Car makers slashed production. PlayStations got harder to find in stores. Broadband providers faced months-long delays for Internet routers. All of these phenomena and more had a similar cause: an abrupt and cascading shortage of semiconductors.

Car makers slashed production. PlayStations got harder to find in stores. Broadband providers faced months-long delays for Internet routers. All of these phenomena and more had a similar cause: an abrupt and cascading shortage of semiconductors.

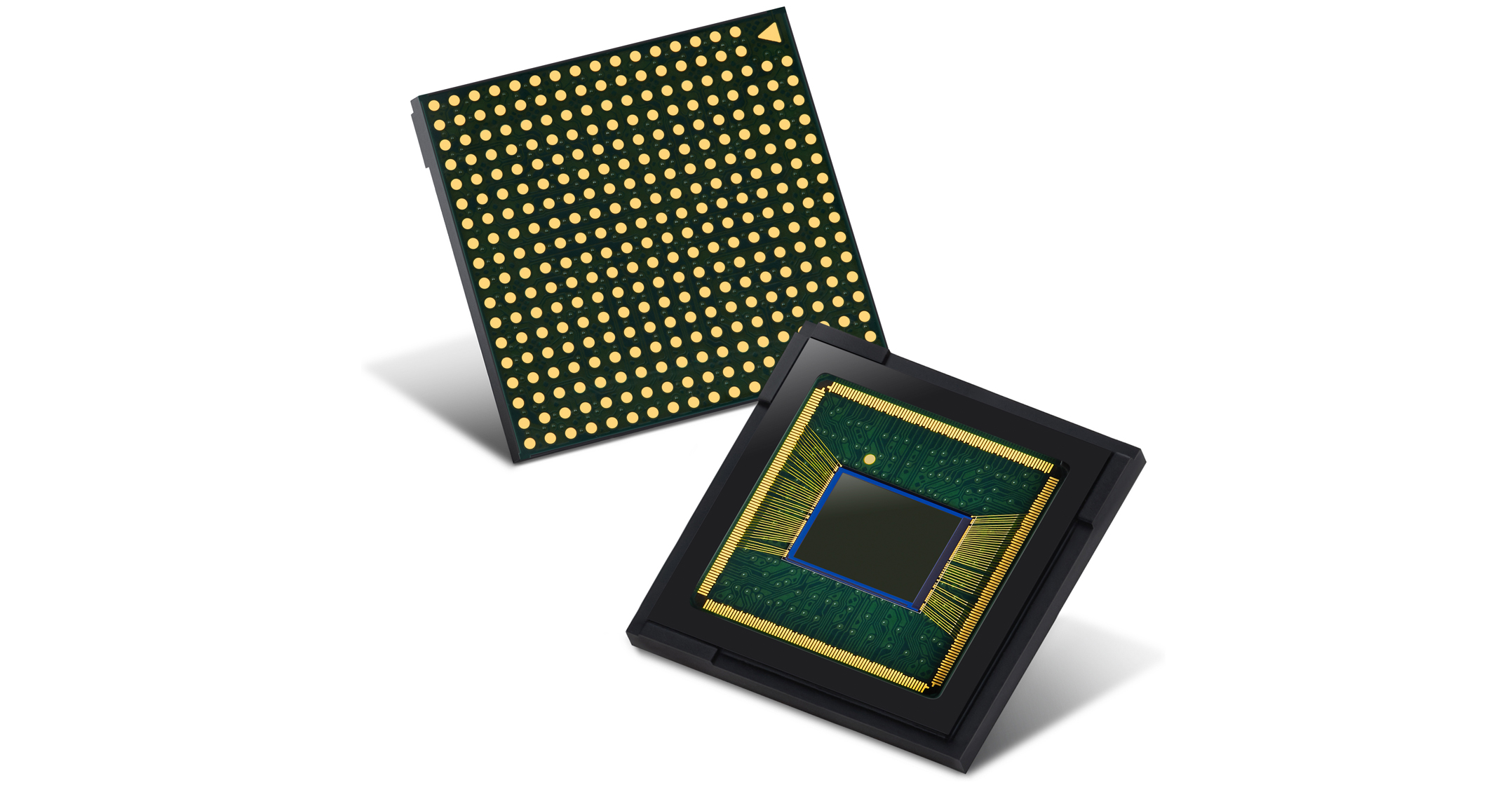

Also known as integrated circuits or more commonly just chips, they may be the tiniest yet most exacting product ever manufactured on a global scale.

