Governments around the world are pausing to reconsider the approval of construction permits for new data centres due to the strain that their huge demand for electricity places on national grids.

Governments around the world are pausing to reconsider the approval of construction permits for new data centres due to the strain that their huge demand for electricity places on national grids.

So far, there is no indication that South Africa is planning similar measures, even as data centres proliferate in the country – and especially in the Gauteng region.

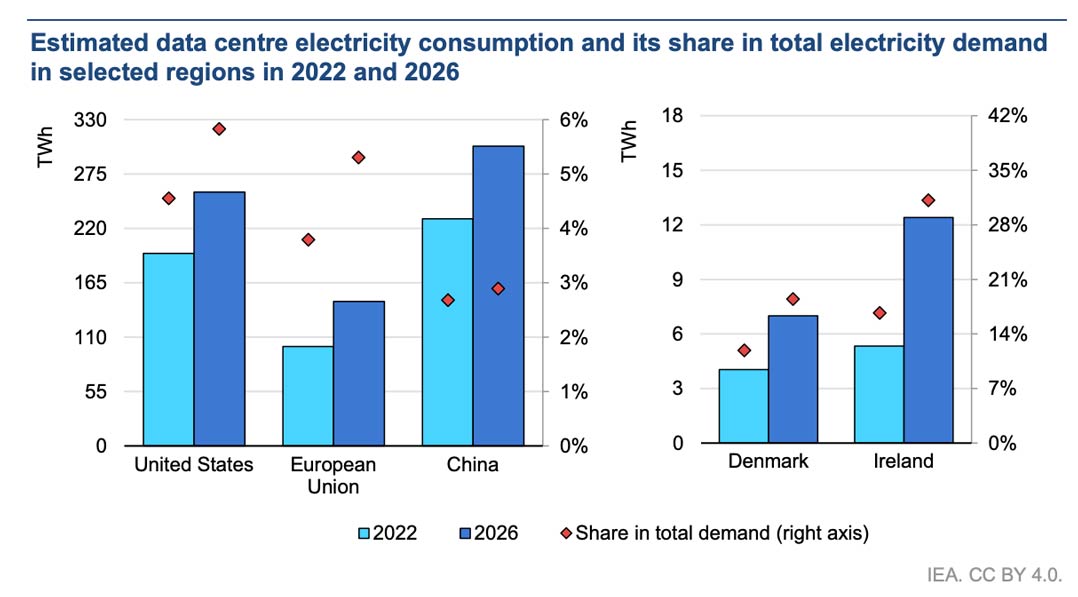

In recent years, Ireland, Germany, Singapore and China have placed restrictions on the development of new data centres to ease demand-side pressure and reach environmental sustainability goals, the Financial Times reported (paywall) on Monday.

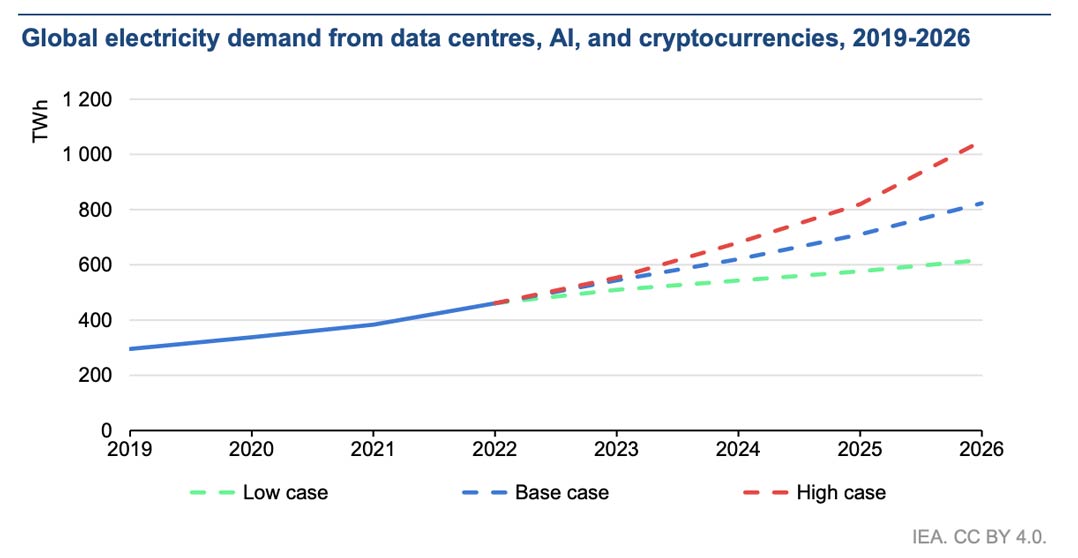

“An important new source of higher electricity consumption is coming from energy-intensive data centres, artificial intelligence and cryptocurrencies, which could double by 2026,” according to a recent report by the International Energy Agency (IEA).

