Interest in hybrid and electric cars is skyrocketing in South Africa as consumers, driven in part by the steady decline in the cost of these vehicles, increasingly consider them as an alternative.

Interest in hybrid and electric cars is skyrocketing in South Africa as consumers, driven in part by the steady decline in the cost of these vehicles, increasingly consider them as an alternative.

This is a key finding in a new survey by PwC on South Africa’s economic outlook, published on Wednesday.

The document is based on PwC’s Voice of the Consumer Survey 2024 and examines what consumer trends mean for the country’s economic prospects.

Consumer spending makes up 60% of South Africa’s GDP, PwC said, and so shifts in their spending behaviours can have a direct impact on entire industry sectors.

PwC found that the cost of living is the top economic concern among South African consumers, with salaries and wages not keeping pace with inflation.

According to the survey results, 82% of South Africans would be willing to use public transport if their area had better public transport infrastructure. Commuters are willing to swap private transport for public options due to increasing congestion, road safety concerns and the rising cost of private transport.

As another alternative to traditional private transport, however, more than three-quarters of those surveyed (76%) indicated that they have an appetite to buy a hybrid (48%) or electric vehicle (28%).

Sales figures

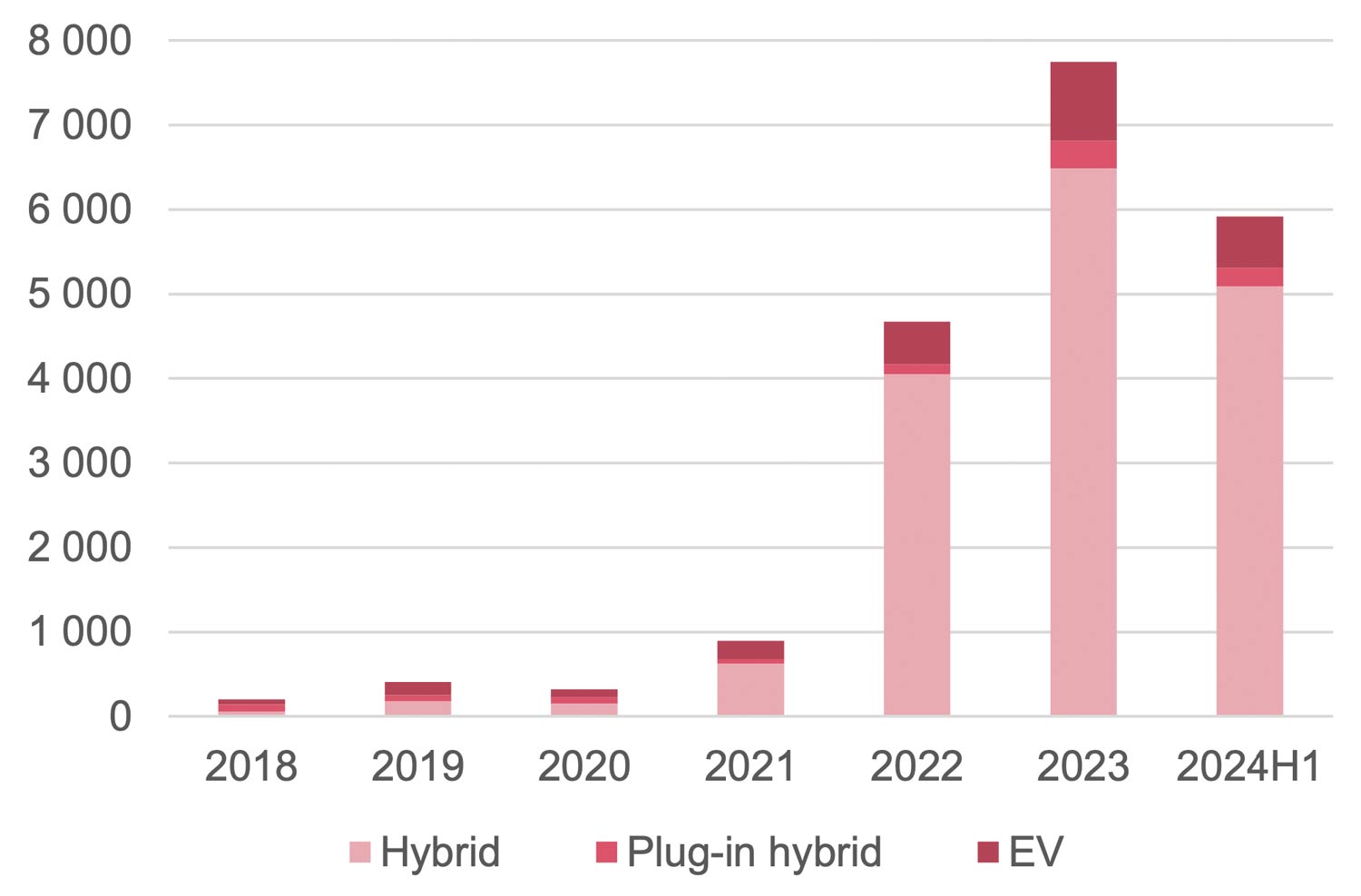

“Data from the Automotive Business Council (also known as Naamsa) shows that combined sales of hybrid drivetrain vehicles and EVs increased 65% last year to 7 746 units,” PwC said. “Sales of traditional hybrids increased by 60% in 2023 to 6 484 units on the back of rising domestic production and increased imports from China. South Africans also bought 929 pure EVs, up 91% from 2022.”

PwC said EV sales already reached 610 units in the first half of 2024, and if this momentum is retained a full-year EV sales figure of around 1 200 units would be nearly 30% higher than 2023’s sales figure.

“To be fair, reported appetite for EV and hybrid ownership is often overstated in surveys like ours compared to actual purchasing intentions. It is easy to say that you would want to own an EV, while the realities of constrained supply, charging challenges (load shedding), range anxiety (the fear that an EV will run out of battery before reaching a charger or destination) and initial purchase cost most often outweigh this interest in favour of internal combustion engine (ICE) vehicles,” the PwC report said.

“Unsurprisingly, while EV sales have increased significantly over the past several years, they still comprise only about 0.2% of total vehicle sales. However, in South Africa, the rising cost of ICE transport and the declining market entry price point of EVs is resulting in increased interest in and actual purchases of EVs.”

At the start of July, the most affordable full-sized EV available on the local market cost close to R540 000, down R150 000 from a market entry price point of around R690 000 in 2022/2023. “This is certainly supporting the increase in EV sales in 2024.”

Indeed, the price of entry-level EVs in South Africa is now below R400 000 with the news on Tuesday that Enviro Automotive is launching the Chinese-made Dayun Yuehu S5 compact SUV for a recommended starting price of R399 900.

Citing Statistics South Africa, PwC said the cost of operating a private vehicle – including fuel and other running costs – doubled over the past eight years, supporting a shift to public transport and to new-energy vehicles. – © 2024 NewsCentral Media