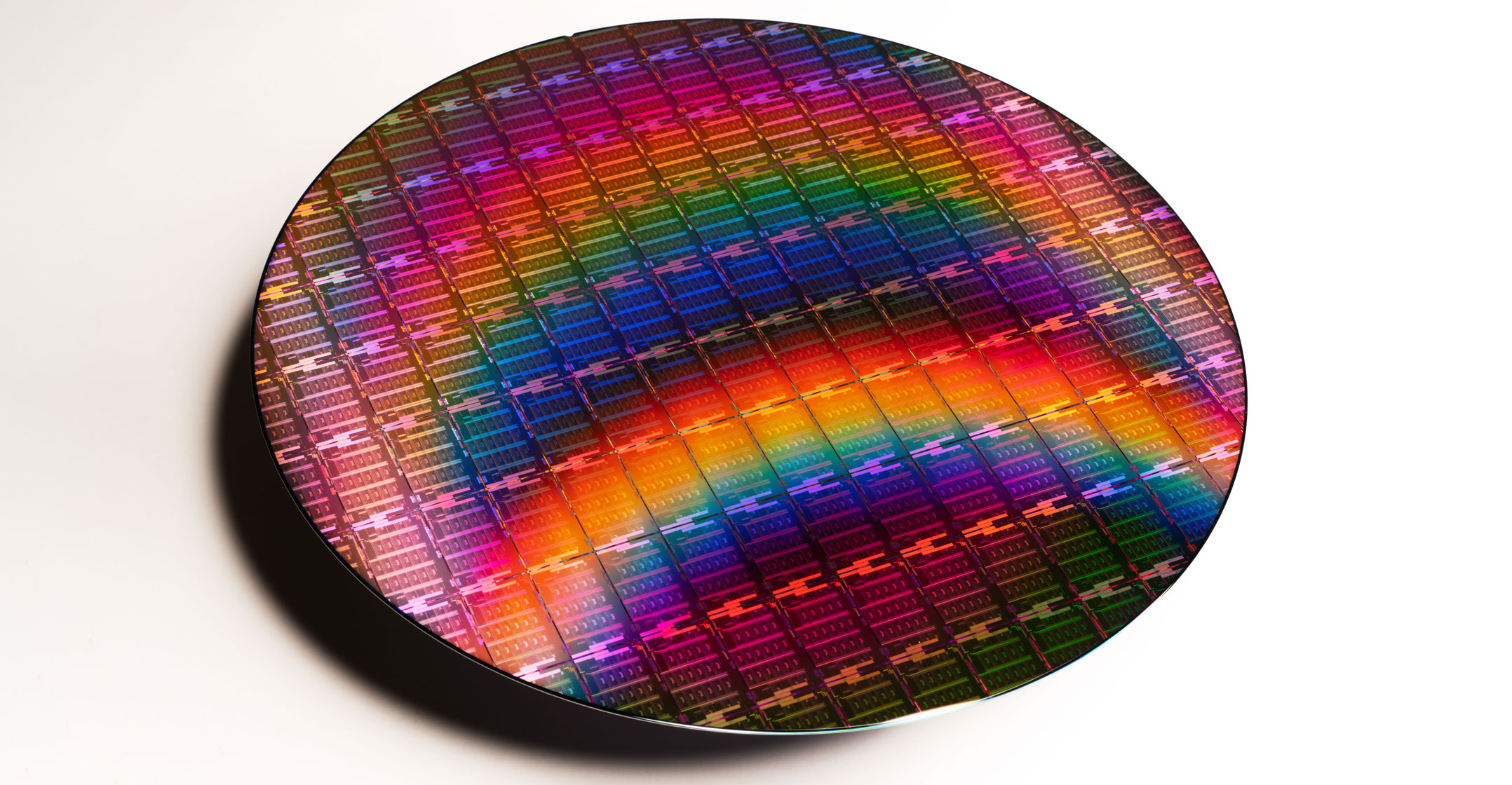

Late last month and with great fanfare, Intel’s new CEO, Pat Gelsinger, unveiled an ambitious overhaul of the company’s business model, at the centre of which is the creation of a chip manufacturing business.

In a bid to regain dominance in this area, Intel will spend US$20-billion to build two new factories in Arizona, vastly expanding capacity for both internal use and for customers of its new programme, called Intel Foundry Services, or IFS. On Tuesday, an Intel executive said the company was preparing for “the biggest build-out of technology infrastructure in human history”.

On the surface, Intel’s strategic pivot comes at an ideal moment. The iconic company has fallen behind in recent years. And chip shortages are disrupting production in sectors from cars to consumer electronics. But despite its bold vision, Intel is set to face challenges to its grand turnaround plan that will prove extremely difficult to overcome.

Here’s the biggest question for the chip maker: Can it win a large chunk of business away from market leader TSMC? During his strategy presentation, Gelsinger confirmed for the first time that the company will be using TSMC to manufacture some of its top-of-the-line CPU processors in 2023. This is a result of years of Intel delays in moving to the latest chip-making technologies. With Intel compelled to use TSMC for some of its leading products, it’s going to be difficult, at least in the near term, for the company to argue that its services are significantly better than its Asian rival.

Apple, AMD

And then there’s the customer-competition issue. While Gelsinger said Intel will pursue all the major semiconductor players as clients, a company such as AMD may not want to partner with IFS as long as it remains a part of Intel — a key rival. The same goes for Apple, which is now making its own chips and is also a Gelsinger target customer. It’s hard to imagine that the two companies — both of which do big business with TSMC — would want to reveal their proprietary chip designs and product timelines to one of their chief competitors instead. Plus, Apple’s history of requiring the most advanced and power-efficient manufacturing techniques for its iPhone processors will be a tough bar for the new unit to meet.

Unfortunately for Intel, it’s easy to imagine a scenario in which TSMC’s manufacturing lead actually grows in coming years. Last week, the Taiwan-based foundry told its customers that multiple new factories are under construction. In a subsequent statement, the company said it plans to spend $100-billion over the next three years to increase capacity and boost research and development. Intel simply cannot match TSMC’s scale. By the time Intel can go to market with its next-generation chip-making technology in 2023, TSMC will be on to its next process and remain years ahead.

There are some tailwinds for Intel’s manufacturing business. On the back of security concerns, the US government will use the company’s offering for military and defence contracts. Analysts expect that Intel will also benefit from future subsidies and tax incentives from the Biden administration for building domestic chip factories. But this may not be enough to move the needle. According to Bank of America research, defence and aerospace chip demand represents less than 1% of the total semiconductor market.

So, while it is easy for Intel to talk a big game about building a “world-class” foundry business, it will be much harder to create a viable and profitable one. The company should pursue something more dramatic: a breakup where it separates itself into two companies — one for chip design and one for manufacturing. This alternative would have eliminated some of the aforementioned issues and raised the probability for success. By stopping short of taking this path, the chip maker made its challenge that much tougher. — By Tae Kim, (c) 2021 Bloomberg LP