With the first public companies and legendary investors publicly stating their support for bitcoin, 2021 will go down as the year of mass adoption and the beginning of institutional interest in crypto.

With the first public companies and legendary investors publicly stating their support for bitcoin, 2021 will go down as the year of mass adoption and the beginning of institutional interest in crypto.

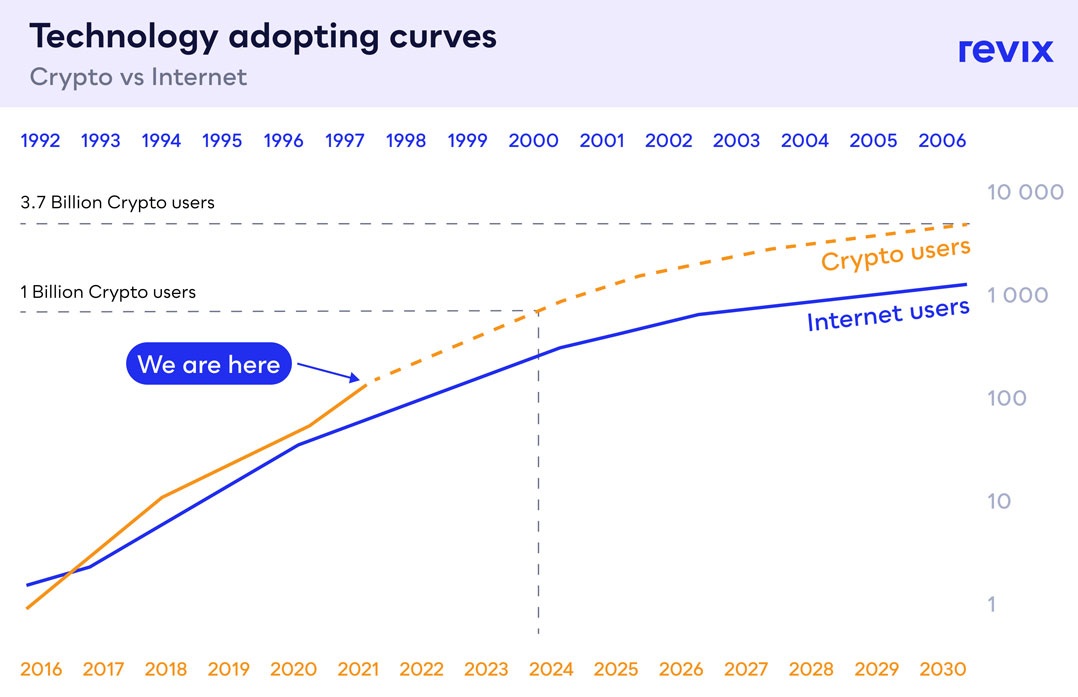

After an already crazy year for crypto in 2020, the market continued to soar and, more importantly, network adoption followed suit. An estimated 400 million people are in crypto today and many predictions are circulating around when we will see a billion people actively using crypto.

Binance CEO Changpeng Zhao believes that will happen this year, while other forecasts, as seen below, project a more conservative goal of 2024.

Crypto adoption has been growing at over 110% per year since bitcoin’s conception in 2009. This surpasses the adoption rate of the Internet. Even with a conservative estimate (80% over three years, followed by a 33% growth), this adoption curve could easily see 3.7 billion worldwide users by 2030.

