Alphabet, Microsoft and Intel, which all posted quarterly results on Thursday, reinforced what’s become a truism in technology: the biggest growth is in businesses that deliver computing over the Internet.

Microsoft topped projections on the strength of rising customer sign-ups for its cloud offerings like Azure, which saw revenue almost double. Intel sales rose more than expected, helped by orders for processors that power data-centre servers — the machines at the heart of cloud computing.

While profit at Google parent Alphabet disappointed, the numbers also signalled that heavy spending to catch cloud leaders Amazon.com and Microsoft is paying off. Google’s “other revenue” line, which includes cloud computing, jumped 62% to US$3,4bn in the fourth quarter.

“Our cloud business is on a terrific upswing,” Google CEO Sundar Pichai said on Thursday during a conference call with analysts. “I definitely think we’re going to have a great year.”

What started a decade ago as an easy way for start-ups to run websites has turned into an increasingly popular way for companies of all sizes to access the software needed to run their operations. Many big technology companies are in a strong position to provide this because they already have huge data centres to support their own Web services.

More than $1 trillion in IT spending will be directly or indirectly affected by the shift to cloud during the next five years, Gartner estimated in July. “This will make cloud computing one of the most disruptive forces of IT spending since the early days of the digital age,” the research firm said at the time.

Stock prices reflect this optimism. Microsoft and Alphabet shares hit a record this week, and Intel stock recently came close to an all-time high set in October.

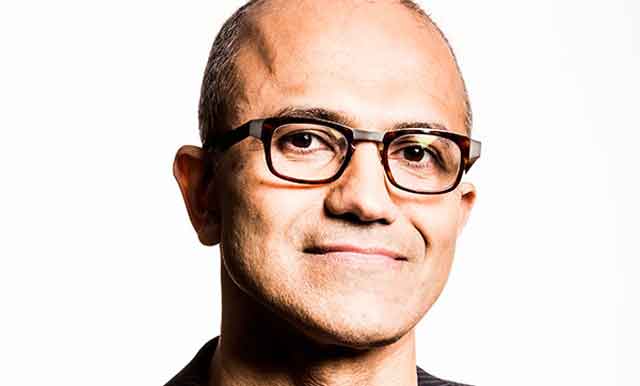

Microsoft CEO Satya Nadella has been working to reposition the company around such Internet services. In addition to robust demand for Azure, consumers and corporations continue to purchase Office 365, a cloud-based version of the company’s productivity software that includes Word and Excel. Almost 25m consumers are now subscribed to Office 365, Microsoft said, and sales increased 47% in the fiscal second quarter.

“As long as cloud is growing, people are happy,” said Mark Moerdler, an analyst at Sanford C Bernstein & Co, who rates Microsoft shares outperform. “If margins are growing, people are even happier.”

Microsoft’s effort

Redmond, Washington-based Microsoft has been spending on data centres and adding products to win new cloud customers. Chief financial officer Amy Hood said in July that gross margins, a measure of profitability, for the commercial cloud business would “materially improve” in the current year. That’s because previous years of investment are starting to pay off as those data centres support more customers.

Microsoft has pledged to reach annualised revenue of $20bn in its corporate cloud business by the fiscal year that ends in June 2018. That metric stood at more than $14bn at the end of the second quarter.

Intel’s fourth quarter sales of server chips to cloud service providers jumped 30% from a year earlier. Offsetting that, companies and government agencies spent 7% less than they had in the same quarter in 2016 on equipping their in-house computer rooms, the company said.

“It’s moving to the public cloud, it’s moving to those areas at a faster rate than I think we expected,” Intel CEO Brian Krzanich said on a conference call.

Amazon reports earnings next week and analysts at RBC Capital Markets expect the company’s AWS cloud business to generate $3,6bn in fourth quarter revenue, up 50% from a year earlier.

“Microsoft is the plumbing in the cloud,” Moerdler said. “Amazon is much bigger, but still Amazon and Microsoft are pulling away from the pack.” — (c) 2017 Bloomberg LP

- Reported with assistance from Dina Bass, Ian King and Mark Bergen