One of the most important events of the conflict in Ukraine has been the removal of Russian banks from the global Swift banking system. Swift, or the Society for Worldwide Interbank Financial Telecommunication, is a messaging system that enables cross-border payments. Driven by sanctions, Russian banks were cut off from accessing foreign capital reserves – most importantly, the US dollar, the world’s most powerful reserve currency.

One of the most important events of the conflict in Ukraine has been the removal of Russian banks from the global Swift banking system. Swift, or the Society for Worldwide Interbank Financial Telecommunication, is a messaging system that enables cross-border payments. Driven by sanctions, Russian banks were cut off from accessing foreign capital reserves – most importantly, the US dollar, the world’s most powerful reserve currency.

While this action effectively reduced Russian President Vladimir Putin’s ability to fund the invasion, it set a precedent that will change the global economy forever.

The age of weaponised finance

If we turn back the clock a few weeks to the riots in Canada, an event of similar importance occurred. In response to Canadian protesters fighting vaccine requirements in Ottawa, President Justin Trudeau announced an unprecedented public order emergency for the first time since World War 2. Using these emergency powers, Trudeau froze the bank accounts of protesters, forcing them to return home.

With the innovation of digital banking, centralised institutions are able to exert control over your money. They can take away your access according to their own agenda. If you happen to fall on the wrong side of history, like the innocent Russians opposing the war in Ukraine or the protesters in Canada, your finances can and will be used against you as a weapon.

The cat is out of the bag: you don’t own your dollars

While these events are understandably overshadowed by the horrific events taking place in Ukraine, central banks and market makers around the world have taken notice. We can’t put the genie back in the bottle. The conflict has shown us that property ownership is not what we thought it was. If your property or money is not in your region, do you really own it?

Raoul Pal, the influential macro investor, believes this is a monumental event in the de-dollarisation of the world.

Everyone now knows the dollar is a liability, not an asset. It can be taken away at will. – Raoul Pal

The weaponisation of the dollar is forcing central banks to reconsider their dollar holdings. Russia and China have been planning for a de-dollarisation for decades, selling off their dollars and filling their vaults with gold and alternative reserve currencies.

