Bitcoin has landed on Wall Street with a bang.

Futures on the world’s most popular cryptocurrency surged as much as 25% during their debut session on Cboe Global Markets’ exchange, triggering two temporary trading halts meant to cool volatility.

Dealers said initial volumes exceeded expectations, while traffic on Cboe’s website was so strong that it caused delays and outages. The exchange said all its trading systems were normal.

“It was pretty easy to trade,” Joe Van Hecke, managing partner at Chicago-based Grace Hall Trading, said in a telephone interview from Charlotte, North Carolina. “I think you’ll see a robust market as time plays out.”

The launch of futures traded on a regulated exchange is a watershed for bitcoin — testing infrastructure that will make it easier for legions of professional traders and mainstream investors to bet on the cryptocurrency’s rise or fall, potentially helping to steer its price.

Until now, trading in bitcoin was driven mainly by individual investors who were willing to risk buying on mostly unregulated markets. Some users of those little-policed venues have been targeted by hackers who’ve stolen digital tokens.

Bitcoin futures expiring in January were priced at US$17 780 as of 12.57pm Hong Kong time, up from an opening level of $15 000. About 2 300 contracts changed hands.

The first trading halt came about two-and-a-half hours after the session began, while the second one triggered after four hours. Cboe imposes circuit breakers to curb volatility, halting transactions for two minutes if prices rise or fall 10%, and for five minutes at 20%. Trading will stop for at least five minutes if the rally extends to 30%, Cboe said in a notice on its website.

Price rises

Bitcoin last changed hands at $16 318, up about 4.3% since late Friday, according to the composite price on Bloomberg.

“So far, looking at the contract volume traded, we believe that there is a decent demand and this is driving up the price of bitcoin,” said Naeem Aslam, chief market analyst at TF Global Markets in London. “Prices are going higher because of the increase in confidence.”

CME Group’s exchange is set to start offering similar futures next week.

Once the markets are better established, professional traders will arbitrage between the Cboe and CME futures and bitcoin itself, improving pricing efficiency, Aslam said.

“In the future, traders will also start arbitraging and speculation will go in another higher gear,” Aslam said.

At this point, some people who would like to trade futures are having a hard time accessing the market because not all brokers are supporting it initially, said Garrett See, CEO of DV Chain, a sister company of trading firm DV Trading. Participation may also be limited because of higher capital requirements and tighter risk limits, See said.

Being on the sidelines has been painful. This year alone, bitcoin is up more than 1 600%. The surge has been driven largely by demand from individual investors, even as technical obstacles kept out big money managers like mutual funds.

Derivatives trading is the culmination of a wild year for bitcoin, which captured imaginations and investment around the world, propelled by its stratospheric gains and its anti-establishment mission as a currency without the backing of a government or a central bank. The derivatives contracts should thrust bitcoin more squarely into the realm of regulators, banks and institutional investors.

Both Cboe and CME on 1 December got permission to offer the contracts after pledging to the US Commodity Futures Trading Commission that the products don’t run afoul of the law, in a process called self-certification.

