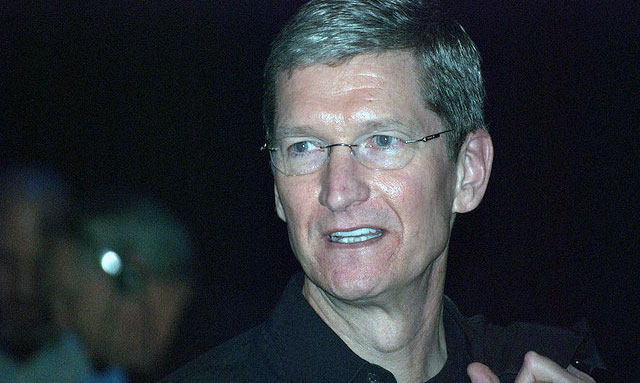

Tim Cook, who is marking his five-year anniversary as Apple’s CEO this week, received shares valued at US$373m (R5,3bn at the time of writing) during that period as the iPhone maker’s stock doubled on his watch.

When Cook took the helm in 2011, he was granted a million shares. Originally, 50% of those were scheduled to vest on his five-year anniversary, with the rest coming due after a decade with the company. That changed in 2013, when Cook voluntarily tied one-third of the award to outperforming the S&P 500 Index and the shares began vesting annually.

That hasn’t slowed him down much. He’s received 98,6% of the units available to him in his first five years, according to data compiled by Bloomberg. Those were valued at $373m at Wednesday’s close — and he can still earn the same number of shares over the next half decade.

Cook’s payout is based on Apple returning 61% during the past three years, placing it in the top-performing third of the S&P index, according to data compiled by Bloomberg. Cook would get all of his shares for 2016 under those terms. He’s earned 3,45m shares under the plan when accounting for a seven-for-one stock split in 2014.

Apple spokesman Josh Rosenstock declined to comment, and referred to a 6 January proxy statement on Cook’s share awards. The stock closed at $108,03 Wednesday in New York, up from a split-adjusted $53,74 on the day Cook took over the top job.

Cook has used buybacks and dividend increases to help ensure that Apple stock outperformed the S&P 500 even as sales slowed. In 2013, he extended a share buyback programme sixfold ahead of the introduction of the iPhone 6 the following year, which reignited growth. — (c) 2016 Bloomberg LP