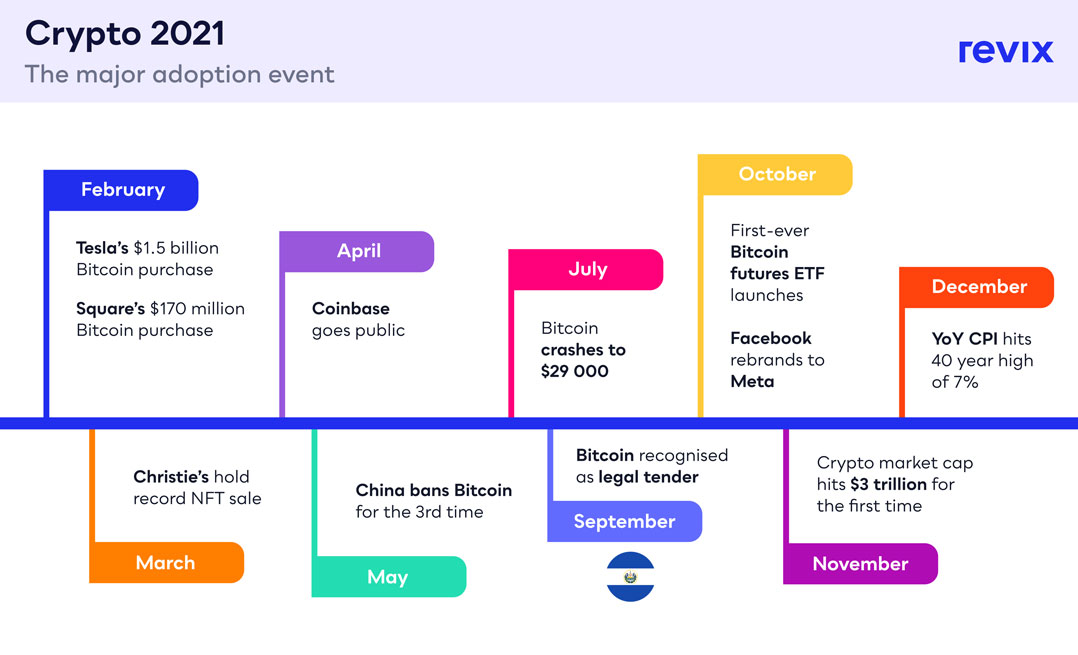

With all this adoption, let’s break down the most prominent events of 2021 and show you that if these institutions, countries and investors are taking crypto seriously, then so should you.

The year held some major milestones for the industry. We saw institutions like Tesla and Square purchase large sums of bitcoin. World-renowned auction house Christie’s held its first NFT auction and a record-breaking one at that. We even saw the likes of Coinbase go public and China ban crypto … again. But the biggest news came out of a little country called El Salvador.

Legal tender

As of September 2021, Bitcoin became an official currency of El Salvador alongside the US dollar. This was an historic moment, not only for bitcoin but the entire cryptocurrency asset class. Many crypto naysayers fall back to the statement that “cryptocurrencies can’t fulfil the classic functions of money”, yet here is a country using it as its national currency.

In El Salvador, you can walk into a McDonald’s, scan a QR code and, just like that, you’ve paid for your meal using bitcoin. Not only was the price of that meal denominated in units of cryptocurrency, but you’ve used your stored bitcoin as a means of payment. The naysayers cannot deny it: bitcoin is fulfilling the “classic functionality” of money.

Why did El Salvador choose Bitcoin?

President Nayib Bukele mentioned that legalising Bitcoin would encourage investment in the country and help the 70% or more of Salvadorans who don’t have access to traditional financial services. It is also a cost-effective method for people outside the country to send remittances to their families within.

El Salvador plans to issue the first-ever bitcoin bond. This bond will raise US$1-billion that will be split between a $500-million allocation of bitcoin and $500-million in infrastructure spend to build out energy and bitcoin mining infrastructure.

First-ever bitcoin futures ETF launches

October 2021 marked a milestone for cryptocurrency as investors started trading the first US bitcoin futures exchange-traded fund. The ProShares Bitcoin Strategy ETF saw one of the biggest first days on record for ETFs, raking in $550-million from crypto-hungry investors. Overall, more than $1-billion of shares changed hands.

What is a bitcoin futures ETF and how does it work?

The exchange-traded fund (ETF) tracks the futures price of the digital currency, allowing investors to buy into the ETF without trading bitcoin itself.

For many investors, this was a relief. Finally, here was a product that allowed them to gain access to bitcoin in a regulated and structured environment. Due to the major demand for cryptocurrencies, it took just two days for the fund to accumulate $1-billion — making it one of the best starts for an ETF on record. The initial surge in interest showed the degree of pent-up demand for crypto exposure among US investors in ETFs.

What does this mean for you?

There is a clear interest and demand for cryptocurrencies in both the traditional and alternative space as more people start to understand cryptocurrencies. The allowance of a bitcoin ETF shows that regulators are finally starting to accept crypto as an investment and asset class. This also helps regulated investors get access to this asset class, further strengthening the demand for crypto, and further pushing the adoption and resilience of the crypto market forward.

