Facebook has racked up plenty of milestones in its pioneering journey. Now the social media giant is poised to add one it would doubtless rather avoid: the biggest stock market wipe-out in American history.

That could happen on Thursday if the 24% tumble in Facebook’s stock in after-hours trading is replicated in the regular New York session. Its market capitalisation plummeted late on Wednesday, at one point by about US$151-billion, as sales and user growth disappointed investors. A move of that magnitude on Thursday would likely be the largest ever loss of value in one day for a US-traded company.

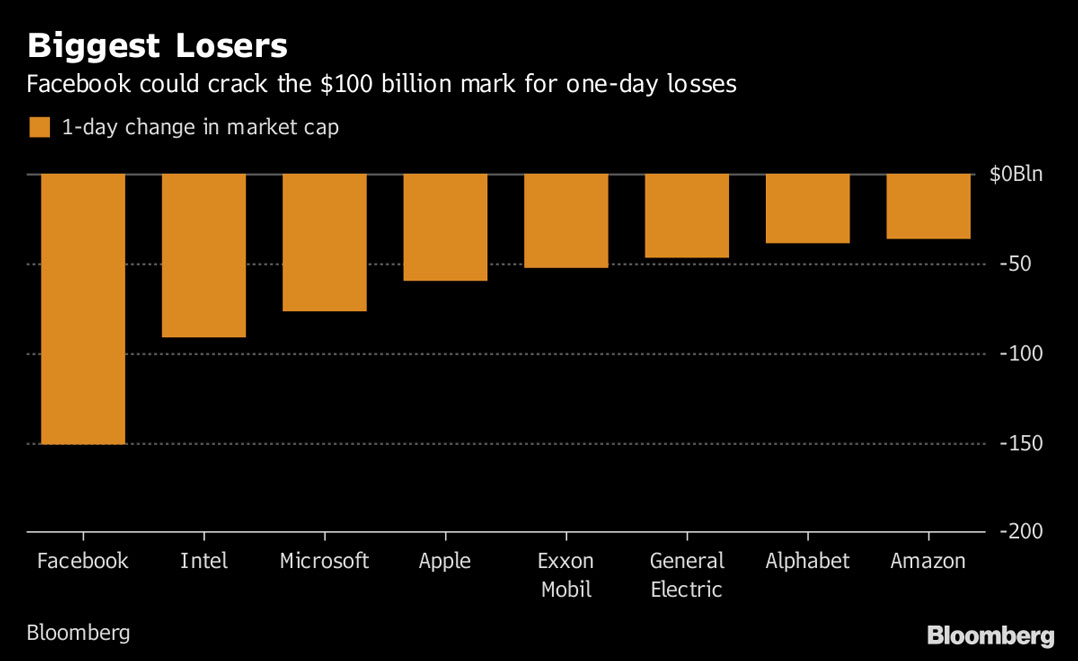

The following is a look at some of history’s other notable one-day share slams, considering American firms that were worth at least $150-billion in any year over the past decade:

Back in the depths of the tech bust, Intel lost about $91-billion on one September day in 2000. Exxon Mobil, already reeling from the financial crisis and recession in October 2008, lost $53-billion one wretched Wednesday that month. And the slowest profit growth at Apple in 10 years triggered a loss of almost $60-billion on 24 January 2013.

Facebook ended the after-hours session down 20% at $173.50, a loss of about $126-billion in market cap, having declined as much as 24% earlier. — Reported by Adam Haigh and Garfield Reynolds, (c) 2018 Bloomberg LP