Naspers spin-off, Netherlands-listed Prosus, is making an audacious, R93.5-billion hostile bid to buy London-listed Just Eat.

Browsing: Naspers

Tuesday’s dramatic hostile counter-bid for the British Internet takeout company Just Eat arrived almost fully baked. But the new offer isn’t that tempting – it needs a big dollop of dessert to make it irresistible.

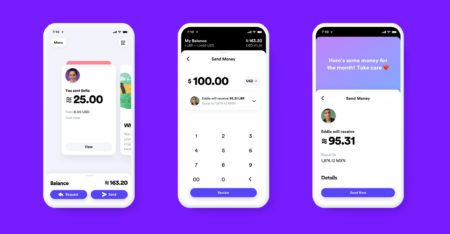

Facebook’s remaining partners in its digital currency project signed paperwork on Monday to officially join the Libra Association.

Facebook’s effort to create a cryptocurrency was dealt a blow on Friday after several key partners, including Mastercard, Visa, eBay, Stripe and Mercado Pago, abandoned the project.

Naspers CEO Bob van Dijk said on Wednesday that the South African consumer Internet group remains a committed member of the Libra Association, the organisation overseeing the libra cryptocurrency.

Prosus, which listed in Amsterdam just last week, is splitting opinion among the first investment banks to cover the stock.

The astonishing things is that shareholders were asked to approve the new scheme – and did – without knowing what the performance condition was.

Investors piled into Naspers’s newly listed Dutch unit, holding assets including a lucrative stake in Tencent Holdings, sending its shares soaring on their trading debut in Amsterdam.

The dominance of Naspers over the South African stock market is about to be reduced – partially at least. And that’s good news for a number of fund managers.

When Naspers’s Latin America chief cold-called Alec Oxenford in 2010, he got straight to the point: he wanted to buy a majority stake of the Argentinian entrepreneur’s online classifieds business.