Reduced demand for set-top boxes, poor sales of Altech’s much-hyped Node product, the loss of a television assembly business, tough trading conditions at Autopage Cellular and poor performance at Powertech are some of the problems that are being blamed for what looks set to be an annus horribilis for JSE-listed technology group Altron.

For the year ended 28 February 2015, Altron warns that normalised headline earnings per share could be as much as 55% lower than a year ago, while basic earnings per share — which incorporate various significant impairments — are expected to be as much as 110% lower.

The only bright spot has been its IT business, but this has not been enough to offset the problems elsewhere in the Altron stable.

Altron, which is controlled by the Venter family and led by CEO Robbie Venter, is now promising a new strategic direction, which will result in it shedding operations identified as not core and exploring equity and technology partnerships with global industry players in other areas of the business. Particular emphasis will be placed on significantly reducing central costs by creating a leaner management structure.

“The Altron TMT division (telecommunications, multimedia and IT) has experienced a decline in profit levels notwithstanding the strong performance of the IT businesses, which was insufficient to offset the deterioration in the telecoms and multimedia businesses,” Altron says.

Altron’s Multimedia division was “significantly impacted by a combination of reduced order intake in its core set-top box business in Africa, the loss of the Samsung TV assembly contract and the impact of the Numsa strike in July 2014”.

“The business, which has already undergone a significant rightsizing process, has seen its order book improve in recent months and has an encouraging pipeline of local and international prospects, including the South Africa digital migration programme.”

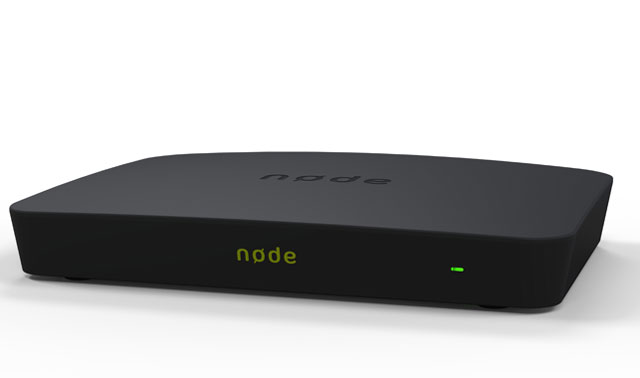

But the Altech Node, the set-top box entertainment and home automation platform launched with much fanfare last year, has tanked, the group says. “It has performed below expectations with regard to retail customer take-up. Altron TMT is well advanced in terms of exploring alternative opportunities for this business.”

In addition, an expected recovery in the performance of Altech Autopage did not materialise in the second half of the financial year.

Making matters worse, Altron’s Power division — its Powertech businesses — experienced a deterioration in their performance, resulting in a breakeven position at headline earnings level.

“Most of the businesses were affected by challenging macroeconomic conditions, namely the four-week Numsa strike in July, weak economic growth and the various challenges created by Eskom’s current position.”

At a corporate head office level, Altron also recorded a big decline in earnings, mainly because of increased interest costs associated with borrowings taken on to delist Altech from the JSE in the previous financial year.

Despite this, Altron says its balance sheet “remains resilient” and it “continues to be well inside its debt covenants”.

Altron is expected to publish its annual results on 13 May. — © 2015 NewsCentral Media