Bloomberg writer Lionel Laurent argued in his article “Bitcoin and gold are monuments to irrationality” that these asset classes aren’t good stores of value due to their volatility. Laurent is approaching this problem from the wrong angle. Yes, these asset classes are volatile. But investors are being forced into them by persistent monetary stimulus by global central banks, which has eroded the store-of-value characteristics from traditional financial markets.

Bloomberg writer Lionel Laurent argued in his article “Bitcoin and gold are monuments to irrationality” that these asset classes aren’t good stores of value due to their volatility. Laurent is approaching this problem from the wrong angle. Yes, these asset classes are volatile. But investors are being forced into them by persistent monetary stimulus by global central banks, which has eroded the store-of-value characteristics from traditional financial markets.

Where can we store our value?

We save in order to spend in the future but we need to know that our future spending power will be at least equal to the current spending power — that the savings will “store value”. A form of savings “holds its value” if it maintains its purchasing power. In this article, I argue that global central banks have eroded store-of-value characteristics from traditional financial markets — first cash, then bonds — leaving investors to use property and equity as quasi store-of-value instruments. Negative interest rates raise the attractiveness of the age-old store of value, gold, and the store of value for the digital age, bitcoin.

Central bank ‘fiat’ money doesn’t store value

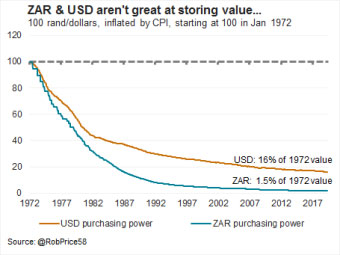

Dollars and rands stored value in the past, but almost without exception government-issued monies do not hold value today. I’ve used the relevant consumer price index in order to adjust the purchasing power of 1972 US dollars and South African rand. Inflation has eroded purchasing power so that money is worth a fraction of what it was in 1972. That these currencies have reasonably stable purchasing power day to day in the US or South Africa says nothing about their ability to store value over time.

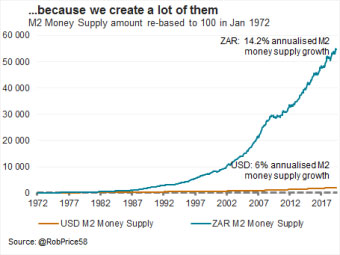

Why don’t they store value? We create a lot of these currencies. South Africa has created many more rands than the US has created dollars, hence rands have depreciated more than dollars. The less scarce, the worse an asset holds its value. If Apple created 10 trillion iPhones, would they have the same value? No. Lots of iPhones flooding the market would make them less valuable and reduce the price.

Interest rates aren’t great, especially in developing markets

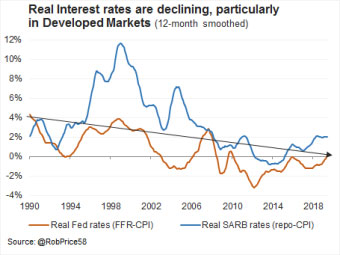

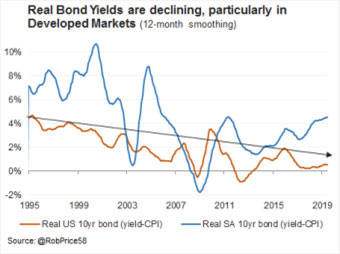

Rather than just hold money, we could hold short-term interest instruments. If the instruments yield interest above inflation, then we know that our savings can beat inflation. The first chart below shows the way in which real interest rates (interest rate minus inflation) in the US and South Africa have gradually trended lower, reducing the ability to store value in these instruments. South African investors could store value in rand but they assume currency risk in this scenario as the rand could depreciate and erode global purchasing power.

Bonds generate sovereign risk

Alternatively, we could purchase longer-dated debt instruments (bonds), issued by governments or companies. If the real bond yields (yield minus inflation) are positive, our value might be maintained relative to inflation. This makes sense, but the uncertainty and risk increases notably at this point. What if inflation rises? What if government credit risk deteriorates and the bond loses value?

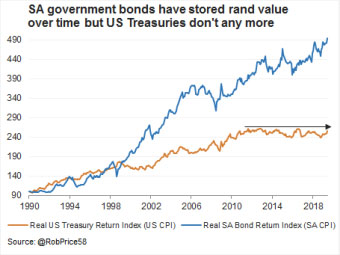

Bond yields are close to record lows across the developed world, despite record-high debt levels, so the probability that these assets will hold their value over the coming years is incredibly low. South Africa isn’t in nearly as an extreme situation as the developed world but the trend is the same: lower rates, lower growth, higher debt and deteriorating credit risk. The graph below shows real index returns on South African bonds (in rand) and US bonds (in dollars). Real US bond returns have flat-lined, while South African bonds have managed to keep pace with South African inflation, so perhaps South African investors are able to store value in bonds, if they’re willing to assume currency, volatility and credit risks of the government.

