Two US senate Democrats are urging three payment processing companies to reconsider their involvement with the libra cryptocurrency project envisioned by Facebook and a coalition of other groups.

Two US senate Democrats are urging three payment processing companies to reconsider their involvement with the libra cryptocurrency project envisioned by Facebook and a coalition of other groups.

Libra poses risks not only to global financial systems, but also to the companies’ broader payments business, senator Sherrod Brown of Ohio and senator Brian Schatz of Hawaii said in letter on Tuesday to Visa, Mastercard and Stripe.

In the letter, the lawmakers cited news reports on the difficulty some of Libra Association members have faced in obtaining details on the organisation’s management and risks.

The association is composed of a group of 27 members including Facebook and the payments companies, as well as a swathe of tech companies like Uber Technologies, telecommunications providers Iliad and Vodafone Group, and cryptocurrency companies like Coinbase.

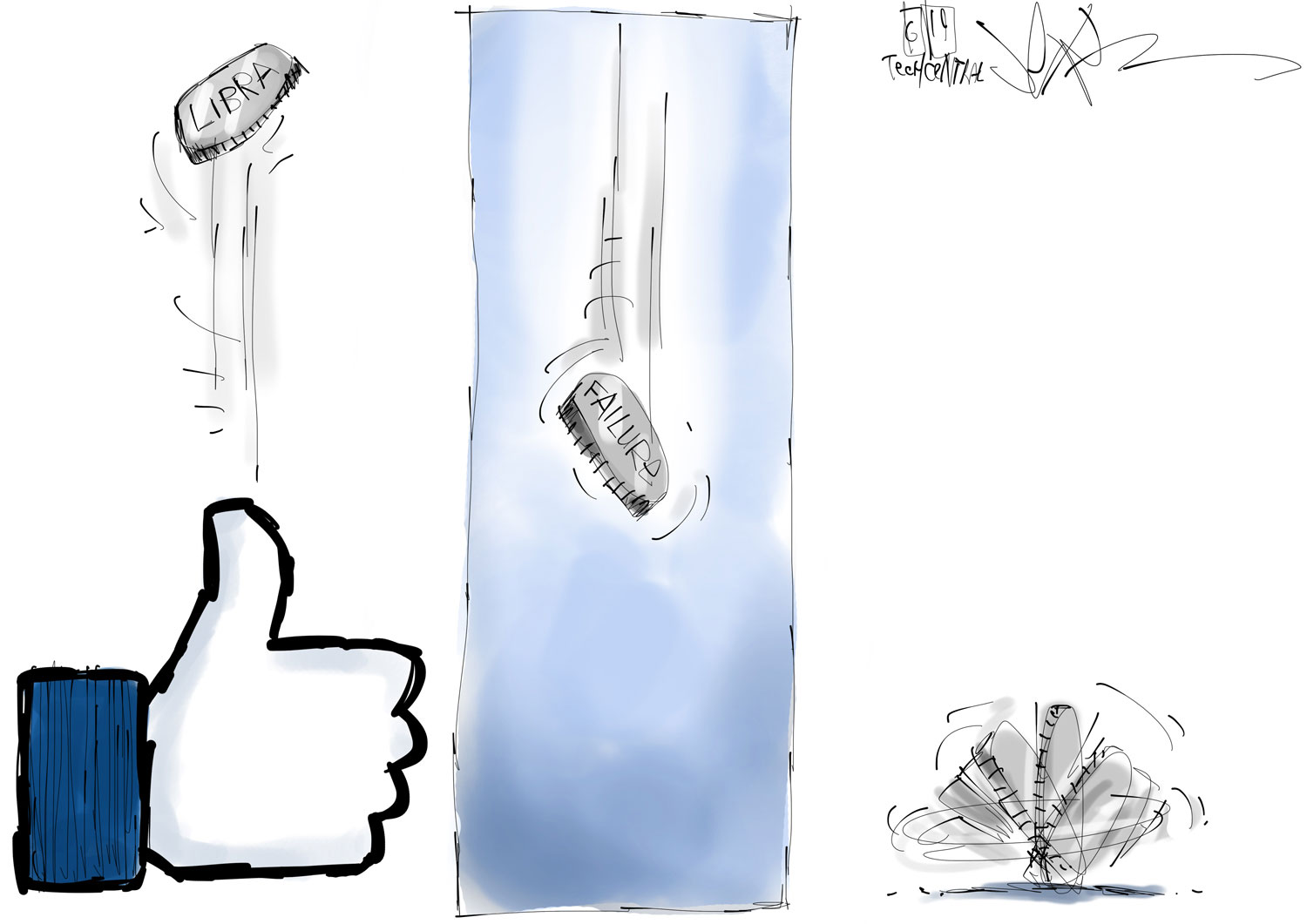

PayPal, one of the original members, confirmed it had left the organisation on 4 October.

In a statement, Brown, the senior Democrat on the banking committee, and Schatz, a panel member, said they pointed out in the letter that “congress, financial regulators and potential Libra Association member companies have struggled to get sufficient details from Facebook about risks that libra may pose, including facilitating criminal and terrorist financing, destabilising the global financial system, interfering with monetary policy, or exposing consumers to risks currently limited to accredited investors.”

‘You should be concerned’

“We urge you to carefully consider how your companies will manage these risks before proceeding, given that Facebook has not yet demonstrated to congress, financial regulators — and perhaps not even to your companies — that it is taking these risks seriously,” they said in the letter.

“Facebook,” the senators added, “is currently struggling to tackle massive issues, such as privacy violations, disinformation, election interference, discrimination and fraud, and it has not demonstrated an ability to bring those failures under control.”

“You should be concerned,” Brown and Schatz said, “that any weaknesses in Facebook’s risk management systems will become weaknesses in your systems that you may not be able to effectively mitigate.”

“You should be concerned,” Brown and Schatz said, “that any weaknesses in Facebook’s risk management systems will become weaknesses in your systems that you may not be able to effectively mitigate.”

A spokeswoman for MasterCard declined to comment, as did a spokesman for Visa. Representatives for Stripe, Facebook and the Libra Association did not immediately respond to requests for comment.

In July, both Republican and Democratic senators had pointed questions for Facebook at a banking committee hearing over its digital currency plans. That session reflected the scepticism across Washington and underscoring the challenges the company faces in getting libra off the ground. — Reported by Lydia Beyoud and Joe Light, with assistance from Kurt Wagner, Julie Verhage and Jenny Surane, (c) 2019 Bloomberg LP