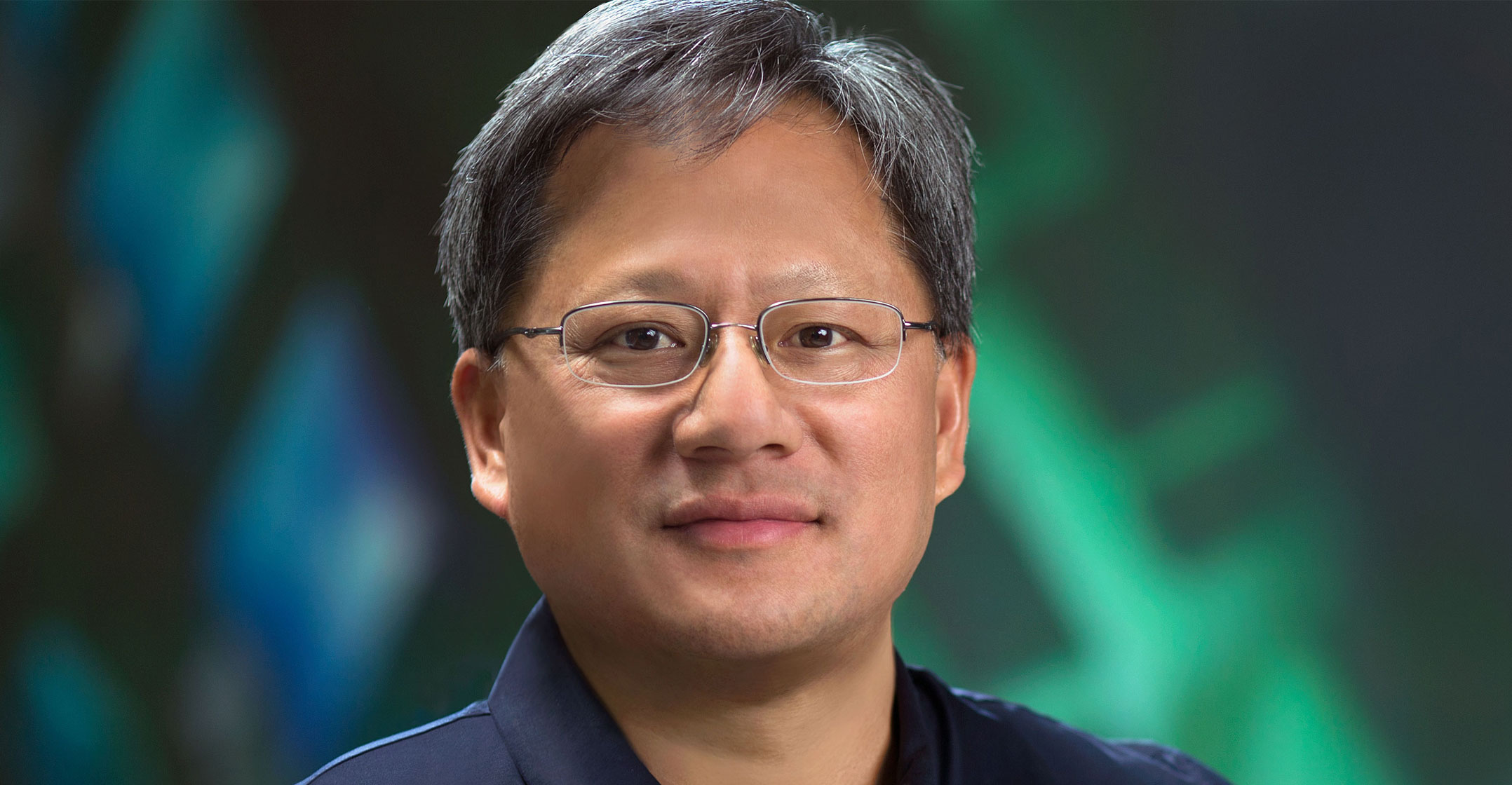

Nvidia extended its rally on Tuesday, briefly driving the company’s market value over US$800-billion, after CEO Jensen Huang gave what analysts said was an upbeat address at the company’s annual technology conference.

The shares rose as much as 4.9% to hit an intraday record, though they pared much of that advance and last traded up around 1.4%. The gains have pushed the stock nearly 60% above a low hit in early October and made it by far the best performer in the Philadelphia Stock Exchange Semiconductor Index this year, with a 2021 gain nearing 140%. The industry’s benchmark index is up about 36% year to date.

Analysts at Wells Fargo Securities and Rosenblatt Securities both raised their price targets on Nvidia after the CEO’s speech.

“We find it hard to step away from the momentum,” Aaron Rakers, an analyst at Wells Fargo wrote after the address. Rosenblatt Securities was similarly emphatic, writing: “Nvidia is so, so far ahead of any chip company in virtual world dynamic it’s not even close.”

The advance in Nvidia’s shares resulted in the market valuation briefly moving above $800-billion, making it the seventh largest member of the S&P 500. At current levels, Nvidia is within 20% of Meta Platforms, the company formerly known as Facebook, which has a market valuation of $946-billion.

Some of Nvidia’s recent rally can be attributed to Meta, which last month announced a new corporate focus on the metaverse, a digital environment accessed with virtual reality tools that rely on high-powered processors. Meta is investing billions into this initiative and Nvidia is expected to be a key beneficiary.

Wheelhouse

The new focus is “right in Nvidia’s wheelhouse, and for Facebook to put its weight behind this theme is helping Nvidia a lot”, said Deepon Nag, senior research analyst for technology hardware at ClearBridge Investments.

The rally comes ahead of Nvidia’s third quarter results, which are expected to be released next week. Some have expressed concern that the stock’s move may have resulted in an elevated valuation. Shares are more than 20% above the average analyst target price, near the biggest premium ever.

“While the run exceeds anyone’s expectations for what you’d expect to see in such a short period of time, we’re not surprised that investors are focused more on this story,” said Matt Peron, MD of equity research at Janus Henderson Investors. “It certainly looks fully valued in the near-term,” and amid the earnings and the conference, “there could be some disappointment, given the size of the spike we’ve just had.” — Reported by Ryan Vlastelica, (c) 2021 Bloomberg LP