Cell C, for years saddled with unsustainable debt on its balance sheet, is looking to a more hopeful future after reporting a R2-billion net loss for the six months ended 30 June 2022.

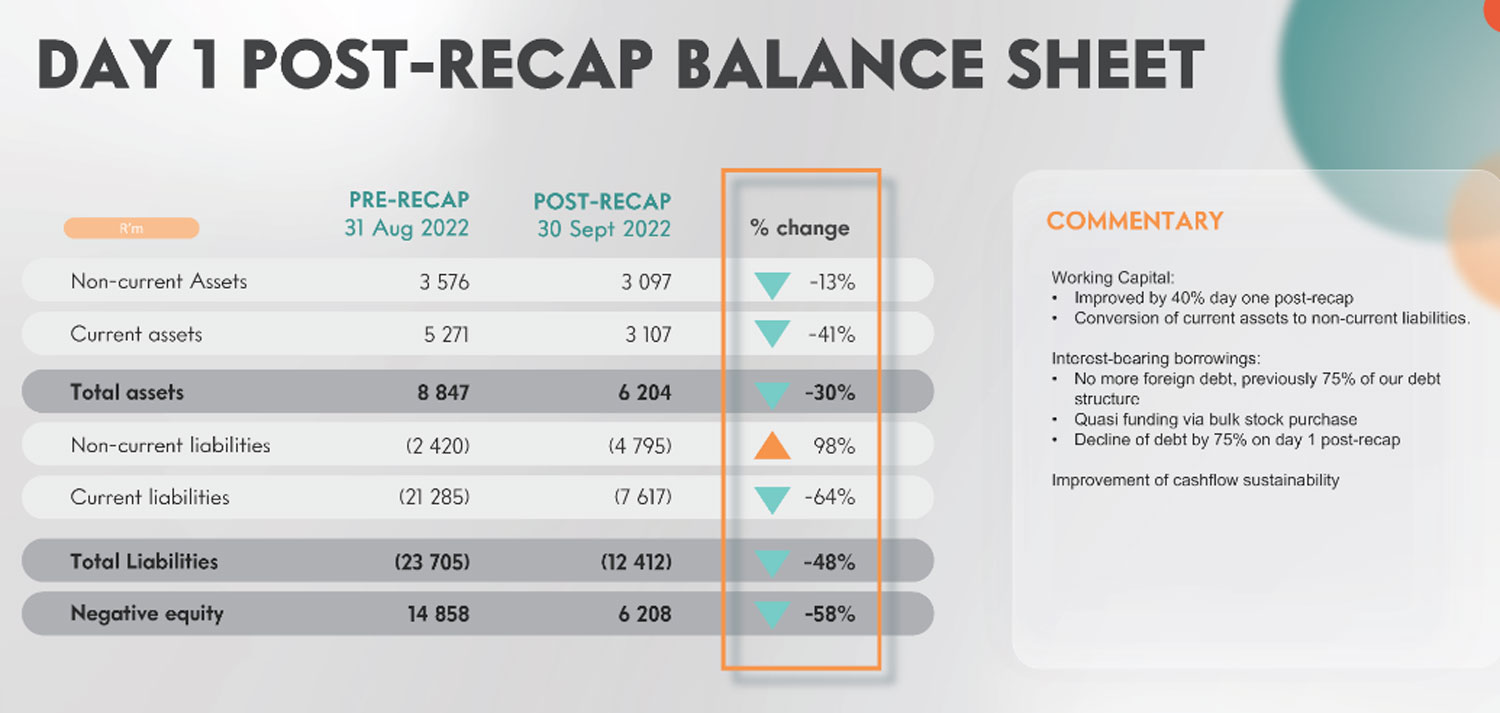

With the recapitalisation of the mobile operator, led by its largest shareholder, JSE-listed Blue Label Telecoms, now completed, it said the large once-off costs it has incurred in recent reporting periods are now a thing of the past.

Cell C on Thursday reported interim revenue of R6.51-billion to end-June, a slight decline from the R6.59-billion of the same six-month period a year ago. (That compared to full-year revenue, to 31 December 2021, of R13.4-billion, a 5% decline from the 2020 full-year number.)

“The bulk of revenue continues to come from the prepaid segment, including prepaid broadband, which during the first half of 2022 contributed about 45% to total revenue at R2.96-billion,” Cell C said in a statement.

Total Arpu – average revenue per user is a closely watched metric among investors – rose by 2.6% in the six-month period to end-June – R80.11 compared to R78.07 a year earlier.

In the same period, direct expenditure was R4.7-billion, 29% higher. This was mainly due to liquidity support and roaming costs, offset by some operational cost savings, the company said. This served to push down the gross margin to R1.77-billion, from R2.93-billion.

Recapitalisation costs continued to negatively impact Ebitda, a measure of operational profitability.

Ebit loss

The Ebit (earnings before interest and tax) loss in the first half was R1.09-billion, from a profit of R667-million before. Cell C blamed impairments as a result of “audit adjustments and the business transition into the new operating model” for this number. Foreign exchange losses and costs associated with Cell C’s recapitalisation were once-off and “will not be repeated in future financial periods as the business is now fit for purpose”.

“The interest charges and forex losses which have burdened Cell C over the past few years will be significantly lower post-recapitalisation, as the foreign debt will be reduced to nil and the once-off costs associated with the recap will be taken in full in the 2022 financial year,” said chief financial officer Lerato Pule in the statement.

“We are almost there – over the past 18 months we have actively focused on optimising our network operating expenses, finance leases, capex spend and roaming costs. We will be reinvesting in our billing and network systems. Our capex-light infrastructure model will ensure a sustained liquidity position for the business,” Pule said.

Blue Label shares were trading 1.5% higher on the JSE at 2.57pm on Thursday, after publication of Cell C’s financial results. — (c) 2022 NewsCentral Media