Card payment growth is muscling in on cash and outstripping other payment methods in South Africa’s informal economy, new research shows.

Card payment growth is muscling in on cash and outstripping other payment methods in South Africa’s informal economy, new research shows.

The digitisation of payments in the cash-driven informal economy is shining a light on consumer behaviour in what is often thought of as the country’s invisible or “dark” sector.

Lesaka Technologies, parent to the Kazang merchant solutions business, has collaborated with kasi economy expert GG Alcock and used data from more than 70 000 merchant devices to glean insights into the nature of digitisation in the informal economy.

The results are outlined in the Lesaka Informal Economy Digitalisation Index, published this week. It found that card payments are skyrocketing as consumers in this segment begin turning away from cash.

“We are seeing a greater portion of card payments into the digital wallets that underpin our point-of-sale devices,” said Lesaka Technologies group CEO Chris Meyer. “We have transitioned from 0% to 42% of our R2-billion/month transaction volumes being card-based in the period from 2021 to 2023. More than 90% of these volumes are from debit cards.”

Comprised of businesses mostly in townships, rural and outlying areas, the informal or kasi economy is estimated by Alcock to be worth more than R600-billion annually.

In recent years, various factors have driven digitisation in the informal sector. The changes are driving consumer and merchant behaviour away from a reliance on cash.