Crypto market cap hits $3-trillion

By November 2021, the crypto market was proving its resilience and displaying extraordinary growth, reaching a market capitalisation of $3-trillion. To put this into perspective, the only countries with a higher GDP ranking are the US, China, Japan and Germany. Besides those four countries, the crypto market cap overshadows every other country’s GDP.

The graph above displays just how fast the market cap has grown, hence the phrase “2021, the year for crypto”.

This is an important milestone for the crypto industry. It re-emphasises investors’ trust in the potential of blockchain technology to disrupt the way we as humans interact with just about everything. Bitcoin has proven that it can be a hedge to inflation, as many investors seek shelter from an inflationary environment.

Will crypto continue this parabolic growth?

Market analysts believe that cryptocurrencies are the biggest financial revolution in modern history, and it looks like the consumer agrees. After all, crypto is showing a faster adoption rate than the Internet. Just think about daily life outside of the internet. It’s almost unimaginable to most. This will be the same for blockchain technologies when we fast-forward 10 years. And this market has not only been run by retail: we are seeing large institutions also betting on crypto and blockchain technology.

There’s a reason Facebook changed its name to Meta Platforms — the signs of global adoption are everywhere you look.

US inflation prints a 40-year high — is crypto the life raft?

Remember all that money that was injected into the global financial system in 2020 and 2021? Well, it was roughly 15% of all money in circulation today. This mass amount of monetary printing causes one thing — inflation.

This basically means that life is getting more and more expensive and your money just isn’t buying as much as it used to. One thing is true, though: bitcoin and crypto have actually outperformed the monetary printing by over 300%, meaning that not only did you keep your purchasing power but you actually substantially improved it. Compare this to holding your cash in the S&P 500 (which also did rather well) which only outperformed money printing by 4%.

During this time of excessive printing, crypto was the life raft offered in a sea of inflation.

So, all of this begs the question…

If institutions are investing in crypto, if millions of people are adopting it at a rate faster than the Internet, and if countries are accepting it, then why aren’t you?

Where do I get exposure to this asset class?

Whether you are looking to invest in the most reputable single assets and take on the risk, or for a safe option through a basket of diversified cryptocurrencies, Cape Town-based cryptocurrency investment platform Revix has you covered.

You’ll find an easy-to-navigate platform for investing in single cryptocurrencies like bitcoin, ethereum, solana, Binance coin, polkadot and many more.

The platform also takes the guesswork out of long-term investing by offering you better value for your money with bundle offerings.

Revix offers its customers access to ready-made crypto bundles that hold the most reputable cryptocurrencies in each sector. These bundles automatically rebalance every month to make sure your bundle is up to date with the fast-changing world of cryptocurrencies.

There is no need to pick a single cryptocurrency and run the risk of it not sticking around. With Revix, simply pick the sector you are interested in and we do the rest.

Revix’s empowers users to invest in three different theme-based bundles:

- The Top 10 Bundle is like the JSE Top40 or S&P 500 for crypto. It provides equally weighted exposure to the top 10 cryptocurrencies that make up more than 75% of the crypto market. This bundle has significantly outperformed bitcoin over the last 12 months.

- The Smart Contract Bundle provides equally weighted exposure to the top five smart contract-focused cryptocurrencies like ethereum, solana and polkadot. These cryptocurrencies enable developers to build applications on top of their blockchains, similar to how Apple builds apps on top of its iOS operating system.

- The Payment Bundle provides equally weighted exposure to the top five payment-focused cryptocurrencies looking to make payments cheaper, faster and more global. These cryptos include the likes of bitcoin, ripple, stellar and litecoin.

About Revix

Revix brings simplicity, trust and great customer service to investing. Their easy-to-use online platform enables anyone to securely own the world’s top investments in just a few clicks.

Revix guides new clients through the sign-up process to their first deposit and first investment. Once set up, most customers manage their own portfolio but can access support from the Revix team at any time.

For more information, please visit www.revix.com.

Disclaimer

This article is intended for informational purposes only. The views expressed are not and should not be construed as investment advice or recommendations. This article is not an offer, nor the solicitation of an offer, to buy or sell any of the assets or securities mentioned herein. You should not invest more than you can afford to lose, and before investing, please take into consideration your level of experience, investment objectives and seek independent financial advice if necessary.

- This promoted content was paid for by the party concerned