There can be little argument that over the last 10 years, Naspers has been one of the best investments in the world. The share price has seemed to be on an unstoppable growth trajectory as it has gained year after year.

Despite concerns around its valuations, the share price is up around another 30% over the course of 2015. It is now trading on a price-to-earnings (p:e) multiple of over 90 times, and a forward p:e of between 30 and 45 times.

The market nevertheless seems to have an insatiable appetite for the counter. Analysts remain largely bullish on its prospects.

“Naspers is a transformative company,” says Anthony Rocchi, portfolio manager at Rexsolom Invest.

“They have captured the trends evolving in e-commerce and how we consume media. While it’s very hard to forecast what Naspers is going to look like in five years’ time; you can use your imagination to think how it could grow along with the e-commerce market.”

The suggestion is that the expectations that investors have of this company remain justified, and that it remains a good long-term investment. However, market watchers will be keeping an eye on four particular themes that will dictate how the counter is likely to perform.

The rand

The first is what happens to the local currency. Given that the majority of its value is now derived from offshore, Naspers has become a rand hedge play.

If the rand were to remain subdued or lose further ground against the dollar, this would therefore be good news for the company. A significant strengthening in the local currency would however be a major headwind.

Given South Africa’s current fiscal position, the more likely scenario would be that the rand remains under pressure. That suggests this is a positive for Naspers.

Tencent’s earnings

The bulk of Naspers’s valuation is its holding in Chinese company Tencent. The spectacular growth in this business has been the major driver of Naspers’s own growth surge, and as long as Tencent continues to deliver, the market’s view on Naspers is unlikely to change.

Some concerns have been raised about Tencent’s valuation and the fact that it is trading at very demanding multiples itself, but most analysts believe that the potential earnings warrant these ratings.

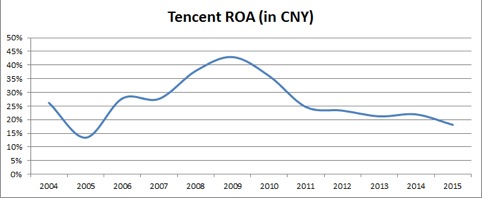

“We are very happy with what we see in Tencent,” Rocchi says. “The cash flows are very good, so I believe that what they are seeing is real because the cash flows look real. Also, if I look at its profitability in terms of return on assets (ROA) in renminbi, they have been growing earnings at breakneck speed, but the company has kept profitability in tact.”

As the below graph shows, Tencent’s ROA has been steady even as earnings before interest and tax (Ebit) have been growing at 33% per annum.

This paints a positive picture. However, the question is what happens if this isn’t maintained.

Portfolio manager at Mergence Investment Managers Peter Takaendesa says a step down in the growth rate at Tencent is probably the biggest risk that Naspers faces.

“From a market point of view, the rating seems to be pricing in more of the same good execution,” says Takaendesa. “Once the market starts doubting that, however, that could be a turning point.”

Returns from pay TV

Nasper’s pay-television business, MultiChoice, has been the cash cow on which everything else has been built. The money it generates there has allowed it to make its other investments around the world.

“That’s the beauty of having a highly cash-generative business,” says Nadir Thokan, investment strategist at 27Four Investment Managers. “They are able to draw on their war chest to go on an acquisition spree and to increase the barriers to entry in this business itself.”

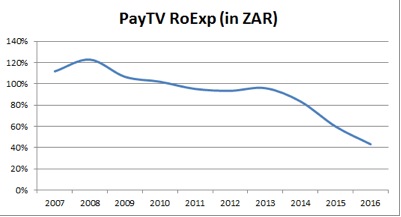

Over the last few years, however, there has been a significant decline in the pay-TV division’s return on expenditure, as the below graph shows:

Inflation in development spend and the cost of acquiring programming is running ahead of the revenue growth from subscriptions, and if this doesn’t bottom out it will have an impact on Naspers’s business model. Analysts do see this as a concern, although it is not yet at alarming levels.

“As long the business continues to remain cash-flow generative and it’s not overspending relative the subscriber base, they can continue to draw down on the war chest,” says Thokan. “If it was a mining business where the balance sheet was already strained that would be concerning. But this is not a company with an impaired balance sheet.”

Loss-making e-commerce assets

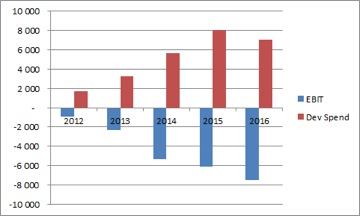

Currently the majority of e-commerce businesses in which Naspers is invested are not adding to company earnings. As the below table shows, losses in the group’s e-commerce cluster have actually been increasing every year.

What the graph also shows, however, is that development spend on this sector is also likely to peak in 2015 and decline going forward. The message from Naspers is that it has made its investments into this cluster and is now going to let them monetise.

Rocchi says that this is something he will be watching closely. He will be looking for these losses to start bottoming out and reversing, as these businesses represent the blue sky that investors are paying up for in Naspers.

“As an investor, you are hoping that this cluster will produce the next Tencent,” he says. “If it doesn’t, I think the share price could come under pressure because investors will say: you keep throwing money into this cluster, but where is the next big thing?”

Takaendesa agrees. Although Naspers has already admitted failing and pulled out of a number of smaller investments, it’s the larger ones that really need to perform.

“I don’t think the current e-commerce losses on their own would be enough to change the market view,” he says. “I’m only expecting e-commerce to reach breakeven after 2018. But if there was a big failure somewhere like India or Brazil, then the market would lose faith, particularly following the change in management with Bob van Dijk having taken over from Koos Bekker as CEO.”

- This piece was first published on Moneyweb and is used here with permission