A consortium co-founded by Riccardo Spagni, the South African blockchain and cryptocurrency expert who is lead maintainer of monero, has announced a new open-source blockchain protocol built specifically for digital assets.

And the company that will develop the protocol, called Tari — and whose backers include several high-profile Silicon Valley venture capital firms — is setting up shop in Johannesburg. Tari has already drawn financial backing from Redpoint (one of the early investors in Netflix), Trinity Ventures, Canaan Partners, Slow Ventures, Aspect Ventures, DRW Ventures, Blockchain Capital, Pantera Capital and Multicoin Capital.

The idea behind Tari is to “redefine the digital asset experience for both businesses and consumers by making these assets easier to manage, transfer and use”, the company said in a statement.

Plettenberg Bay-based Spagni, who is also known by the moniker “fluffypony”, is well known — and highly regarded — in global cryptocurrency circles as a member of the monero core team, which oversees development the privacy-focused digital currency. Monero is one of the world’s top 10 cryptocurrencies.

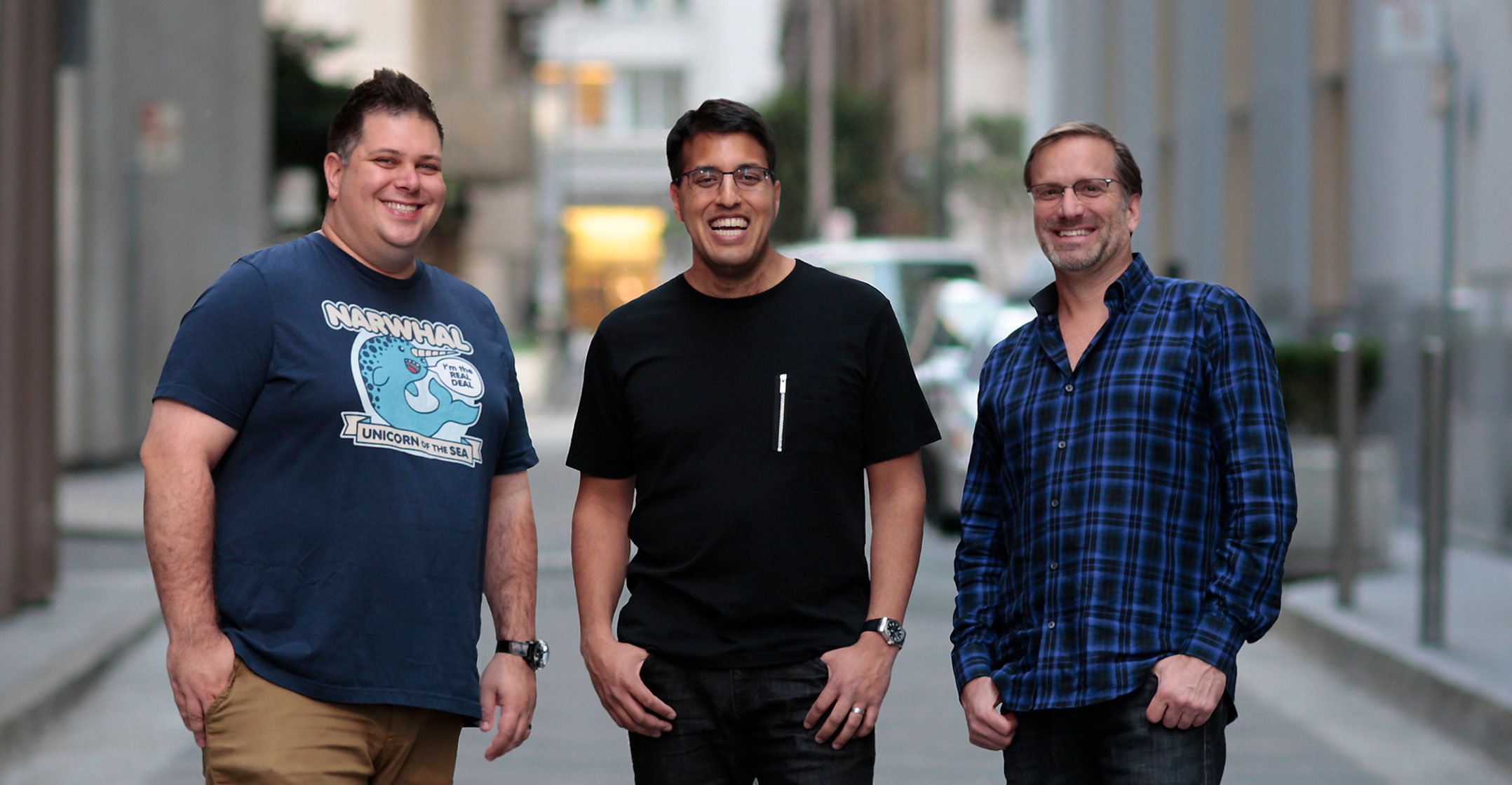

Tari is headed by Spagni, US-based entrepreneur and angel investor Naveen Jain, and Dan Teree, who built Ticketfly into one of the biggest players in the US ticketing industry before selling it to Pandora in 2015 for $450m.

The company is now hiring a Johannesburg-based team — mainly developers — to build the protocol, which will allow people to “manage and transfer digital assets with more flexibility, enable true digital scarcity and break down the industry-specific silos in which businesses currently operate”.

“Tari is going to fundamentally change the way we interact with digital assets,” Jain said. “Our current world of digital assets is incredibly inefficient and frustrating, and we want to fix that.”

Spagni said that much of the talent needed to build Tari already exists in South Africa, hence the decision to open the office in Johannesburg. “The process of recruiting our team is well under way. Our developers have the opportunity to build a decentralised assets protocol, on top of monero, that will be used by millions of people in their everyday lives.”

Developers

“There is incredible talent here in Johannesburg,” Jain said in a podcast interview with TechCentral. “The quality of the developers you can find here is amazing.”

The Johannesburg office will have about 30 people to start with, most of them developers, Jain said.

The team will focus on solving problems in the digital asset management space and on “bringing a blockchain protocol to the real world in a highly visible way”. Jain said one of the big challenges in the blockchain space is applying the technology to real-world problems.

“Growing up in the music business, I learnt a lot about ticketing and the videogame industry and other entertainment-related industries,” Jain said. “There are some real challenges around digital assets — things like concert tickets, loyalty points, virtual goods and games — and a very common problem is the people that issue these digital assets (promoters or artists, for example) set rules around them that they really aren’t able to enforce.

“A promoter might not want his tickets to be resold, but once they sell the ticket to somebody they are unable to enforce the rule. A videogame publisher might want to issue an in-game item that might have a lot of power but doesn’t want that resold for a certain period of time, and ultimately a thriving black market is created where people try to game the system.”

The idea behind Tari is that digital assets are a “really good use case” for blockchain-based systems, Jain said. “We are building a protocol on top of monero that is purpose-built for digital-asset use cases.”

He said the platform is meant to solve problems for both businesses and consumers. Issuers of digital assets — tickets, say — will be able to use Tari to set rules and know they will be enforced.

“If you are a promoter or an artist or a venue or a sports team, you can now say that every time my tickets are resold I want 20% of the revenue that is generated. You can now participate in the secondary market for your tickets. Well, it turns out that the secondary market for tickets is a $15bn industry worldwide.” — © 2018 NewsCentral Media

- For more on Tari, listen to TechCentral’s podcast interview with Riccardo Spagni and Naveen Jain