Vodacom Group spent a record R5.8-billion on its network in South Africa in the past six months to fight load shedding and improve its network quality and performance.

Vodacom on Monday reported a 9.5% decline in headline earnings per share (Heps), despite a 5% improvement in normalised revenue.

The JSE-listed network operator blamed higher finance costs and soaring energy prices as well as the start-up costs of Safaricom in Ethiopia for the rare slip in Heps.

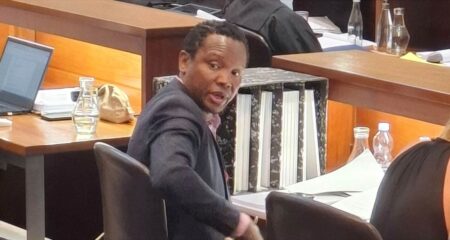

“The war in Ukraine, which followed hard on the heels of a global health crisis, continues to result in increased inflationary pressures and elevated living costs in many countries across the world, including markets where Vodacom operates,” the group’s CEO, Shameel Joosub, said in a statement.

“Vodacom has attempted to absorb considerable inflationary costs from the dramatic increase in energy costs as far as possible and … has sought to accelerate various initiatives to deliver even greater value to financially strained customers.

“These efforts, coupled with expected start-up costs associated with the recent launch in Ethiopia of a national telecommunications network through Safaricom Ethiopia, in which Vodacom holds a minority and which is accounted for as an associate, contributed to a 9.3% decline in earnings per share.”

Vodacom’s group service revenue rose by 7.7% (5% normalised) to R53.7-billion. Ebitda, a measure of operational profitability, was flat, however, impacted by higher energy and network costs.

Load shedding

Vodacom made huge investments in its network in South Africa as it fought Eskom’s intensified load shedding.

“In the past two years, we invested over R2-billion in batteries alone to enhance the resilience of our network so that we keep customers connected during extended periods of load shedding,” Joosub said.

“At the same time, we continue to work closely with Eskom to find a renewable energy solution for the benefit of our planet and customers, having announced in September 2022 an in-principle agreement with South Africa’s energy utility to pilot a programme that would see Vodacom South Africa source its electricity from renewable independent power producers and contribute this into the national grid.”

Read: Safaricom surges after securing Ethiopia mobile money licence

Vodacom declared an interim dividend of R3.40/share. It also changed its dividend policy to pay out at least 75% of headline earnings to shareholders.

The new policy “provides scope for the group to invest within its 13-14.5% capital intensity target, de-lever the balance sheet, and accommodate the upstreaming and dividend pay-out profiles of Safaricom and Vodafone Egypt”, it said. – © 2022 NewsCentral Media