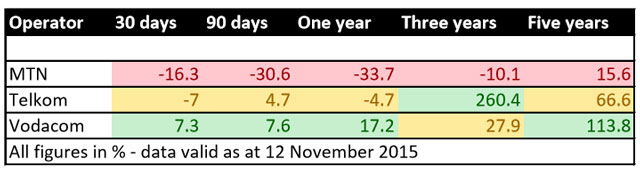

Vodacom has performed far more consistently on the stock market than its two principal listed rivals, MTN and Telkom, generating a positive return for shareholders over not only the past 30 and 90 days, but also over a one-year and five-year period.

The worst performer over all five periods has been MTN, which has consistently underperformed its rivals.

Telkom’s returns have also been more muted than Vodacom’s, except over a three-year period — if someone had snapped up Telkom shares in November 2012, they would have generated a healthy 260% return now.

MTN’s performance has been depressed because of recent weakness in its share price, brought on in part by the record-setting US$5,2bn fine imposed on it in Nigeria for allegedly failing to disconnect 5,1m unregistered Sim cards in time to meet a deadline imposed by Nigerian regulators.

Over a five-year period, a R10 000 investment in Vodacom would have turned into R21 380. The same money invested in Telkom and MTN would have become R16 660 and R11 560 respectively.

These calculations exclude dividend payments to shareholders. — (c) 2015 NewsCentral Media