Taiwan Semiconductor Manufacturing Co hopes to keep supplying Huawei Technologies but is confident its other customers can replace any business lost because of tightening US curbs on China’s largest tech company.

TSMC, the main chip maker to Apple and Huawei, is studying the latest restrictions on making chips for the Chinese company and is hopeful the issue will get resolved over time, chairman Mark Liu told shareholders on Tuesday without elaborating. Its other clients can step in to fill the gap should TSMC be compelled to stop doing business with Huawei, he added.

TSMC is experiencing one of its most turbulent years in memory with the coronavirus pandemic depressing the global economy and smartphone demand that top clients Apple and Huawei depend on for growth. The company, which in April trimmed its 2020 sales outlook, also finds itself caught in the crossfire as the Trump administration ratchets up a campaign to contain China. Washington last month barred any chip maker using American equipment from supplying the networking giant without US approval, effectively blocking Huawei’s access to semiconductor manufacturing and dealing a blow to TSMC’s business.

Shareholders “can rest assured that we will resolve these new restrictions one by one. We will find a solution to continue to grow and secure more profits for our shareholders,” Liu said at Tuesday’s AGM. “If there are no more HiSilicon orders, our other customers will want to fill the gap in our capacity, market share, or smartphone market share left by Huawei. How fast they can fill that gap depends.”

Washington’s curbs — a more precise strike against Huawei because it targets its secretive and cutting-edge HiSilicon semiconductor division — threaten to wreak havoc throughout the complex chip ecosystem that produces technology for consumers and companies globally.

Crucial role

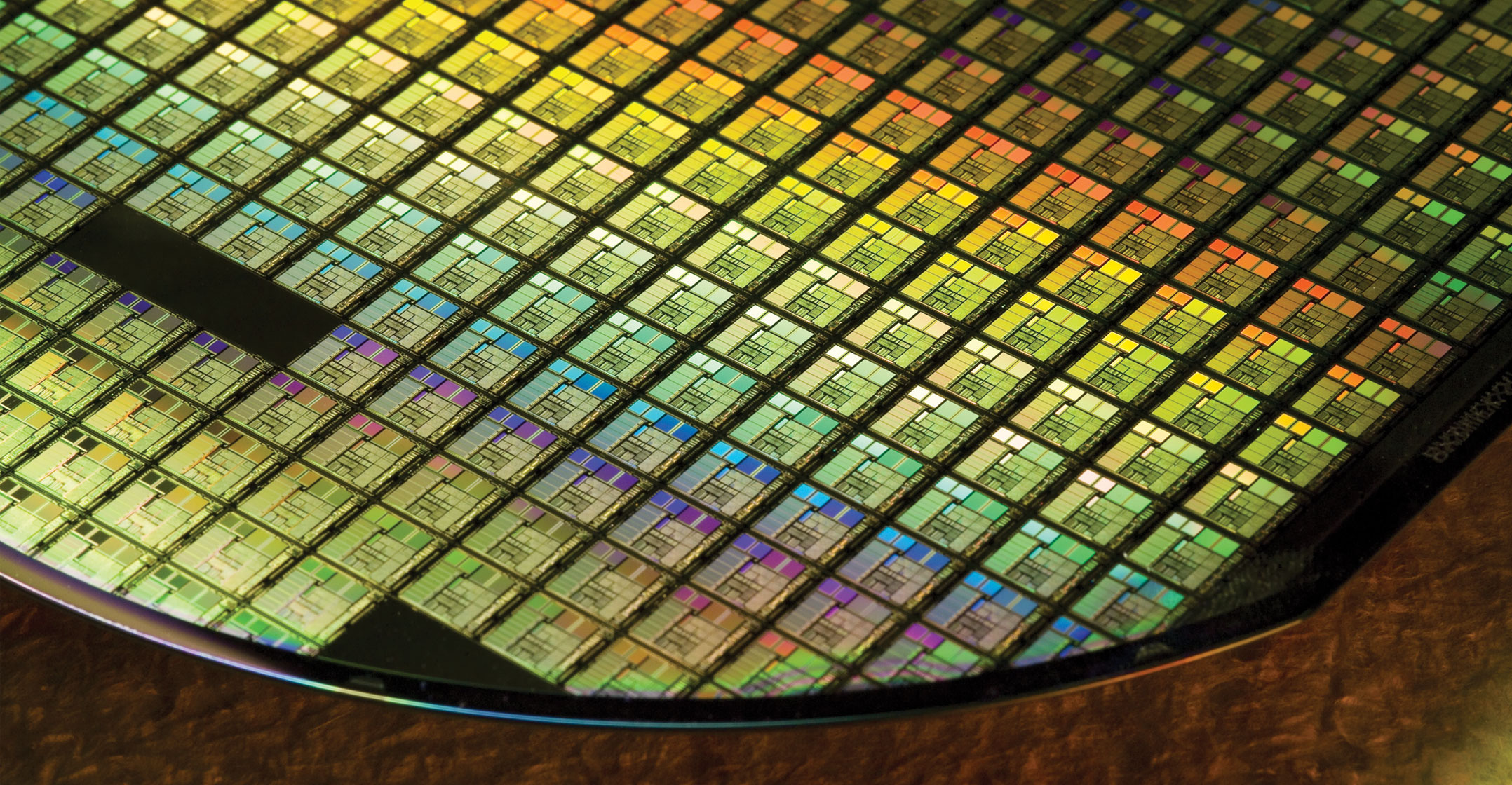

As the world’s largest and most advanced maker of chips for other companies, TSMC plays a crucial role in the production of devices from smartphones and laptops to servers running the internet. Huawei is TSMC’s largest customer after Apple and accounts for about 14% of the Taiwanese chip maker’s sales.

The Taiwanese firm may now have to cut off Huawei unless it gets waivers from the US commerce department. But additional business from existing clients like Apple, Qualcomm, MediaTek or AMD could help offset a decline in orders.

For TSMC, it’s growing ever more difficult to remain neutral amid the growing tensions between the US and China. The company brands itself “everybody’s foundry”, effectively the Switzerland of the tech industry — something executives reiterated on Tuesday. It supplies not just Chinese customers like Huawei but also the American military, while relying on US producers of semiconductor-making equipment like Applied Materials and Lam Research.

The Taiwanese company now plans to spend US$12-billion building a chip plant in Arizona, a decision designed to allay US national security concerns and shift more high-tech manufacturing to America. That decision to situate a plant in the western state comes after White House officials had warned repeatedly about the threat inherent in having much of the world’s electronics made outside of the US. TSMC had negotiated the deal with the administration to create American jobs and produce sensitive components domestically for national security reasons.

Executives told shareholders that specific plans for that project hadn’t been finalised but that TSMC hopes to convince its own suppliers to set up operations in the vicinity over time. — Reported by Debby Wu, (c) 2020 Bloomberg LP