First National Bank and a start-up fintech company in South Africa are partnering to connect informal traders in townships with fast-moving consumer goods companies.

First National Bank and a start-up fintech company in South Africa are partnering to connect informal traders in townships with fast-moving consumer goods companies.

FNB is seeking to tap into a market that it estimates could consist of as many as a million enterprises that have largely been ignored and falls into the “unseen economy”, the lender said in an e-mailed statement.

“With 50% of South Africa’s urban population living in townships, the ecosystem supporting these communities warrants significantly greater focus from the banking sector,” Michael Vacy-Lyle, the CEO of FNB Business, said in the statement. FNB estimates that about 300 000 of these traders are “survivalist” in nature, employing three or more people, and relying on cash payments, he said.

The company has partnered with Selpal, which connects informal merchants ranging from bars and grocery stores to hairdressers and micro manufacturers, according to the statement.

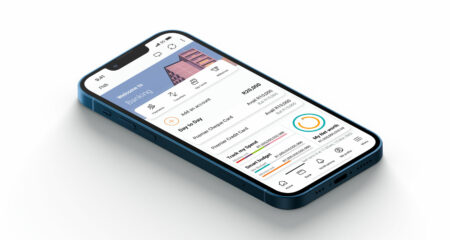

The traders are provided with a point-of-sale device to enable payments “that lets them view, order, pay for and sell stock and value-added services without the store owners ever needing to leave their shop, and unlocks extra revenue for them”, said Selpal CEO Stephen Goldberg.

“It also changes the way that their customers buy from them, extending the benefits and extra value to the end consumer,” he said. “Our partnership with FNB Business will help expand our network and supercharge our growth.” — Reported by Vernon Wessels, (c) 2018 Bloomberg LP