The combination of cost and difficulty in producing them has fostered a worldwide reliance two Asian powerhouses — Taiwan Semiconductor Manufacturing Co (TSMC) and South Korea’s Samsung Electronics.

That dependence was brought into stark relief in 2020 when the Covid-19 pandemic and rising US-China tensions made chips scarce. Hundreds of billions of dollars will be spent in the coming years in a global race to expand production, with geopolitical as well as economic implications.

1. Why are there shortages?

Here are some factors:

- The stay-at-home era: This pushed chip demand beyond levels projected before the pandemic. Lockdowns spurred growth in sales of laptops to the highest in a decade. Home networking gear, webcams and monitors were snapped up as office work moved out of the office. Sales also jumped for home appliances from TVs to air purifiers, all of which now come with customised chips.

- Fluctuating forecasts: Car makers that cut back drastically early in the pandemic underestimated how quickly car sales would rebound. They rushed to increase orders late in 2020, only to get turned away because chip makers were stretched, supplying computing and smartphone giants like Apple.

- Stockpiling: PC makers began warning about tight supplies early in 2020. Then around mid-year, Huawei Technologies, the Chinese smartphone maker that also dominates the global market for 5G networking gear, began building inventory to ensure it could survive US sanctions that were set to cut it off from its primary suppliers. Other companies followed suit, hoping to grab share from Huawei, and China’s imports of chips climbed to almost US$380-billion in 2020, up from $330-billion the previous year.

- Disasters: A bitter February cold snap in Texas led to power outages that shut semiconductor plants clustered around Austin; it was late March before Samsung’s facilities there were back to normal. A factory in Japan belonging to Renesas Electronics, a major provider of automotive chips, was damaged by fire in March, disrupting production for months.

2. Who is affected?

Chip shortages are expected to wipe out $110-billion of sales for car makers this year, with production of 3.9 million vehicles lost, or about 4.6% of the projected total. “Never seen anything like it,” Elon Musk, Tesla’s CEO, tweeted. Samsung warned in March that it saw a “serious imbalance” in supply and demand globally. TSMC forecast in April that the shortages could extend into 2022. Broadband providers in Europe were facing delays of more than a year when ordering Internet routers. Apple said that supply constraints were crimping sales of iPads and Macs, which it said would knock $3-billion to $4-billion off its third-quarter revenue. Nintendo said in May that shortages were slowing production of its Switch gaming device.

3. What is a chip?

It’s the thing that makes electronic items smart. Made from a conductive material, usually silicon, the chip performs a variety of functions. Memory chips, which store data, are relatively simple and have become cheap commodities. Logic chips, which run programs and act as the brains of a device, are more complex and expensive. These often carry name brands like Apple, Qualcomm or Nvidia, but those companies are actually just the designers of the semiconductors, which are manufactured in factories called foundries.

4. Why is it so hard to compete?

Manufacturing advanced logic chips is a high-volume enterprise that requires incredible precision, along with huge long-term bets in a field subject to rapid change. Plants cost billions of dollars to build and equip, and they have to run flat-out 24/7 to recoup the investment. But it’s not just that. A foundry also gobbles up enormous amounts of water and electricity and is vulnerable to even the tiniest disruptions, whether from dust particles or distant earthquakes.

5. Who are the big manufacturers?

- TSMC pioneered the foundry business — purely manufacturing logic chips for others — with government support in the 1980s and now produces the most sophisticated chips. Everyone beats a path to its door to get them; its share of the global foundry market is larger than its next three competitors combined.

- Samsung dominates in memory chips and is trying to muscle in on TSMC’s gold mine. It’s been improving its production technology and winning new orders from companies such as Qualcomm and Nvidia.

