Co-location allows for a more sustainable financial model that can bolster operator revenues, take pressure off consumers and increase network penetration in underserviced areas.

The telecommunications landscape has changed significantly in the past decade due to pricing pressure, rising network costs and evolving consumer demands.

According to Ovum, average revenue per user (Arpu) is forecast to decline at 16% globally (and at a faster 19% in South Africa) between 2012 and 2019. Related to this, data demand will drive 4G/LTE traffic, to grow at a compound annual growth rate of 110% from 2014 to 2019. Data is also driving future revenue, with LTE revenues in the Middle East and Africa predicted to grow from 23% of total radio access network revenues in 2015 to 67% in 2019.

To add to this, over-the-top services and increasing adoption of the Internet of things are presenting new challenges for operators.

Essentially, operators find themselves in a “perfect storm”, with margin pressures weighing heavily on current business models. The net effect will be that consumers are increasingly bearing the costs of connectivity, as witnessed in the recent pricing adjustments by South African operators.

In the circumstances, how can operators provide better services, supported by a financially sustainable business model?

Significant opportunities can be found in an evolution of the operator value chain. Traditionally, operators owned all activities associated with the access network, through to customer and value-added services. This model has evolved, to the extent that various sections of the value chain now belong to different players (evident in the growth of over-the-top services). One such element, the access network, is experiencing increased collaboration between operators in the form of strategic partnerships in the interests of better efficiencies through specialisation.

Network infrastructure sharing can be classified according to the different strategic and commercial rationales of operator partners:

- Passive infrastructure sharing, or mast sharing, involves the sharing of tower structures on which active equipment is located (typically the mast, energy generation and site-related infrastructure). This is achieved through an inter-operator agreement or by using independent tower companies.

- Radio access network sharing extends network sharing beyond passive equipment to active equipment, including antenna and transmission equipment.

- Core network sharing is the most advanced form of network sharing, and entails sharing core network elements.

Based on current economic and market trends, the South African telecoms industry is poised to explore market-wide passive infrastructure sharing opportunities.

In 2014, the African tower market was estimated by TowerXchange at 165 000 towers — 25% of them owned and operated by tower companies. By the end of 2015, this figure will rise to 50%.

Tower company infrastructure deal activity has been high (39 transactions took place between 2010 and 2014, involving about 45 000 towers). Although most transactions are structured as asset divestitures, operators still hold most of the towers on the continent, making collaboration a continued possibility. In South Africa, only about 10% of towers are under the control of tower companies, providing a large opportunity for collaboration between operators.

Three models

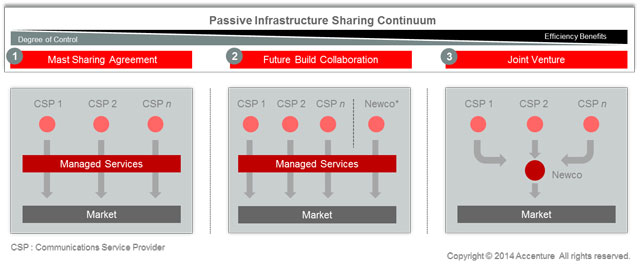

Three passive infrastructure sharing models can be considered by operators, as illustrated below.

There are three alternatives for operators: those who want to keep a high degree of control would prefer a mast sharing agreement (model 1). Standard terms and agreements allow for a facilities management vendor to be assigned to service the portfolio, in the interests of operational efficiencies and operating expenditure savings.

Future build collaboration (model 2) involves the creation of a new company, jointly owned by all operators, that rolls out all new infrastructure. On top of the opex savings of model 1 for current and new infrastructure, model 2 offers capital expenditure savings on all new infrastructure.

Lastly, a full joint venture (model 3) would see operators jointly creating an independent company which provides infrastructural services to the market. The new company will own, manage and commercialise the combined passive infrastructure portfolio, and roll out all future infrastructure. The regulator would play a strong role in providing guidelines on the fair market and competition considerations related to such a venture. It would enable all operators and related parties (consumers, the regulator and government) to unlock the full value of the infrastructure.

Network infrastructure sharing has a beneficial impact as it lowers the cost to service subscribers. Even more importantly, the economic business case for rolling out communications infrastructure into underserviced (often rural) areas improves significantly, due to lower capex requirements. Industry estimates have indicated probable savings of up to 60% annually.

In addition, it will allow operators to explore the deployment of newer technologies (such as 4G) at a lower cost and to a wider customer base, in turn improving the quality of service provided to customers.

Other effects include a reduction in duplicate infrastructure, which has multiple negative economic and environmental impacts, including a higher carbon footprint and unsightly landscapes littered with mobile towers.

Improved economics for the deployment of infrastructure in remote areas further support government’s ambitions to provide improved connectivity under the national broadband plan.

Opportunity

Passive infrastructure sharing presents a great opportunity for everyone. Operators are, to a degree, relieved from their margin squeeze by realising improved operating efficiencies from their network and opex savings of up to 30%, according to GSMA numbers.

Consumers further enjoy improved quality of service and increased network coverage, while operator cost savings frequently translate into more competitive pricing. The potential development of the independent tower company market also has the added benefit of job creation and upskilling.

Regulators would welcome passive infrastructure sharing on this basis, and for reasons of increased market competition, due to network access for potential new entrants.

There is need for increased engagement in the industry to determine the appropriate next steps to unlock the potential value that passive infrastructure sharing has to offer.

- De Wet Bisschoff is MD of Accenture Communications, Media and Technology, while Hennie de Villiers is senior manager: Accenture Strategy