom’s group revenue would be somewhere around half of what it is today (BCX reported operating revenue of R21bn of the R41bn total). BCX is of the scale to make a meaningful impact with even modest growth.

Reversing Telkom’s enterprise business into BCX had the (unintended?) consequence of its public sector revenue dropping by R1.6bn in the past 12 months, mainly because of a drop in fixed-line voice subscriptions from government. Revenue from the large and medium enterprise segments grew by R600m. This means the core of BCX is healthy.

A lot has been done since the acquisition, but because of the nature of its business, we’ll only start seeing the results of changes implemented in the past year or two in the next 12 months.

Mobile cannot be Telkom’s only growth engine. Telkom has to get BCX growing.

- This article was originally published on Moneyweb and is used here with permission