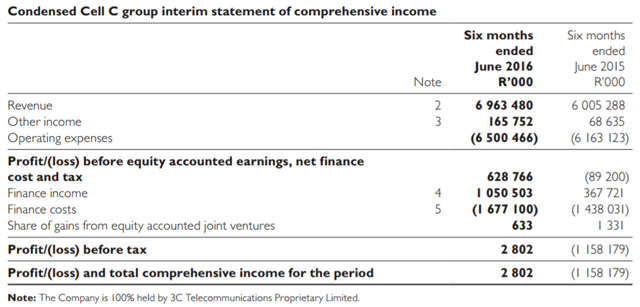

Mobile operator Cell C turned a small profit of R2,8m in the six months ended 30 June 2016, an improvement from a loss of almost R1,2bn in the same six-month period a year earlier.

It’s the first time that Cell C’s full financial results have been made public. The numbers are contained in a circular published by Blue Label Telecoms on Tuesday. JSE-listed Blue Label is acquiring a 45% stake in Cell C for R5,5bn as part of a broader restructuring of the telecommunications operator aimed in part at reducing its debt to below R8bn.

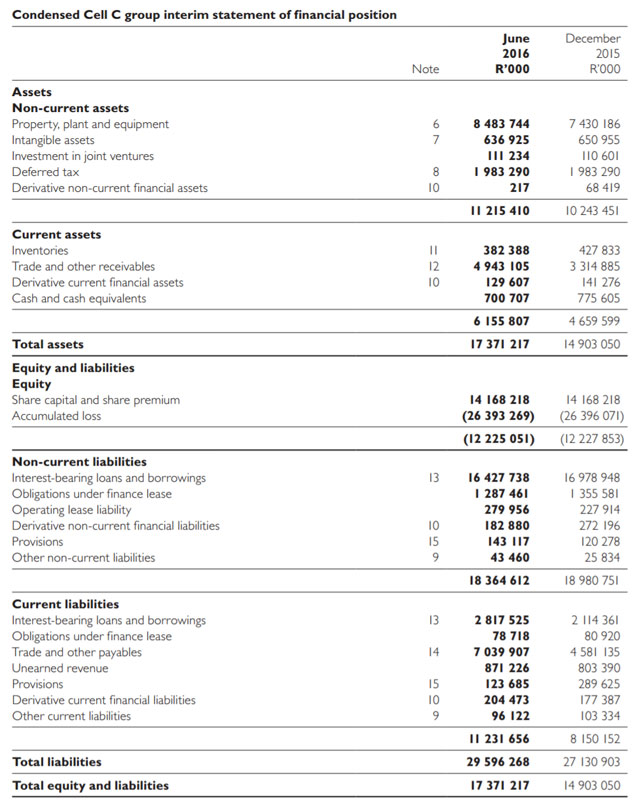

The circular reveals that in the first six months of 2016, Cell C recorded revenue just shy of R7bn, up from R6bn a year ago (see tables below for detailed financial information).

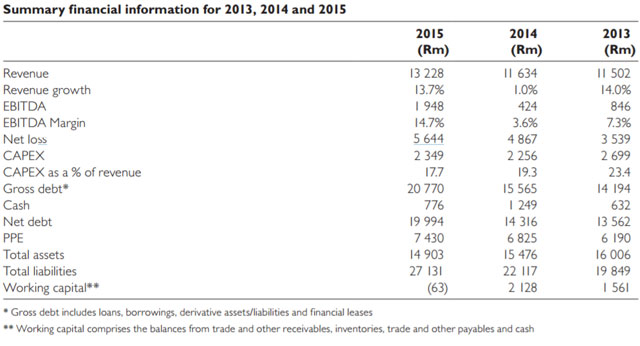

In the 2015 financial year, to 31 December 2015, Cell C reported revenue of R13,2bn and a net loss of R5,6bn. In 2014, those same numbers were R11,6bn and R4,9bn respectively, and in 2015 they were R11,5bn and R3,5bn respectively.

Net debt at the end of 2015 was R20bn, from R14,3bn in 2014.

Cell C attributed the growth in revenue in the first half of 2016 to an increase in service spend and equipment sales. The prepaid segment was the main driver in service spend due to growth in the core customer base, significant growth in data usage and new product offerings. Equipment revenue increased due to an increase in demand for smartphones and new handset financing arrangements.

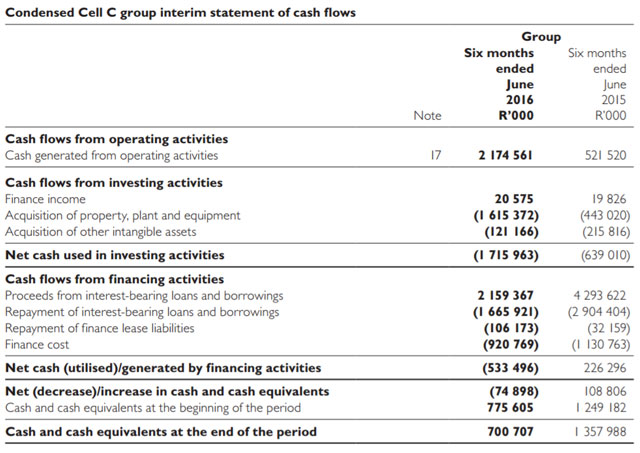

Profit before equity-accounted earnings, net finance costs and tax came to R628,8m, from a loss of R89,2m in 2015. Total cash generated from operations was R2,2bn, up from R521,2m previously.

Non-current and current liabilities totalled an eye-watering R29,6bn, from R27,1bn at the end of December 2015.

Its total liabilities exceeded its total assets by R12,2bn as at end-June 2016. However, the company and its shareholders have “demonstrated that funds will be available to finance future operations and that the realisation of assets and settlement of liabilities will occur in the ordinary course of business”.

“The directors and management have reviewed the group’s budget and cash flow forecast for the period to 30 September 2017 [and] … there is sufficient funding available to enable the group to meet its obligations as they fall due.” — (c) 2016 NewsCentral Media

- See also: Discrepancy in Cell C subscriber numbers