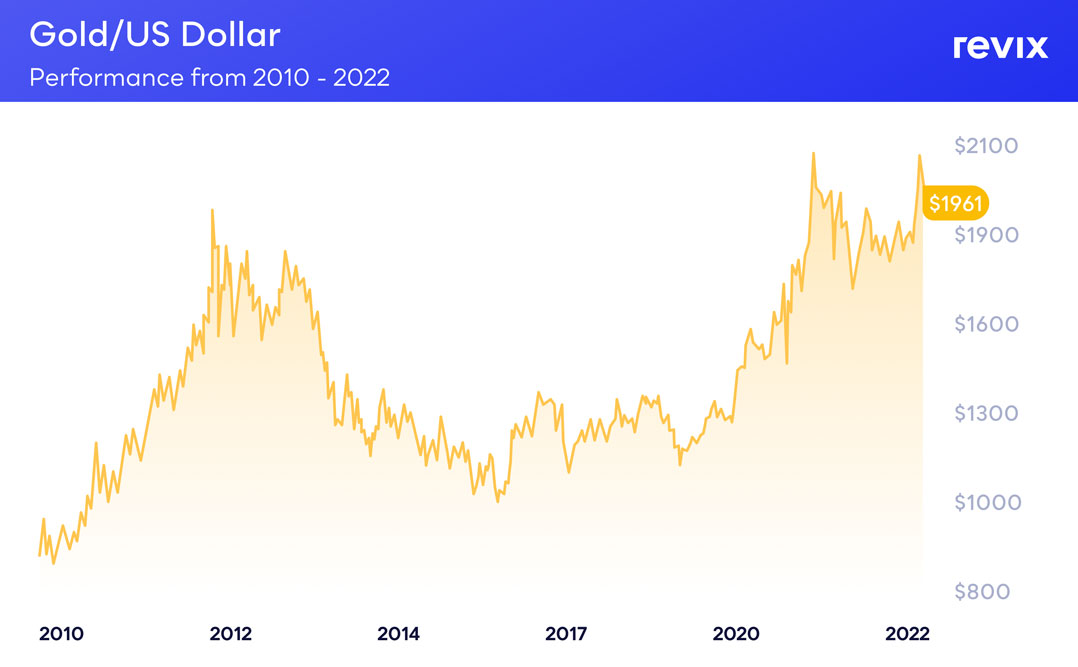

Raoul believes de-dollarisation will be a lengthy process, but the comfortable power of the dollar as the world’s reserve currency is on the inevitable decline. He believes that right now “the only thing central banks can do is buy more gold” because it’s a regulated store of value they can own and hold in their own vaults.

The result should be a significant upside to the price of gold and crypto, as banks and individuals look to stores of value that are not controlled by governments.

Gold may be the headline for now, as investors avoid riskier assets, but this is incredibly bullish for crypto, especially the most decentralised of all cryptos: bitcoin. As the importance of this situation unfolds, it is inevitable that adoption will soar.

Never has it been more important to invest in a store of value that governments and banks cannot control. While the current price volatility holds many investors at bay, the use case for crypto as a store of value has never been more clear.

It’s exactly for these uncertain times of volatility and inflation that the team at Revix — a Cape Town-based investment platform backed by JSE-listed Sabvest — developed a one-of-a-kind ready-made investment that protects your wealth against the exceedingly high inflation reading — our South African CPI — announced last week.

It’s called the Inflation Shield Bundle — an algorithmically optimised investment basket, giving you the protection of gold with the performance of bitcoin, through a single investment. The ratio of gold to bitcoin within the bundle is based on historic risk versus return data aimed at maximising returns while taking on the least amount of downside risk as possible. What’s great is that with Revix’s bundles, which include three cryptocurrency bundles that offer diversified ETF-like exposure to the crypto market, automatically rebalance every month. This means that the weights of the different assets within the bundle are re-weighted to ensure that you’re never overly exposed to any single investment.

Today the bundle is composed of 75% Pax Gold (a cryptocurrency backed by 1:1 by physical gold in London Brinks vaults) and 25% bitcoin (digital gold for a digital world).

How has the bundle performed?

The Inflation Shield Bundle has outperformed both bitcoin and gold over the last 12 months.

The Inflation Shield Bundle offers protection against rising inflation, allowing you to ride out the current market volatility while making the most of the rising gold trend before the coming interest rate hikes that global central banks will undoubtedly roll out.

The inclusion of bitcoin gives you just enough growth exposure to spring back from the dips, while the high percentage of Pax Gold anchors your investment against the money printers. The Inflation Shield Bundle is an invaluable tool to add to your portfolio, allowing you to hedge and secure value while facing curveballs.

0% buy-in fees from 11-17 March

0% buy-in fees from 11-17 March

Revix is cutting all buy-in fees for any Inflation Shield Bundle purchase from 11 to 17 March.

0% losses. 100% gains!

If you’re serious about security, between 11 March and 17 March 2022, Revix is offering free loss cover on your Inflation Shield Bundle for a new deposit of R20 000 and a R20 000 purchase of the bundle. If the market value of the bundle is lower at the end of March than when you bought it, we’ll top it up for you. If the value is higher, you keep the gains. Win, win!

About Revix

Revix brings simplicity, trust and great customer service to investing in cryptocurrencies. Its easy-to-use online platform allows you to securely own the world’s top cryptocurrencies in just a few clicks. Revix guides new clients through the sign-up process to their first deposit and first investment. Once set up, most customers manage their own portfolio but can access support from the Revix team at any time.

Disclaimer

Remember, cryptocurrencies are high-risk investments. You should not invest more than you can afford to lose, and before investing please take into consideration your level of experience, investment objectives and seek independent financial advice if necessary.

This article is intended for informational purposes only. The views expressed are opinions, not facts, and should not be construed as investment advice or recommendations. This article is not an offer, nor the solicitation of an offer, to buy or sell any cryptocurrency.

To learn more visit www.revix.com.

- This promoted content was paid for by the party concerned