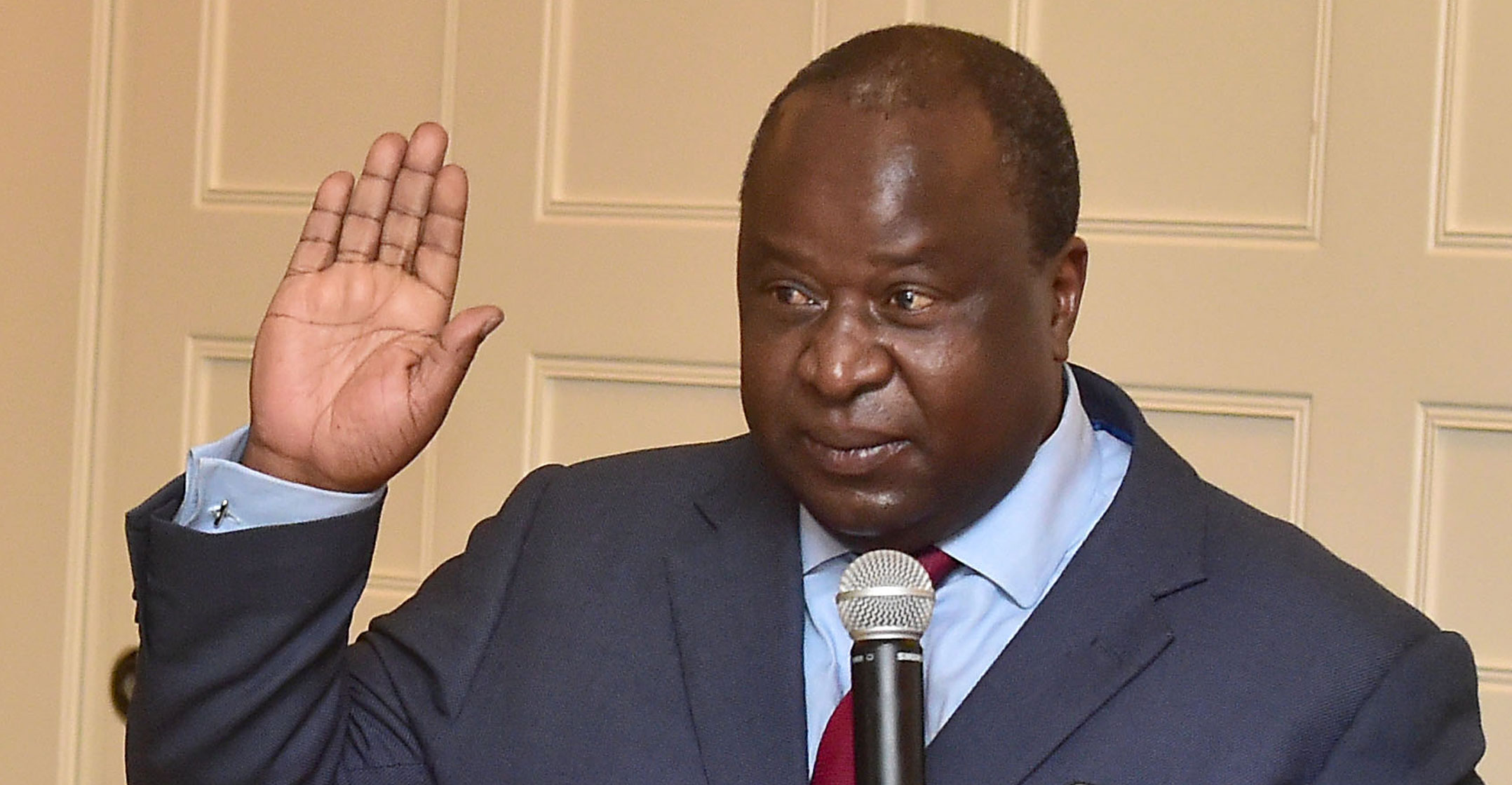

The Public Investment Corp, Africa’s biggest fund manager, is willing to help Eskom resolve its debt crisis, finance minister Tito Mboweni said at the Bloomberg Capital Markets Focus virtual event on Tuesday.

“Most of the bonds actually are held by the PIC and the banks and so on,” Mboweni said. “Eskom treasury is working on this matter together with national treasury of South Africa, to make sure we smooth out the bonds as they mature.”

Eskom’s debt had ballooned to R488-billion by the end of March, almost 11% more than it owed a year earlier. The utility’s finances have deteriorated despite the government having given it R188-billion in grants and loans over the past decade.

“The key issue in South Africa is that Eskom must manage their business, they must manage their income stream and their borrowing programme because all of us need Eskom to be successful,” he said.

Mboweni also said:

- The country must adjust its expenditure patterns and ensure the debt-to-GDP ratio doesn’t reach the 100% level;

- There are “green shoots” of a recovery in the economy, particularly in mining and manufacturing;

- He hopes an agreement can be reached with labour unions to freeze civil servants’ wages for the next three years;

- Any public-sector wage deal must be within the confines of a prudent fiscal framework;

- The government is edging closer to an understanding with the World Bank about securing a loan, but won’t accept that any conditions be attached to it; and

- South Africa seeks a rebound in economic growth to 3.3% in 2021. — Reported by Manus Cranny and Gemma Gatticchi, (c) 2020 Bloomberg LP