IBM has announced it will buy Red Hat, the world’s biggest Linux company, for US$34-billion. That’s more than a quarter of IBM’s market capitalisation, and comes as the legacy computer giant tries to play catch-up in the fast-growing cloud computing market.

IBM has announced it will buy Red Hat, the world’s biggest Linux company, for US$34-billion. That’s more than a quarter of IBM’s market capitalisation, and comes as the legacy computer giant tries to play catch-up in the fast-growing cloud computing market.

Under the proposed deal, which is still subject to shareholder approval, IBM will acquire 100% of Red Hat for $190/share in cash.

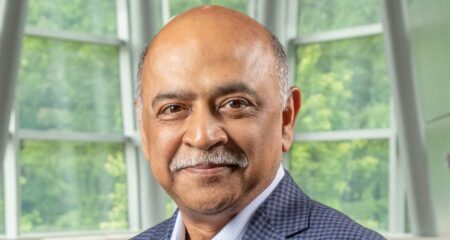

“The acquisition of Red Hat is a game changer. It changes everything about the cloud market,” said IBM CEO Ginni Rometty in a statement on Sunday evening South African time.

“IBM will become the world’s number-one hybrid cloud provider, offering companies the only open cloud solution that will unlock the full value of the cloud for their businesses,” Rometty said.

“Most companies today are only 20% along their cloud journey, renting compute power to cut costs,” she said. “The next 80% is about unlocking real business value and driving growth. This is the next chapter of the cloud. It requires shifting business applications to hybrid cloud, extracting more data and optimising every part of the business, from supply chains to sales.”

Red Hat CEO Jim Whitehurst said the deal will provide Red Hat with a “greater level of scale, resources and capabilities to accelerate the impact of open source as the basis for digital transformation and bring Red Hat to an even wider audience” while preserving innovation in open-source software.

Distinct unit

“Upon closing of the acquisition, Red Hat will join IBM’s Hybrid Cloud team as a distinct unit, preserving the independence and neutrality of Red Hat’s open-source development heritage and commitment, current product portfolio and go-to-market strategy, and unique development culture. Red Hat will continue to be led by Jim Whitehurst and Red Hat’s current management team. Whitehurst also will join IBM’s senior management team and report to Rometty. IBM intends to maintain Red Hat’s headquarters, facilities, brands and practices,” IBM said.

IBM, which has a market valuation of $114-billion, has seen revenue decline by almost a quarter since Rometty took the CEO role in 2012. While some of that has been from divestitures, most is from declining sales in existing hardware, software and services offerings, as the 107-year-old company has struggled to compete with younger technology companies.

Acquiring Red Hat makes IBM “a credible player in cloud now — both private and hybrid cloud,” Bloomberg Intelligence analyst Anurag Rana said. “This gives them an asset that looks forward and not backwards.”

JPMorgan Chase & Co advised IBM on the deal and provided financing.

“Knowing first-hand how important open, hybrid cloud technologies are to helping businesses unlock value, we see the power of bringing these two companies together,” JPMorgan CEO Jamie Dimon said in an e-mailed statement. — (c) 2018 NewsCentral Media, with additional reporting by Bloomberg

- TechCentral will have more on this story throughout Monday