According to the FT report, among new data centre projects at the highest risk of being stopped are those in Ireland, which historically has been a choice location for technology giants such as Meta Platforms, Google and Microsoft. They have been attracted to that country’s low taxes and easy access to high-capacity subsea cables for transporting data around the world.

In 2021, Ireland’s Commission for Regulation of Utilities updated its requirements for allowing data centres to connect to the national grid. The new stipulations take into consideration whether the location of a proposed site has sufficient grid capacity there and if the applicant can be flexible by reducing power consumption when asked to do so.

Environment

Beyond the concerns about power consumption, a stronger focus on the environmental impact of data centres has taken centre stage in jurisdictions like Germany. As a result, requirements around renewable energy contributions to the grid and waste heat recycling have been incorporated into the legislation for permit approvals. Restrictions have also been placed on the number of permits approved in residential areas.

The restrictions are seen by legislators as a way of curbing the rapid growth in power demand from data centres, but given the rate of digitisation worldwide, data centre growth – and the power these facilities consume – will continue to rise quickly.

“We expect global electricity consumption of data centres, cryptocurrencies and artificial intelligence to range between 620TWh and 1 050TWh in 2026, with our base case for demand at just over 800TWh – up from 460TWh in 2022. This corresponds to an additional 160TWh to 590TWh of electricity demand in 2026 compared to 2022, roughly equivalent to adding at least one Sweden or at most one Germany,” said the IEA report.

According to the report, computing typically accounts for around 40% of a data centre’s total power consumption. With compute-intensive use cases such as AI and cryptocurrency mining on the rise, the demand for electricity from a single data centre could see “tenfold” growth in the case where AI is fully implemented in the facility.

The calculation is based on a comparison between the average electricity demand of a typical Google search – 0.3Wh of electricity – to OpenAI’s ChatGPT which uses 2.9Wh per user request. Considering nine billion searches daily, this would require almost 10TWh of additional electricity in a year, according to the IEA.

The surge in demand has influenced a renewed interest in nuclear energy in Europe and the Americas, according to the FT. In February 2023, 11 EU member states – led by France – formed an alliance with the goal of adding 50GW of nuclear capacity to the region by 2050, according to a report by Euractiv.

According to a post on the website DataCentre Knowledge, the US government has provided more than US$600-million in funding to companies involved in the development of small modular reactors, a new generation of safer, cleaner and more efficient nuclear power plants that have a small geographical footprint and produce up to 300MW of power.

But national governments are not the only ones pursuing a nuclear energy strategy. In May last year, Microsoft announced that it had signed a power purchase agreement with a Sam Altman-backed nuclear fusion start-up called Helion. Helion’s first fusion power plant is scheduled for 2028, and unlike the fission-based nuclear reactors of yesteryear, fusion-based reactors promise high energy output with zero carbon emissions.

In the South African context, the energy crisis presents a troubling conundrum for companies looking to build data centres. On one hand, growth in demand for digital services justifies the business case for additional infrastructure; on the other, the ongoing energy deficit – and uncertainty on the future stability of South Africa’s energy supply – introduces an element of risk which affects long-term planning.

Fortunately, these challenges are not getting in the way of investment – yet. Earlier this month, Microsoft announced it will build a new data centre in Centurion, near Pretoria, adding to five data centres already in operation in Johannesburg and Cape Town.

“[The energy deficit] raises costs because there may be greater reliance on backup power, but data centres typically have preferential access to the grid, like other high-priority industrial applications,” said Jon Tullett, senior research manager at International Data Corp.

Large commercial data centres in South Africa typically consume 12-20MW of power. Just like their international counterparts, local facilities are sophisticated in their approach to power usage efficiency (PUE) and using the right mix of energy sources.

“New South African cloud data centres are built to the same standards as hyperscale facilities elsewhere in the world. They focus on reducing PUE, and there’s a growing emphasis on renewable sources of energy,” said Tullett.

Read: Microsoft to build another data centre in South Africa

Some data centre operators in South Africa, including Vantage Data Centers, which recently built the first phase of a campus facility in Midrand, have announced plans to wheel renewable energy over the grid from elsewhere in South Africa. — (c) 2024 NewsCentral Media