A competitor with a sharp edge. That appears to be the conclusion if the R7bn tie-up between Vodacom and Neotel goes ahead. While this will be good for investors in Vodacom, it might also be positive for the man in the street.

The deal is going through due process at the Competition Commission. So how will it change the competitive landscape in the ICT sector if approved? And what are the chances of a similar deal being done between MTN and Telkom?

David Lerche, the telecommunications analyst at Avior Research, thinks the deal is likely. “We think it will go ahead, with perhaps one or two conditions attached by the regulator.”

Regardless of the compelling reasons for Vodacom (which we will delve into later), Neotel simply doesn’t have many options: it needs money.

Neotel is owned by India’s Tata Communications (the majority shareholder), CommuniTel and Nexus Connection (a black-owned consortium) and has battled to gain traction against Telkom.

“They were always going to be fighting an uphill battle as an under-capitalised late entrant,” says Lerche. “You can say what you like about Telkom, but it still has an incredible network.”

By Lerche’s estimates, Telkom has as much as seven times the fibre-optic cable in the ground as Neotel. In the absence of any deal with Vodacom, Neotel would require further capital injections, something its owners appear unwilling, or unable to do.

Besides access to fixed-line fibre optics, Neotel would give Vodacom access to precious spectrum that would allow the mobile operator to expand its data offerings with far less capital than might be required without it.

Bone of contention

The spectrum has been a particular bone of contention for Vodacom’s direct competitors, MTN and Cell C. Cell C CEO Jose Dos Santos believes the spectrum needs to be returned to Icasa, who should then reallocate it to all operators. Neotel would provide access to spectrum in the 800MHz, 1,8GHz and 3,5GHz bands.

Lerche explains the importance of access to spectrum. “Spectrum is valuable because when your network gets full you either have to increase the number of base stations or get access to more spectrum in order to expand network capacity. In Vodacom’s case (in which they are particularly constrained), they would have to spend a huge amount of money to expand their data services by increasing the number of base stations, which can be much more expensive than buying spectrum.

“So, from Vodacom’s perspective, the deal bodes well for greater network capacity, and this should translate to higher speeds and lower data pricing for consumers,” he says.

If access to the spectrum was excluded as part of the deal fashioned by the Competition Commission, Lerche thinks it would not be consummated anywhere near the current R7bn price tag.

But if successful, the result will be a huge advantage for Vodacom. It will have the room to grow its dominant data business as well being able to cross-sell services in both directions by providing converged solutions. It will also give Vodacom a first-mover advantage in rolling out 4G/LTE broadband.

For Telkom, the deal would mean the entrance of a well-capitalised competitor that can go toe-to-toe with it. Vodacom has already said it would seek to roll out fibre-optic lines to over a million households in a few years. So the gloves will be off. While that might have scared the pants off of Telkom a year ago, the state-owned company is a different animal now. It has also been the subject of speculation of a potential tie-up with MTN.

The rationale for MTN acquiring Telkom would not be dissimilar to Vodacom’s in acquiring Neotel. There is an established fixed-line business, and access to spectrum. A potential combination has become all the more intriguing due to government’s need to support Eskom financially. This became evident in light of comments made by national treasury alluding to the sale of certain noncore assets that will provide funds with which to prop up the beleaguered parastatal.

Strategic asset

But Lerche is not convinced Telkom is non-core. “I don’t think so. [Government’s] actions over the last few years suggest Telkom is a strategic asset. [Korea’s] KT Corp could not acquire control. So I don’t think the government wants to sell Telkom. And when it comes down to the details, how would MTN approach some of the legacy issues — like Telkom’s obligations to service unprofitable areas?” says Lerche.

The company is also undergoing a revival since the board was reconfigured, and since CEO Sipho Maseko took the helm in April 2013. While probably having double the amount of employees it requires — a problem that has been (and will continue to be) addressed by successive rounds of retrenchments, Maseko has started to box the company into shape.

“With Telkom now being run much better, and the share price approaching R80/share, I’m not sure MTN could earn a suitable return on capital even if they could get their hands on the business,” says Lerche.

Which begs the question: where was MTN when Telkom was at R11/share? If the addition of a fixed-line operator with access to spectrum gives your competitor such a big advantage that it should be rejected by regulators, why wasn’t MTN scheming to do the same thing?

This all does not bode well for Cell C. Lerche says: “I don’t think they are making enough cash to fund the reinvestment required in the network. This relates to the upgrading of infrastructure required to meet the data needs of their clients that would keep them competitive.”

While government intends to make more spectrum available to all three operators later this year, the newest addition to the family has a long road ahead of it

Time to buy?

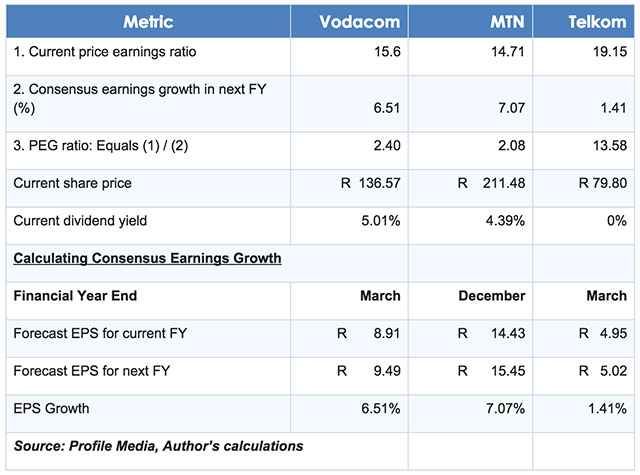

Looking at the table below, it appears little of the growth offered by the Neotel acquisition has been priced into Vodacom. When factoring growth into the value of a company, it’s worthwhile dividing the price:earnings ratio by the expected earnings growth rate to get a price:earnings to growth (Peg) ratio with which to compare companies.

Vodacom’s paltry 6,5% forecasted growth in earnings for the 2015/2016 financial year is lower than that of MTN. But it has a slightly higher price:earings ratio, so Vodacom’s Peg ratio is slightly higher than MTN’s. The implication is that MTN appears to offer the best value at the moment — but not by much. Telkom’s short march from R11/share to R80/share appears to have been a little overdone if its Peg ratio is anything to go by.

Looking even further out at forecast earnings for Vodacom (not shown here) suggests little growth has been priced in either. So the acquisition of Neotel may usher in a new phase of growth for a mature-looking business.

- This was republished from Moneyweb with permission