Bond yields are close to record lows across the developed world, despite record-high debt levels, so the probability that these assets will hold their value over the coming years is incredibly low. South Africa isn’t in nearly as an extreme situation as the developed world but the trend is the same: lower rates, lower growth, higher debt and deteriorating credit risk. The graph below shows real index returns on South African bonds (in rand) and US bonds (in dollars). Real US bond returns have flat-lined, while South African bonds have managed to keep pace with South African inflation, so perhaps South African investors are able to store value in bonds, if they’re willing to assume currency, volatility and credit risks of the government.

Property being used as a bank account

Another alternative to store value is financial assets, like equity and property. These assets are directly linked to economic activity, through revenues, rentals and asset ownership, so extended periods where they under-perform inflation are rare. Most people don’t view these financial assets as stores of their value. Clearly, there is a grey area, but some people are definitely using these assets as growth-generating investments and stores of value because we cannot store our value in money or short-term interest rates. On reflection, many people use properties as bank accounts, dipping into their bond during periods of financial stress (dis-saving) and paying down the bond during better times (saving). Data (below) suggests that property was a prudent investment strategy prior to the subprime mortgage bubble in 2008 but that property markets have failed to beat inflation effectively thereafter.

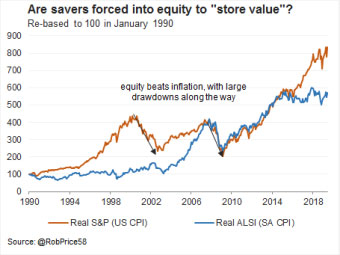

With equity, there are times when real returns are negative, exposing savers to volatility and draw-downs, but they’re certainly positive through time. Property and equity generally benefit from lower interest rates because people tend to use debt to purchase these assets. Additionally, interest rates are the discount parameter used when valuing future corporate incomes. As interest rates fall and debt rises, the price of property and equity might continue to rise. It is, however, also important to note that these assets aren’t cheap today, so the long-term return potential isn’t as wonderful as it has been. Low interest rates also hinder long-term sustainable economic activity by dissuading savings and encouraging capital consumption, which dampens the long-term return potential from these growth-centric asset classes.

‘Precious’ for a reason

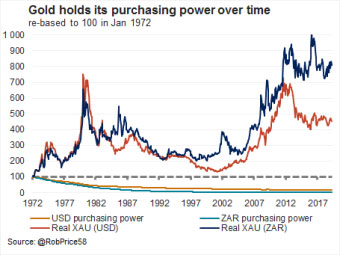

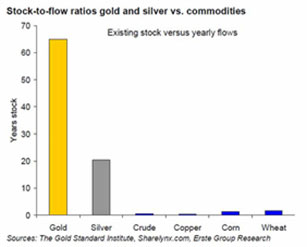

Gold has been used as a pure store of value throughout history because it’s scarce, difficult to mine and has limited productive use. There is a finite amount of gold in the world; approximately 190 000t above ground and supply only grows between 1% and 2%/year. Unlike government-issued monies, where the central bank can just create more, it’s tough to increase gold supply. Unlike most other commodities, gold is also not really used in production so it’s never destroyed. The stock of gold above the ground continues to grow, which implies that the ratio between the existing stock and the flow of newly available gold is incredibly high. In fact, gold’s stock-to-flow ratio is the highest among all commodities, which is exactly why the market chose gold as the monetary medium for thousands of years. It’s called a “precious” metal for a reason and it’s not because it’s yellow and shiny! Silver has similar characteristics to gold, but not nearly as high a stock-to-flow ratio, which is why silver has been called “the poor man’s gold” and used as a risky alternative to gold.

Clearly, gold is more volatile than fiat currencies but, through the cycle, it has a superior ability to maintain purchasing power and stores value significantly better than US dollars and South African rands.

What does the future hold?

Since the 1980s, central banks have used low interest rate policy to stimulate economic activity without considering the consequences of their actions. Post-2000, policies went full whack-a-mole with negative rates and quantitative easing. Bond yields are negative in Japan and Europe, which is absolutely extraordinary! Bondholders pay the government for holding their debt! The further central banks exacerbate this monetary corruption trend the greater likelihood of negative interest rates on actual bank deposits — criminal!

Where people could historically store their savings in money, lower and lower rates implied that investors had to seek out alternative stores of value. Bonds, property, art, classic cars or equity are options but they all come with their own risks and they aren’t the intended use case for these assets. As central banks exacerbate the negative interest rate path and this pushes debt deeper into negative yields, investors will become increasingly interested in stores of value like gold. Volatile, yes, but proven to store value much better than government regulated fiat currencies. Bitcoin is a complex and unregulated technology with a host of risks but it holds similar constrained supply characteristics to gold. Continued global monetary corruption is the primary reason for increasing demand for store-of-value technologies.

- Rob Price is head of asset allocation at an asset management firm in Johannesburg. His views don’t necessarily represent those of his employer. You can contact him on Twitter at @RobPrice58.