- Intel, the last US champion in the field, has more overall revenue than any other chip maker, but its business is heavily concentrated in manufacturing its own-brand chips that serve as the CPUs for laptops and desktop computers. Production delays have made it vulnerable to rivals, who are winning share using TSMC to produce their designs. Intel unveiled an ambitious bid in March to regain its manufacturing lead and break into the foundry business by spending $20-billion to build two new factories in Arizona.

- Smaller manufacturers include the US’s GlobalFoundries, China’s Semiconductor Manufacturing International (SMIC) and Taiwan’s United Microelectronics. But they’re at least two to three generations behind TSMC’s technology. Famous names such as Texas Instruments, IBM and Motorola, all US companies, have exited or given up trying to keep up with the most advanced manufacturing.

6. How’s the competition going?

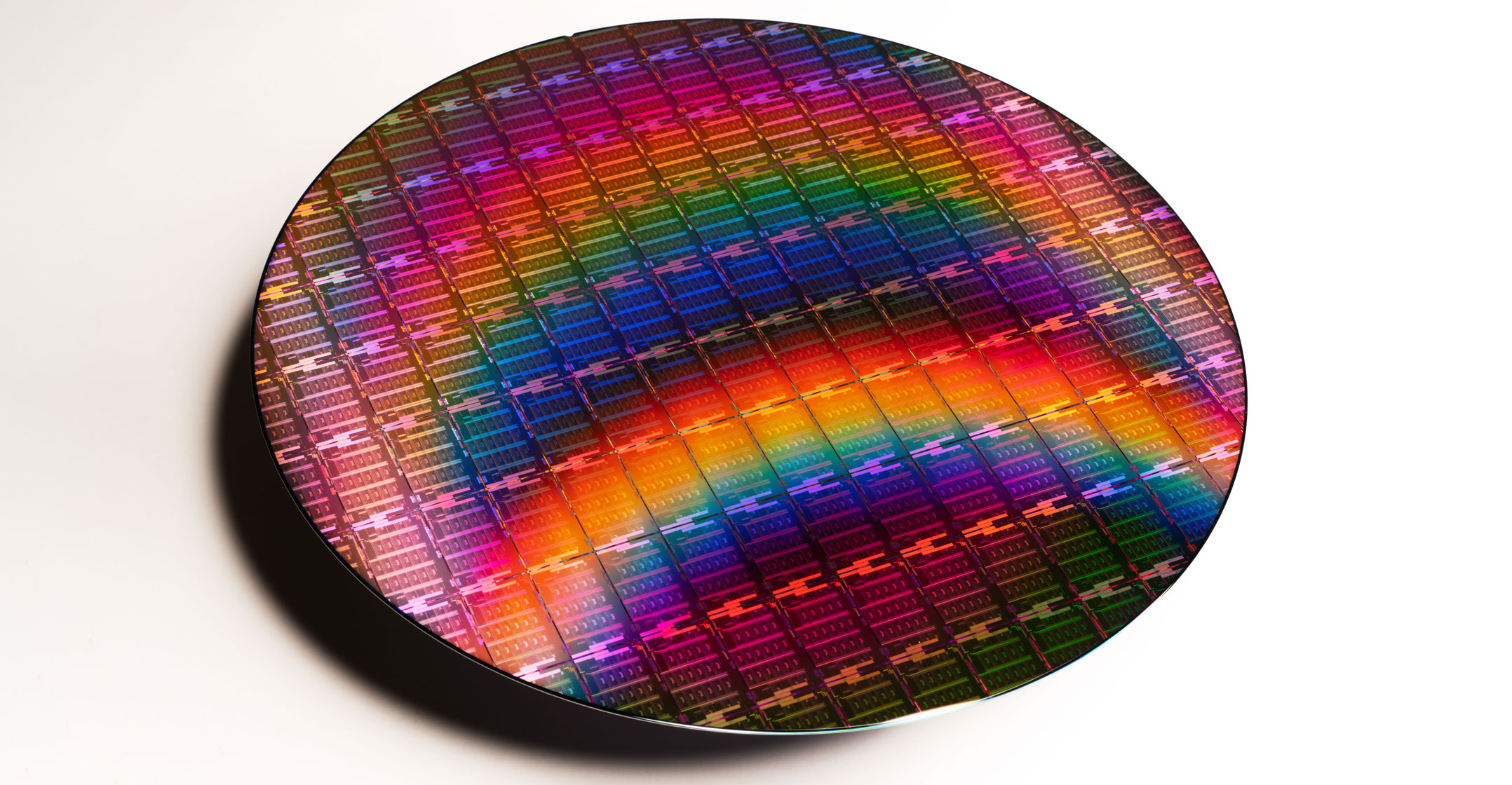

The two giants are spending heavily to cement their dominance: TSMC said in April it would ramp up its capital expenditure over the next three years to $100-billion, including about $30-billion for capacity expansion and upgrades in 2021, from a record $17-billion last year. Samsung is earmarking about $151-billion for a decade-long project to catch its Taiwanese rival, part of a broader plan by South Korean companies including SK Hynix to spend roughly $450-billion to build the world’s largest chip-making base. China is pushing hard to catch up as part of its efforts to reduce the country’s reliance on US technology, spurred by US moves to restrict access to American intellectual property such as software and gear for designing chips. But China has a long way to go. For instance, in the automotive sector it has developed a large number of chip-design companies, but they still aren’t able to come up with the advanced chips that serve as the brains for today’s ever-smarter cars. In March, China again pledged to boost spending and drive research into cutting-edge chips as part of its new five-year economic blueprint. SMIC has already announced plans for a $2.35-billion plant with funding from the city of Shenzhen. The facility aims to begin production by 2022 and eventually churn out about half a million 12-inch wafers a year. (Wafers are used to fabricate chips.) By comparison, TSMC shipped about 12.4 million such wafers in 2020.

7. What about outside Asia?

