Vodacom Group shares fell after the wireless carrier with the most South African customers reported slower revenue growth in its domestic market, as a sluggish economy hurt consumer spending.

Overall, first-half earnings before interest, taxes, depreciation and amortisation rose 4.7% to R16.5-billion, while the interim dividend was increased to R3.95/share from R3.90 previously.

The unit of the UK’s Vodafone Group experienced tough conditions in South Africa, with revenue growth of 4.6%, down from 7.7% last year.

The carrier has used investment in data to offset the weak environment, helping to boost customer numbers, though revenue per user fell as callers opted for cheaper packages.

A 14% fall in headline earnings per share included the impact of a R16.4-billion empowerment deal agreed to earlier this year. That helped Johannesburg-based Vodacom better comply with government initiatives to increase non-white participation in the economy.

Vodacom’s international portfolio was a bright spot, helped by the recent acquisition of a stake in Nairobi-based Safaricom from its parent. Services such as money-transfer service M-Pesa have helped drive growth, and the 2.3 million new customers in the period almost matched the South African figure of 2.5 million.

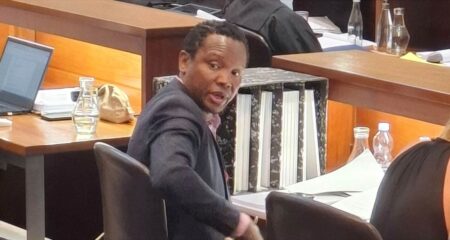

Vodacom shares fell 6.2% to R122.23 as of 10.30am. “Vodacom’s dividend was good, and its international relations are improving, but South Africa’s data revenue growth was a bit disappointing,” said Peter Takaendesa, a money manager at Mergence Investment Managers. — (c) 2018 Bloomberg LP