South Africa’s big four retail banks have been steadily cutting the number of (costly) branches in recent years. That’s no surprise, given the shift in transactional banking to electronic channels. Those transactions that still need some form of physical interaction, primarily anything involving cash, have been effectively handed over to ATMs.

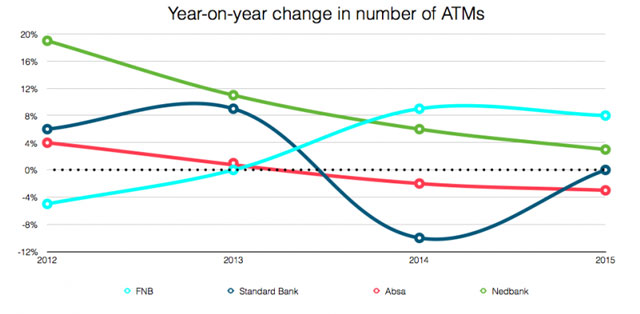

But this doesn’t mean there’s been aggressive build-out of ATM footprints, especially as branch cuts accelerated. In fact, in many ways the opposite is true. The trend over the past four years is clear: we saw robust growth in the number of ATMs countrywide during 2012 and 2013 (the tail end of a shopping centre boom that has all but faltered), but the last few years have seen a noticeable slowdown in growth (and in some cases reductions).

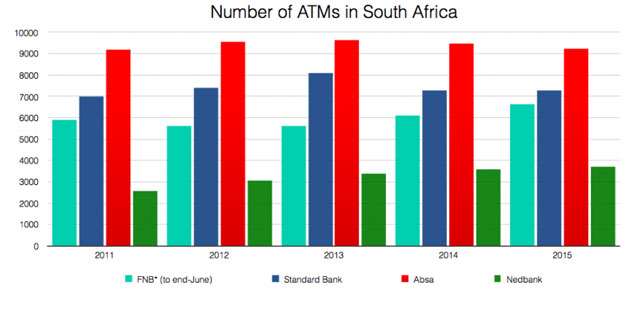

At the end of 2011, Absa, Standard Bank, Nedbank and First National Bank (based on data to end-June, given FirstRand’s financial year) had a total of 24 649 ATMs. By the end of last year, that figure had increased by less than 2 000 to 26 813 — growth of 8,8%. That number translates to net growth of just over 2%/year. Now remember that annual economic growth over the period (2012-2016) was 2,2%, 2,2%, 1,5% and 1,3%. So our retail banks are adding ATMs at a rate of just more than economic growth.

The dynamics for each of the big four are interesting. The ATM footprints of both Absa and Standard Bank, the two largest, peaked in 2013. Absa has cut over the past two years, while Standard Bank took a hacksaw to its base during 2014, removing 10% (net) of its total. It then added a few handfuls (net) during 2015.

FirstRand’s FNB cut in 2012 (technically July 2011 to June 2012), remained flat in 2013 and since then has added ATMs fairly aggressively. Nedbank’s been the most aggressive of all as it completed the decade-long turnaround of its retail division. It has by far the smallest network (of both branches and ATMs), and grew in double digits during 2012 and 2013. Since then, growth has flattened noticeably (over the same period, its retail customer base has expanded by a third).

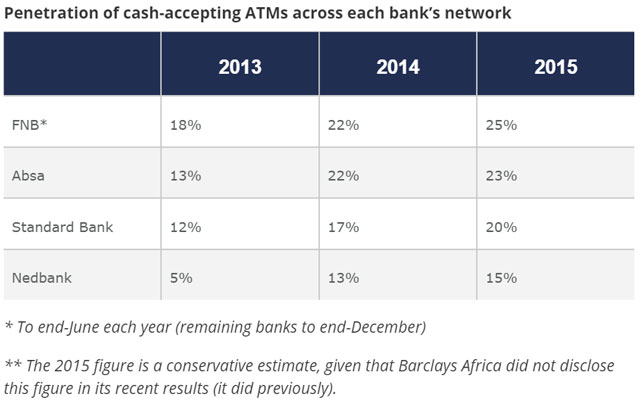

Getting customers to use ATMs (instead of branches) for things like payments and transfers is one half of the equation. However, until five years ago, there was no alternative for deposits (aside from the asinine cheque-in-an-envelope-at-an-ATM method, which was still a manual process for banks, albeit time-shifted).

FNB was the first of the big four to start rolling out cash-accepting ATMs — what it brands “ATM Advance with automated deposits” (ADTs), sometime in 2011 (if not earlier). The other banks followed, with Nedbank being the slowest, by far. FNB remains the most successful to date, with a quarter of its base now accepting cash (Absa caught up quickly during 2014, before slowing its roll-out).

Deposit-accepting ATMs are now nearly one out of every four (across the four largest retail banks).

Expect that number to get to one in three very quickly, particularly if those “reviews” and “optimisations” result in an acceleration in branch closures (they will). Not to mention the cuts by stealth as banks actively shrink floor space across their branch portfolios.

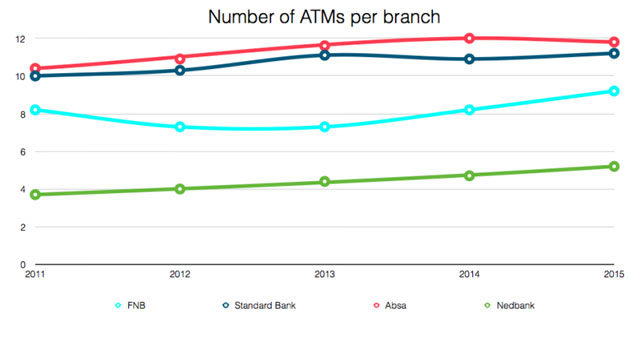

A ratio worth watching is the number of ATMs per branch. All banks except Nedbank are close to or over 10, and all four banks have ratios far higher than they were four years ago. I can see this number getting closer to 20 in the medium term.

Separately, bear in mind that cash-accepting ATMs mean a less frequent need to replenish notes given that the deposits are recycled. My cash deposit becomes your withdrawal. This translates into substantial savings in operating costs, especially since cash-in-transit is not cheap (for rather obvious reasons). Do not discount just how big a driver this has been of the trend.

Cash-accepting ATMs are the new standard and it’s hard to see banks adding anything but these in future, especially as technological improvements mean more functionality. In smaller centres, where branches make no or limited economic sense, it’s hard to see banks not simply closing these (or reducing them to helpdesks) and replacing them with ATMs. (I was surprised to see the number of branches in seriously small towns during my Easter holiday.)

The way retail banking works is fundamentally changing (despite what some argue) and the shifts we’re currently seeing are easily the biggest in decades (with more to come, especially with the long-term trend away from cash). But are the country’s retail banks cutting staff? That answer will surprise you.

- Hilton Tarrant works at immedia

- This piece was first published on Moneyweb and is used here with permission