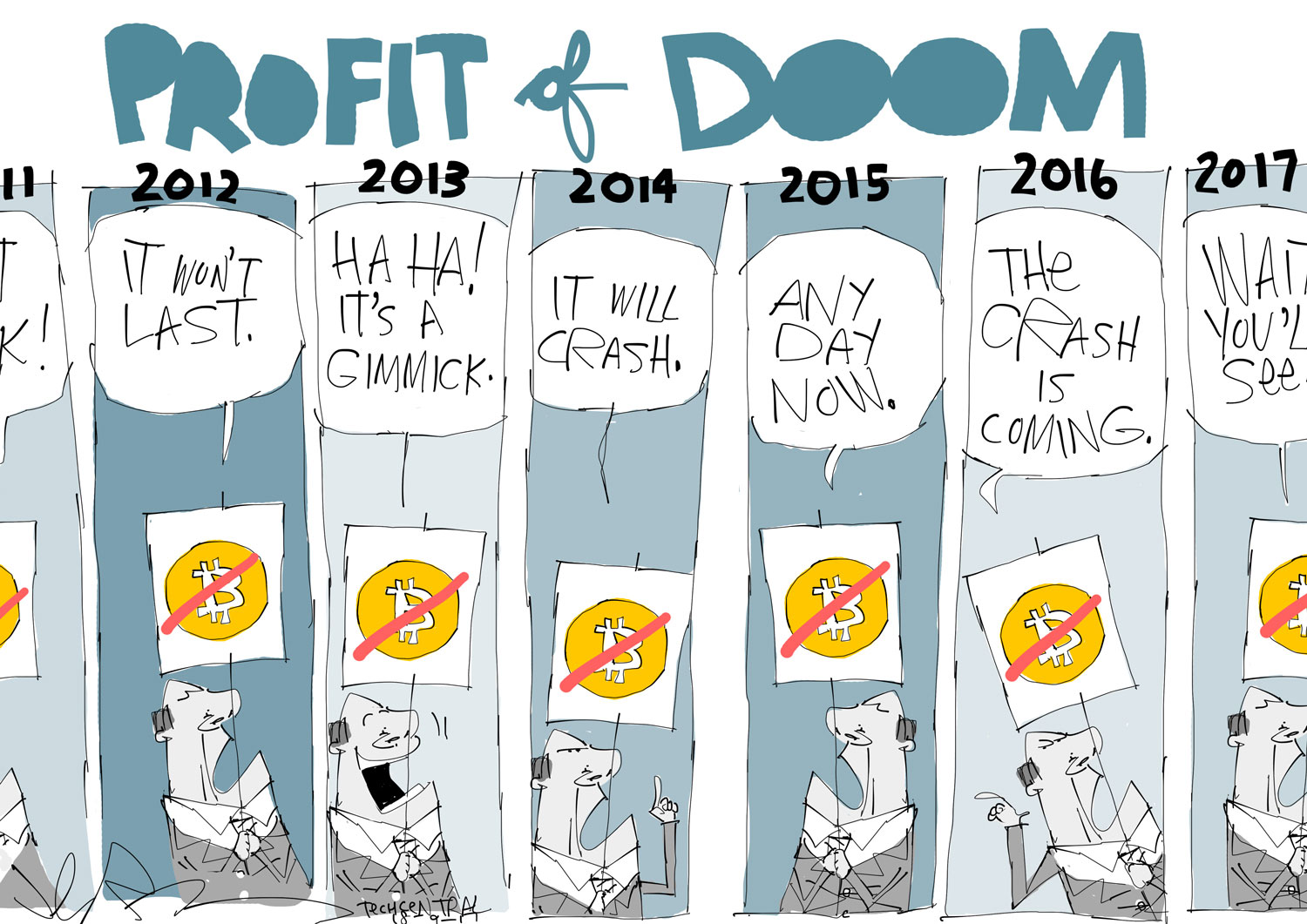

Not everyone is convinced it’s a good idea. On 6 December, the Futures Industry Association — a group of major banks, brokers and traders — said the contracts were rushed without enough consideration of the risks. Last month, Thomas Peterffy, the billionaire chairman of Interactive Brokers Group, wrote an open letter to CFTC chairman J Christopher Giancarlo, arguing that bitcoin’s large price swings mean its futures contracts shouldn’t be allowed on platforms that clear other derivatives.

Still, Interactive Brokers is offering its customers access to the futures, though with greater restrictions. They won’t be able to go short — betting that prices will decline — and Interactive’s margin requirement, or how much investors have to set aside as collateral, will be at least 50%. That’s higher than either Cboe’s or CME’s margin requirements.

Cboe’s futures are cash-settled and based on the Gemini auction price for bitcoin in US dollars. Margins for the contracts, which will be cleared by Options Clearing, will be at 40% or higher. — Reported by Rob Urban, Camila Russo and Brian Louis, with assistance from Matthew Leising, Doug Alexander, Sonali Basak, Annie Massa and Yuji Nakamura, (c) 2017 Bloomberg LP