Social network giant Facebook is allegedly targeting 17 May as the potential date for its initial public offering, according to a TechCrunch report that cites unnamed sources familiar with the company.

The IPO date might be off depending on how much time federal regulators need to review Facebook’s recent US$1bn acquisition of mobile photo-sharing start-up Instagram.

And speaking of Instagram, some have speculated that the $1bn deal was structured around the idea that Facebook shares would be worth more after they began trading publicly. On that assumption, Facebook agreed to pay 30% cash and 70% in stock. Sources from both TechCrunch and the New York Times indicate that Facebook is looking to raise around $10bn from the stock sale, with valuation as high as $104bn.

At that value, Facebook would be very close to trading at the same levels it was hitting while trading on the secondary market, pricing the social network at about $40/share.

But with the alleged 17 May IPO date just under a month away, we’re bound to hear more about it between now and then. Stay tuned. — VentureBeat

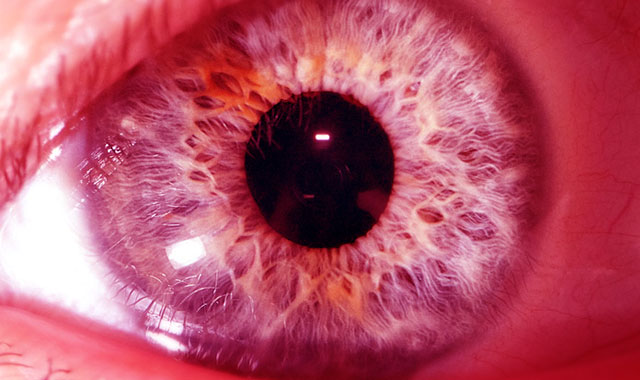

- Image: West.m/Flickr