The US, which still leads the world in chip design, is seeking to encourage companies to build or expand advanced factories domestically to address what US commerce secretary Gina Raimondo called a risk to national and economic security. In a report released in June, President Joe Biden recommended congress appropriate at least $50-billion to support semiconductor research and production in the US. (A bill that easily passed the senate the same day included $52-billion.) His administration will play a role in formulating tax incentives for a proposed $12-billion TSMC plant in Arizona and a $17-billion facility Samsung is considering, possibly in Texas. Similarly, European Union officials are exploring ways to build an advanced semiconductor factory in Europe, possibly with assistance from TSMC and Samsung, as part of its goal to double chip production to 20% of the global market by 2030. In April, the UK ordered an investigation on national security grounds into California-based Nvidia’s $40-billion deal to buy British semiconductor designer ARM.

8. Where’s the technology headed?

8. Where’s the technology headed?

As 5G mobile networks proliferate — driving demand for data-heavy video and game streaming — and with many people working from home, the need for more powerful, energy-efficient chips is only going to grow. TSMC and Samsung are thus working to make transistors increasingly microscopic so more can fit into a single chip. Even small improvements can deliver substantial cost savings when multiplied across the full scale of something like Amazon Web Services, a cloud computing provider. The rise of artificial intelligence is another force pushing innovation, since AI relies on massive data processing. More efficient designs also will help develop the so-called Internet of things — a universe of smart or connected devices from phones to light switches to refrigerators.

9. How does Taiwan fit into all this?

The island democracy emerged as the dominant player in part because of a government decision in the 1970s to promote the electronics industry, aided by a technology transfer deal with RCA, the former US electronics giant, and the trend in the West toward outsourcing. Matching its scale and skills now would take years and cost a fortune: Boston Consulting Group and the Semiconductor Industry Association estimated it would take more than $1-trillion over 10 years for the US to achieve “complete manufacturing self-sufficiency” in chips. Chinese President Xi Jinping has plans to invest $1.4-trillion through to 2025 in key technologies including semiconductors, and tapped a top deputy to lead the initiative. Political tensions could disrupt the race, however. The Biden administration has signalled it will continue efforts to restrict China’s access to American technology — including that used in Taiwan’s foundries. More ominously, the US could face difficulties if it found itself cut off from Taiwan and its foundries. China has long claimed the island as a renegade province and threatened to invade to prevent its independence. — Reported by Debby Wu, Sohee Kim and Ian King, (c) 2021 Bloomberg LP