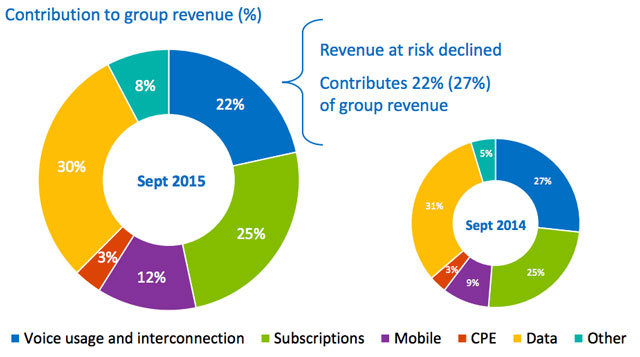

By Telkom’s own admission, its “revenue at risk” declined in the six months to 30 September 2015. This “at-risk” portion is effectively any voice usage or interconnection revenue, which currently comprises 22% of the group’s total.

By Telkom’s own admission, its “revenue at risk” declined in the six months to 30 September 2015. This “at-risk” portion is effectively any voice usage or interconnection revenue, which currently comprises 22% of the group’s total.

It seems rather insignificant, but in the comparable period a year ago, it comprised 27% of group revenue. Either management was successful in further diversifying revenue, or this portion of turnover declined far quicker than contemplated. (The slide from the group’s results presentation for the half-year to end-September doesn’t really indicate which.)

The answer is a bit of both.

Fixed-line voice usage dropped by 14,1% year on year to R3,1bn, while fixed-line interconnect (domestic and international) fell by 18,7% to R543m. The latter is not a massive number, but the international portion of interconnect has cratered in recent years. In the six-month reporting period, it fell by 28,4% year on year. As recently as three years ago, this figure was close to double.

Far more worrying, though, is revenue from fixed-line usage. Two years ago, to September 2013 — the first six months of CEO Sipho Maseko’s tenure — this segment of revenue was a full billion rand more than it is today (R4,1bn). Put simply, people aren’t using their landlines anymore. On a slide titled “A changed and challenging landscape”, Telkom says rather plainly: “Voice usage continues to decline.”

At the rate it’s currently going — with R500m, give or take, of fixed-line usage revenue evaporating every 12 months — the picture is not going to look too pretty in a year or two’s time.

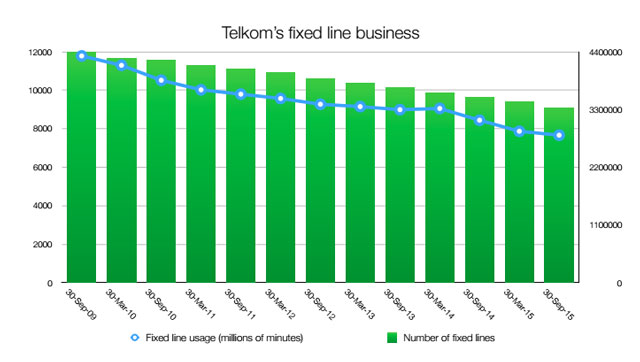

Actual fixed-line traffic looks arguably worse. In the last six years, the number of fixed-line minutes Telkom has carried on its network has dropped by 35%.

Amazingly, Telkom has managed — in fits and starts — to grow top-line revenue (excluding Trudon, Swiftnet and iWayAfrica), from R15,4bn in the first six months of fiscal 2013, to R15,3bn last year, and R15,7bn this year. This has largely been achieved through price increases (and a growing mobile division), which has offset declines in segments of the business.

This is on the back of a loss of a quarter of its fixed-line base (down by 24% in the last six years). At 30 September 2009, there were 4,4m active fixed lines. Now, six years later, that number is 3,3m. Moreover, remove the growth in ADSL lines over the past six years from the equation (net adds of over 400 000), and the drop in active fixed lines is even worse.

The problem, however, is that Telkom does not consider “subscriptions” revenue as “at risk”. This comprises the monthly line rental (or service rental) and voice minute bundle/packages it sells to customers. In the six months to end-September 2015, as in the period last year, this equates to 25% of group revenue.

Indeed, it’s one thing to have annuity revenue for landlines which are simply not used by each of your million ADSL subscribers. But sooner or later, this too surely becomes “revenue at risk”? (Especially if so-called naked ADSL, where customers are able to get ADSL without paying for analogue line rental, becomes reality.)

Just this compulsory analogue line rental charge (at the R189/month consumer, not business, rates) equates to nearly R200m/month. That’s R2,3bn/year, or more than a quarter of Telkom’s “fixed-line subscriptions” revenue of just north of R8bn. Add the subscriptions for ADSL lines (at, say, R250/month — less than the midway between the entry-level and the high-end packages), and that’s another R253m/month, or over R3bn/year. Together, monthly fees for those services are likely two-thirds of Telkom’s subscription revenue.

If my hypothesis — that we’ve reached peak ADSL — holds true, expect the number of fixed lines to decline at an even faster pace in the next five years. What happens to Telkom’s (not at risk) subscriptions revenue then?

- Hilton Tarrant works at immedia, specialists in native mobile app and Web development

- This column was first published on Moneyweb and is republished here with permission

- Subscribe to TechCentral’s free daily newsletter