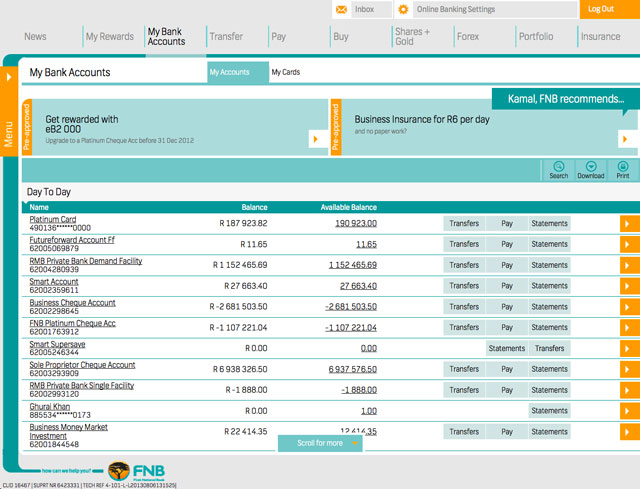

First National Bank has given its online banking portal an overhaul. The new site is more minimalist and allows clients to use the full, online service on smartphones and tablet computers, in addition to laptops and desktops. The new website will be available to consumers on Sunday.

“During the past two years, we have reviewed banking sites across the world to benchmark ourselves. We currently have over 1,5m online banking customers and expect this to increase with the new and enhanced platform,” says online banking CEO Lee-Anne van Zyl.

The bank has created what Van Zyl calls Africa’s first “truly scalable” banking site. Instead of offering a pared-down mobile experience, the site detects and adapts to the device being used.

FNB’s website receives 2,8m unique visitors each month.

Van Zyl says the new site has been designed to be familiar to customers. The bank has done extensive usability testing, which included ensuring the use of plain language wherever possible and overhauling buttons and menus to enhance ease of use.

Enhancements include support for touch on all devices, a more intuitive interface and responsive design. The bank has also ensured that the same level of security is offered regardless of the device used.

The redesigned site was developed in-house. The bank plans to introduce additional features to the platform in coming months.

It will offer question and answer sessions on social media platforms to help consumers get used to the new site and has trained its call centre teams on it. There will also be a number of demonstration videos available online.

In July 2011, FNB became the first South African bank to launch a smartphone application. Since then, Nedbank, Standard Bank, Investec and Absa have all released transactional banking apps of their own. In April, it launched tablet versions of its mobile banking application for Apple, Android and Windows 8 devices.

In addition to the Chrome, Firefox and Safari browsers, the new website supports Internet Explorer 8, 9 and 10. It will not support version 7 of Microsoft’s browser because Van Zyl says it was just becoming “too unstable”.

The new service will also now track things like prepaid purchases so that in instances where, for example, parents are buying airtime or bundles for their children, they won’t have to re-enter their phone numbers each time they wish to make a purchase.

FNB’s new website also includes basic personal financial management features that provide consumers with an overview of their financial standing, including available balances and credit. Van Zyl says these might be expanded in future updates. — (c) 2013 NewsCentral Media