New research shows South Africans actively dislike telecommunications operators, with the industry ranked last in net customer sentiment, well below banking, insurance and retail.

New research shows South Africans actively dislike telecommunications operators, with the industry ranked last in net customer sentiment, well below banking, insurance and retail.

The latest South African Telecommunications Sentiment Index, published by DataEQ – formerly BrandsEye – in partnership with Deloitte, gave the sector a score of -31.1%, compared to -7.5% for banking, +1.4% for insurance and +4.1% for retail.

DataEQ tracked almost two million posts on social media to determine the index rankings. It “quantifies the voice of the consumer with specific focus on how telcos stack up in terms of their pricing and affordability, network quality and customer service”.

It also identifies which areas of social media conversation pose potential risk to the operators, whether this be from an operational, legal, regulatory, or reputational perspective.

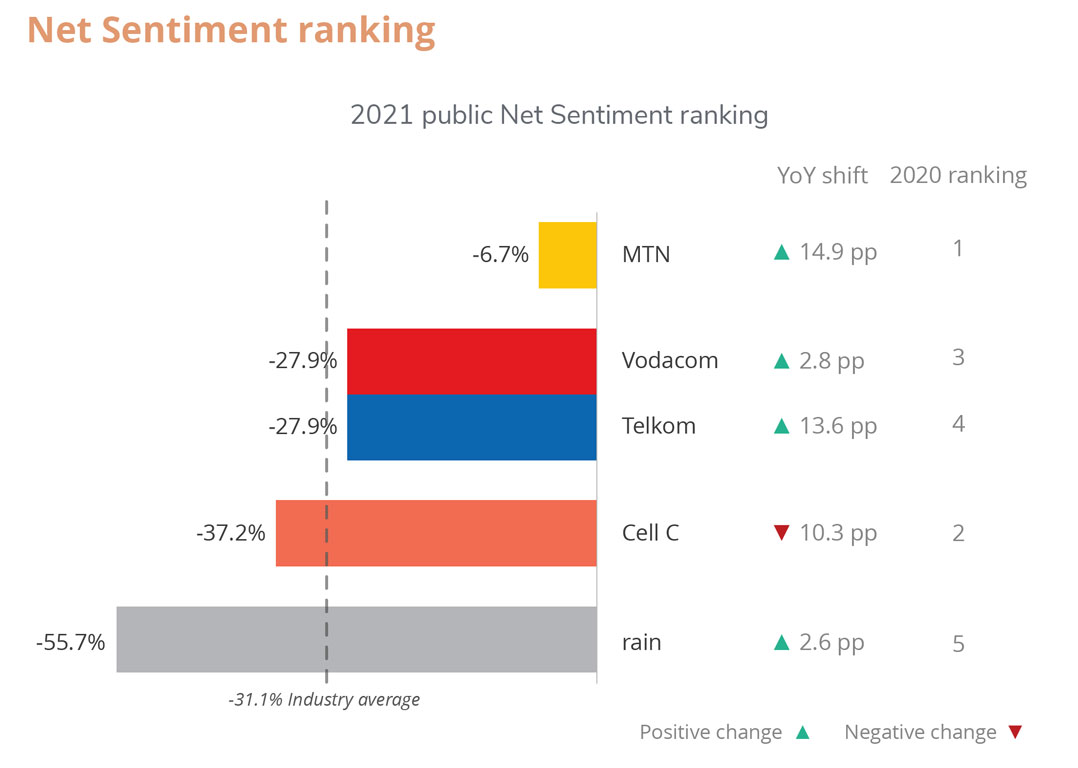

Some operators are doing better than others. While Cell C saw a sharp decline (-10.3 percentage points) year on year, Telkom (+13.6) and MTN (+14.9) showed strong improvement in customer sentiment.

MTN, with a -6.7% score, was the best performer among South Africa’s five big telecoms operators, followed by Vodacom and Telkom (-27.9% each), Cell C (-37.2%) and Rain (with an improved but still very poor -55.7%).

“MTN extended its lead by producing the largest year-on-year net sentiment improvement, while Rain’s uptick wasn’t enough to see a ranking shift,” DataEQ said. “The biggest improvement in both reputational and operational sentiment came from Telkom, which saw the partly state-owned operator climb the rankings to share second place with Vodacom.”

Of the improved sentiment from 2020 to 2021, DataEQ MD Melanie Malherbe said: “Much of the progress relied on telcos’ reputational efforts. Notwithstanding some successful brand and influencer campaigns, customer experience remained a major shortcoming across the industry, with consumer sentiment for this aspect worsening year on year.”

With telecoms operators delving deeper into financial services, this year’s DataEQ index also includes an analysis of the operators’ adherence to the Financial Sector Conduct Authority’s Treating Customers Fairly regulatory framework.

“Beyond the rising regulatory pressures, the results indicate that the operators lag the broader financial services sector in terms of consumer sentiment,” said Deloitte Africa technology media and telecoms industry leader Gill Hofmeyr. – © 2022 NewsCentral Media