Informal sector

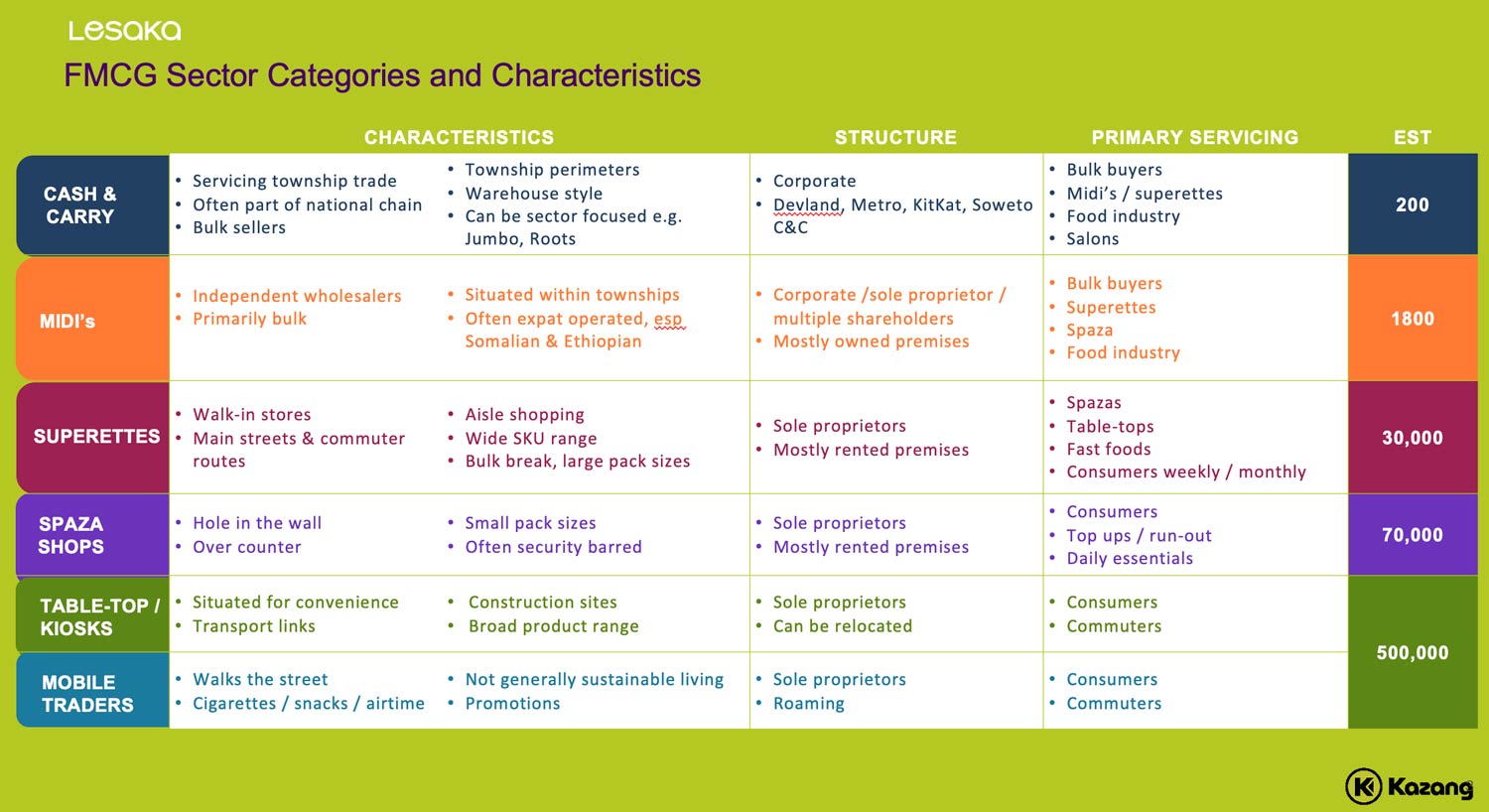

Kazang CEO Martin Wright said the proliferation of fintech companies offering cheaper merchant services along with point-of-sale (POS) devices – which are now often “free” – has coincided with growing demand for digital payment methods in the more formalised portions of the kasi economy. This segment comprises larger cash and carries, independent wholesalers and superettes (medium-sized walk-in stores on main roads).

Alcock, who also wrote the book Kasinomics – African Informal Economies and the People Who Inhabit Them, explained that safety concerns are the main driver of merchant-side demand for digital payment methods. Additional merchant benefits, such as the lowering of employee fraud and the reduced cost associated with moving large sums of money around compared to cash, were also highlighted as significant.

Read: RoomKing takes aim at SA’s backroom rental market

Other drivers include the government transitioning millions of Sassa grant recipients from cash onto card.

“Three years ago, all grants were paid in cash. They then moved to the Post Office, and today the majority (58%) of grant recipients are paid through [digital] financial services,” said Lesaka Technologies South Africa CEO Lincoln Mali, explaining how the transition has accustomed many previously unbanked, lower-LSM individuals to using debit cards as a method of payment.

“We also found that pre-Covid, people were afraid to tap their cards, but during the pandemic they considered it safer to do so – the pandemic changed their psychology.”

In the broader economy, the pandemic’s impact on digital payments also drove growth in in-app payment services such as Zapper, Apple Pay and Samsung Pay where customers tap their phones to make a payment. Although smart device penetration in the lower LSMs inhibits similar levels of growth in the informal market, Alcock explained that there is a safety factor playing a more influential role in how kasi consumers behave.

“People, even old gogos, understand how to tap their card to pay or insert the chip and enter a Pin if they need to. But they don’t feel safe opening their banking app in public because someone might be spying, their phone might get snatched, or they could be cornered and coerced into transferring money from their accounts,” said Alcock.

In line with safety, Alcock explained that trust factors are also deciding which digital payment methods and brands gain traction in the informal market.

“People will tap their card on a machine they recognise, like a Kazang here in Gauteng or an iKhokha in KZN, but they hold back if the brand is unfamiliar. You may find that the company providing the POS machine is well known but the brand name they’re using for it isn’t,” he said. “That’s also why phone scanning or tapping methods have not worked there; people [in the informal economy] are more afraid of being hacked via their phones.”

The digital crimes profile in the informal economy differs from the formal market. Incidents of phishing and other sophisticated scams are superseded by cases involving some element of force. “The fact that you can block a card even though someone may have taken it from you and forced you to give them your Pin makes it much safer,” said Lesaka CEO Meyer.

Safety and convenience

The safety and convenience offered by card payments underpins the resilience of this payment method in the informal economy – so much so that smaller players in this segment, including spaza shops, tabletop merchants and mobile traders, now prefer it to cash.

“The average cost to ‘swipa’ (the colloquialism for paying using a card) at spaza shops has gone down from an additional R20 to just R5. Getting a cashback was once R50 and now costs R10. Traders used to charge a high ‘convenience fee’ in the past because they actually didn’t want card payments back then. Now they incentivise card payments because they mitigate the risk of carrying cash and they often make a cash withdrawal free [for customers] if it accompanies a purchase,” said Alcock.

Read: Big banks, take note: PayShap should be free

The uptick in digitisation is having a positive impact on visibility from a tax collection perspective, but Alcock warns that this is a double-edged sword. Those businesses that were previously not registered for tax also did not claim VAT, which amounted to a saving for the state. As they formalise, their tax liability will be offset by that, he explained.

Merchants, meanwhile, are finding that there are additional benefits to digitising their businesses. The availability of a reliable money trail has opened financing opportunities that are driving growth in the sector.

“There is a huge amount of anecdotal data about the kasi economy, and it has led to red herrings like ‘everyone wants to use cash because they will be invisible to the tax man’, but this is not true. Merchants often find that the value in safety and convenience offsets the cost,” said Alcock. — (c) 2023 NewsCentral Media