South African business leaders are in harmony on what the country needs after this week’s elections.

Reinvigorating the economy leads the agenda of what Cyril Ramaphosa, the favourite to retain the presidency, must tackle once taking office. To get there, he will have to prosecute those accused of plundering the government, fix state-owned companies and cut debt, among others.

Here’s a suggested to-do list from top CEOs, business lobby groups and economists on what could get growth going.

Vodacom CEO Shameel Joosub

South Africa’s biggest mobile phone operator is calling on the new administration to release high-demand wireless spectrum.

“A quick win for the presidency in terms of helping restore investor confidence in South Africa and the growth of the economy is to prioritise its policy direction for the telecommunications industry. There is a direct correlation between lower data prices and gross domestic product growth.

“The most significant obstacle to reducing input costs and, by extension, data prices is the fact that no new spectrum has been allocated in South Africa in the last 14 years,” which has “curbed the pace at which data prices could’ve fallen”.

FirstRand CEO Alan Pullinger

The head of Africa’s largest bank by market value sees the main priorities as turning around electricity utility Eskom and following up on a probe by deputy Chief Justice Raymond Zondo into the looting of state funds by outside interests, known locally as state capture.

“The key developments FirstRand would like to see after the election is firstly the establishment of a reform-minded cabinet that will assist the president in urgently tackling the many structural challenges facing the country, the most important of which is the restructuring of Eskom.

“In addition, and vital to restoring domestic and foreign investor confidence, is that the Zondo Commission leads to the prosecution of major participants in state capture. This will send an important signal that the new ruling party leadership and government will not tolerate corrupt activities.”

Aspen Pharmacare chairman Kuseni Dlamini

The chairman of Africa’s largest drug maker, who also heads the board of Walmart’s Johannesburg-based retailer Massmart, sees growth as “the goose that lays the golden egg”. He has also headed the South African units of insurer Old Mutual and mining firm Anglo American.

“Economies at higher growth rates tend to attract and retain massive inflows of foreign direct investment. It is only through growth that as a country we can push back against the high levels of unemployment, poverty and inequality.

“We need to pursue global competitiveness as a national objective. We need to make sure that we create an enabling environment that encourages companies in different sectors to become global leaders. This requires the right nexus between policy, regulation, business and labour.”

Investec founder Stephen Koseff

One of the founding chiefs of the private bank and money manager spanning South Africa, the UK, US and Australia sees the finances of state-owned companies as a key priority.

“Operationally they have issues, financially they have a very weak structure. All that has to be fixed,” while the government must act on plans to split Eskom into generation, transmission and distribution and open the grid to private producers.

“The issue of state capture needs to be dealt with. There are so many areas of abuse in our society that have been left unchallenged. All this stuff needs to start happening and we’re seeing some momentum. But it will take a long time to get us back on our feet. The last 10 years really cost us a lot.”

Alexander Forbes CEO Dawie de Villiers

The head of the Johannesburg-based provider of retirement administration services echoes the call from business organisations for regulatory certainty and consistency.

“Improving business confidence is going to be one of the key challenges facing the new government.

“Government must continue to fight corruption as it increases the cost of doing business. More importantly, the fast implementation of policies that have been set out will help in building confidence and therefore stimulate economic growth and reduce unemployment, especially if combined with improving access and quality of educational outcomes.”

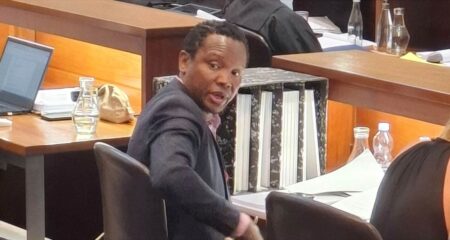

Business Leadership South Africa CEO Bonang Mohale

The head of the lobby group and a former chairman for Royal Dutch Shell’s South African unit wants a focus on raising up more black managers to better represent the country’s demographics.

“Number one is to root out and defeat state capture. Number two is to drive transformation aggressively. Number three is to ensure that we retain the few jobs that we have in order to create more jobs. Lastly, it’s about economic growth.

“For the investment community, economic growth is number one. What are ratings agencies looking for? Only four things: economic, fiscal and institutional strength; stability and continuance.

“In the government’s locus of control is to reduce government debt. They can do this by reducing the size of the cabinet, which will cut the size of the overall government. It can also reduce by a third the 700-odd state-owned enterprises. Eskom has 48 000 employees. It used to have only 32 000 employees — that’s the easiest.”

African Rainbow Capital co-CEO Johan van der Merwe

The head of billionaire Patrice Motsepe investment-holding firm and former CEO of the asset-management unit of Africa’s biggest insurer Sanlam is looking for a more entrepreneurial drive.

“We require more black-owned businesses — both large ones as well as small-to medium-sized enterprises. Broad-based black-economic empowerment should continue to be the preferred mechanism for transferring wealth to black people.”

Cutting the government’s wage bill and fixing state entities will free up cash for infrastructure, which will create jobs and stimulate the economy, while foreign investors need policy clarity.

“International investors would require some level of comfort that, firstly, their investment made in South Africa would enjoy property rights protection, and, secondly, they would achieve a market-related return on their investment.”

Seifsa chief economist Michael Ade

The Steel and Engineering Industries Federation of Southern Africa wants the president to keep ratings companies onside to reduce borrowing costs. Only Moody’s Investors Service has the country at investment grade.

“Policy should be implemented swiftly, monitored and evaluated so that there is a stable increment in confidence.” — Reported by Roxanne Henderson, Tshegofatso Mokgabodi and Loni Prinsloo, with assistance from Prinesha Naidoo, (c) 2019 Bloomberg LP