Lightstone, the developers behind the winner at this year’s MTN Business App of the Year awards, have set their sights on the property market next.

Live Inspect, which is tailored for insurance companies doing pre-inspection vehicle checks at a user’s policy initiation, walked away with the award for best overall business app. The app also received the award for best enterprise app for both Android and iOS.

Now Lightstone has set its sights on the property insurance space.

Live Inspect was conceptualised mid-2013 and launched commercially in February following a proof-of-concept phase with a direct insurer.

Head of business development Jasper van Heesch says that during the early phase of development, Lightstone took the data from 20 000 vehicles that had been inspected manually by the insurer. “More than 40% of the data was incorrect, including VINs (vehicle identification numbers) and the makes and models of vehicles.”

Van Heesch says insurers face a constant battle trying to identify an insured vehicle’s correct details, particularly when it comes to the exact model number, colour and VIN number. “We wanted to address these issues with an app.”

Lightstone has been in business since 2005 and provides comprehensive data and analytics on property, automotive and business assets for a variety of South African industries. It teamed up with development house CustomApp, also founded in 2005, to build the app, which was initially aimed at car dealers to assist them in verifying and validating vehicles that are bought and sold second hand.

CustomApp is no stranger to the financial services and insurance industries. Most of its clients are big players in these industries, says director Graham Harvey.

Harvey says the insurance industry is highly competitive and some insurers have not made profits on their vehicle insurance businesses for the past seven years. “This is partly due to fraud and the massive inefficiencies that exist within the motor insurance space.”

Van Heesch attributes these inefficiencies to human error as the inspection process has traditionally required a person to record vehicles’ details manually. VINs are often recorded incorrectly.

The information can also be captured incorrectly on the insurer’s end as these details are often faxed through once a vehicle has been inspected.

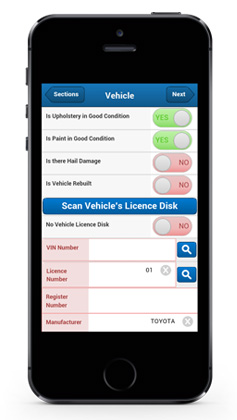

The Live Inspect app eliminates these problems by automating much of the capturing process during pre-inspection. Users scan the barcode on a vehicle’s licence disc using the app. It can also be used to scan and interpret the insurance holder’s driver’s licence.

Other details that the app records include damage to the vehicle and any extras that may have been fitted. Van Heesch says the app also captures geo-location and timestamp data from the photos taken of the vehicle. “This is to prevent fraud by people taking photos of an identical vehicle to pass it off as the one to be insured,” says Van Heesch.

Other details that the app records include damage to the vehicle and any extras that may have been fitted. Van Heesch says the app also captures geo-location and timestamp data from the photos taken of the vehicle. “This is to prevent fraud by people taking photos of an identical vehicle to pass it off as the one to be insured,” says Van Heesch.

The insurer will be able to see if there are inconsistencies with the metadata captured, thus preventing inspection fraud. The app provides a detailed audit trail of the inspection process.

This data is then sent directly to the insurer. Insurers are able to use the technology to prevent claim fraud. Stolen or rebuilt vehicles could also be immediately identified.

Although the app in its current form is aimed only at inspectors in the insurance industry, the company has plans to launch a consumer version of Live Inspect soon. This will allow consumers to do self inspections, because of the stringent data capturing process required, the same principles apply to prevent fraudulent activity. Allowing consumers to do such an inspection will be at the discretion of an insurer, though. Van Heesch says two insurers will soon allow their customers to do self inspections via the app.

“The app gets much of its data from the [National Association of Automobile Manufacturers of South Africa] database and we are the custodians of that data,” Van Heesch adds. “We also have access to police, finance and bank databases.”

The ability to check these databases in real time has already led to the recovery in Cape Town of a stolen luxury Mercedes-Benz worth R1,1m.

Since its development, the Live Inspect app has completed over 150 000 pre-inspection bookings and is used by more than a thousand inspectors.

The Telesure group, which owns Auto & General, Dial Direct, 1st for Women and Budget Insurance, is a key customer. The insurance arms of First National Bank and Nedbank also using the app for their inspections, says Van Heesch. Lightstone is also pitching the app as a white-label solution for insurers wanting to brand it themselves.

Insurance companies pay per inspection rather than buying the app outright.

Lightstone now wants its technology to be used for property and household insurance, too. It intends using the same principles as the vehicle inspection app to record the details of a building or the contents of a house. — © 2014 NewsCentral Media