After coming out all guns blazing, Nigeria’s central bank has surrendered more ground in its tussle with MTN Group by giving a reprieve to one of the banks accused of illegally moving US$8.1-billion out of the country.

After coming out all guns blazing, Nigeria’s central bank has surrendered more ground in its tussle with MTN Group by giving a reprieve to one of the banks accused of illegally moving US$8.1-billion out of the country.

Standard Bank Group said on Tuesday that the Central Bank of Nigeria won’t take at least $2.6-billion from the accounts of its local unit because of its role in repatriating dividends on behalf of the continent’s largest wireless carrier. The news comes less than a week after the regulator said that MTN and the four lenders named in the dispute provided extra information that may lead to an “equitable resolution”.

Nigerian authorities are changing their tone after coming under criticism that the impasse with MTN and lenders including Citigroup, Standard Chartered and Lagos-based Diamond Bank threatened to spook investors. The regulator had initially demanded MTN and the banks refund the money, spurring confusion because the dividends were transferred by the mobile operator’s local unit and causing MTN’s stock to plummet the most in 20 years.

“It’s a shoot-first-and-think-later scenario,” Kayode Omosebi, an analyst at Lagos-based Asset & Resource Management, said on the central bank’s handling of the matter. The CBN should “take their time and do some analysis before coming out to the market”.

The central bank will examine new submissions and, if justified, review an earlier decision to impose a penalty on Standard Bank, the Johannesburg-based lender said in a statement. Standard Bank’s Stanbic IBTC, Standard Chartered, Citigroup and Diamond Bank were fined about $16-million between them for repatriating the dividends.

Standard Bank, which has said it acted properly in its role as transfer agent, will continue to engage with the Nigerian central bank, the continent’s largest lender said. The central bank had already taken the fines from the accounts of some of the lenders, including Stanbic IBTC and Diamond Bank.

“The Central Bank of Nigeria’s decision to review new submissions is a positive,” said Olamipo Ogunsanya, a banking analyst at Renaissance Capital. “If Stanbic can prove it followed all due procedures, it will no longer be subject to the fine.”

Intense criticism

Representatives in Lagos for MTN and Citigroup declined to comment, while a spokeswoman for Diamond Bank said she was unable to immediately provide a response. A spokesman for Standard Chartered didn’t answer a phone call or immediately respond to a text message. Isaac Okorafor, the Central Bank of Nigeria’s spokesman, wasn’t immediately available.

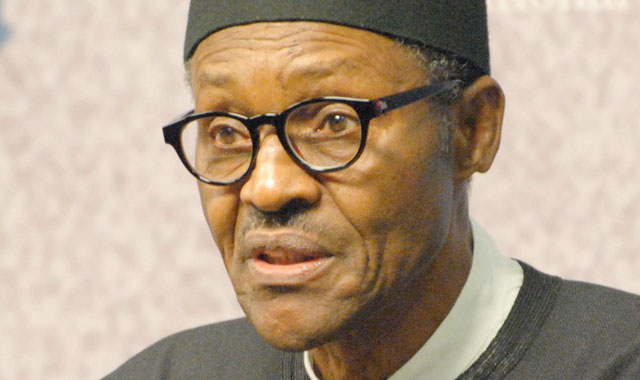

The accusations against MTN — including allegations by the attorney-general’s office that it owes $2-billion of back taxes — come as President Muhammadu Buhari’s administration faces intense criticism of its economic management in the run-up to the elections and several ruling-party lawmakers have defected to the opposition. Nigeria was battered by the 2014 slump in crude prices and its economy is still struggling.

The central bank’s willingness to hear more from Standard Bank and MTN on the dividend repatriations suggests there may be a way for MTN to make a deal with Nigeria, just as the company did two years ago when it negotiated a $5.2-billion fine down to about $1-billion plus a commitment to list its local business in Lagos. That penalty was related to subscribers that weren’t properly registered in the country.

MTN’s shares rose 2.8%, gaining for a fifth straight day. That pared losses to 23% since 29 August, the day before the central bank demanded the company return the money.

“There seems to be some increased level of comfort,” said Asset & Resource Management’s Omosebi. “At least investors know that things may not be as bad as the CBN put it initially.” — Reported by Yinka Ibukun and Vernon Wessels, with assistance from David Malingha Doya, Alastair Reed and Paul Wallace, (c) 2018 Bloomberg LP