Prosus suffers from the same problem as Manchester City Football Club¹: Because everyone knows it has access to vast amounts of capital, it’s always at risk of overpaying for acquisitions.

It may be an enviable position, but it’s still a problem. The Amsterdam-based tech investor said on Wednesday it will reduce its stake in Tencent Holdings from 30.9% to 28.9%. The US$15-billion proceeds give Prosus a sizeable war chest for deal-making and it can always borrow against its $239-billion holding in the Chinese e-commerce giant if it needs to — it’s pledged not to sell any more shares for another three years. But using the cash wisely will be tough.

Prosus CEO Bob van Dijk is on a mission to prove that the company is not a one-trick pony. Its market capitalisation of €154 billion (R2.7-trillion) means that not only does it trade at a discount to the value of its Tencent stake, but that investors assign a negative valuation to its myriad other investments — it has stakes in at least 45 other companies. Its holdings in Delivery Hero and Mail.Ru Group alone are valued at a combined €8-billion on the public markets.

Van Dijk’s capital allocation challenges are in many ways peculiar to Prosus. The likes of Apple and Google parent Alphabet also have oodles of net cash, at $84-billion and $110-billion respectively. Yet they seldom make significant acquisitions, in part because it’s tough to find good value when everyone knows you can afford to pay more. Even when they do smaller deals, the calculation is different: Rather than buying businesses, they tend to snap up technologies that can help existing products.

A recent example is the $50-million that Apple paid for Vilynx, a start-up specialising in artificial intelligence and computer vision technology. They can make that outlay worthwhile by working the innovations into a product, the iPhone, that generates $138-billion in annual revenue. Investors reward that careful approach to takeovers with generous valuations.

Holding company

Prosus, however, is essentially a holding company, without a similar portfolio of products it can readily augment. It therefore has to buy businesses that generate their own returns. But investors didn’t take kindly to its most recent attempt at major deal-making: the £5.5-billion offer for Just Eat in 2019. The share price suffered, widening the discount to the Tencent stake, and Prosus ended up returning $5-billion to shareholders in the form of a buyback.

Van Dijk hasn’t yet done enough to earn investors’ trust. Losing a few more bidding processes, and doing so publicly, might actually help demonstrate he has the necessary discipline. Scoring a bargain would be even better. He’s suggested there’s value to be found in education technology and food delivery companies in emerging markets, but both of those are long-term bets that will require investor patience, and neither is likely to require $15-billion of investment.

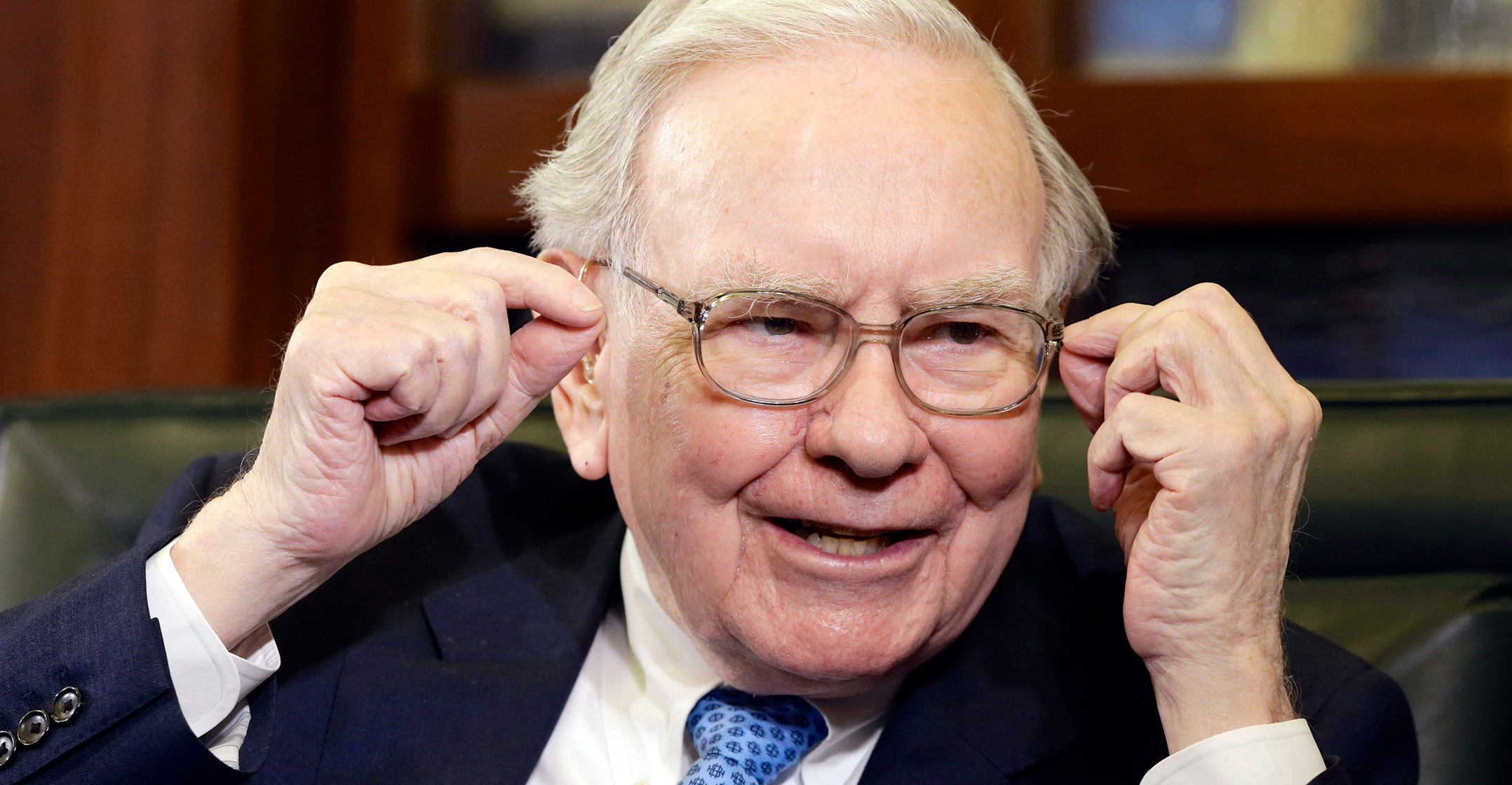

The Dutch executive again has a quandary. Investors won’t want him to overpay for assets, but if he’s too cautious, counterbidders won’t fear his company’s big cash pile. Is he Masayoshi Son, making outsize gambles on the future like at Softbank Group, or Warren Buffett, who has built a reputation as a careful shepherd of his investors’ cash by seeking out value? (That caution also means that Berkshire Hathaway, the firm he leads, is now sitting on $335-billion of net cash.)

At the moment, van Dijk looks like neither. And until investors know the answer, no amount of financial engineering will close the discount to the Tencent stake. — (c) 2021 Bloomberg LP

¹The Abu Dhabi royal family, Man City’s owner, has pumped hundreds of millions of dollars into the English soccer team. Whenever manager Pep Guardiola wants to buy a new player, he can expect to be charged top whack, since other teams know he can access almost bottomless pits of cash.