The latest financial results from JSE-listed Blue Label Telecoms, for the year ended May 2014, provide insight into just how challenging telecommunications operator MTN is finding the intensified levels of competition in South Africa’s mobile market.

Blue Label is by far South Africa’s largest distributor of prepaid airtime, and so its sales in this space largely reflect the performance, at least in the prepaid market, of the country’s four mobile operators.

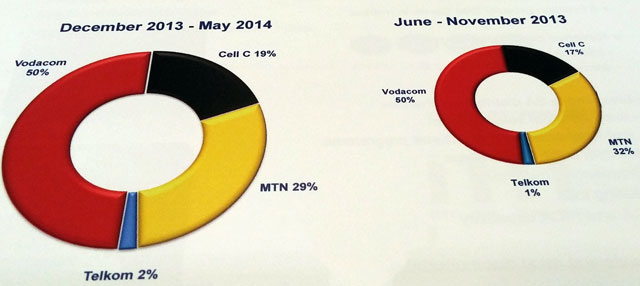

In the past six months, MTN’s share of the rand value of outgoing prepaid airtime sales for Blue Label has fallen to 29% from 32%, while Cell C has increased its share from 17% to 19%. Vodacom has remained steady at 50%, while Telkom Mobile’s contribution doubled from 1% to 2%.

“This has to be an indication of what is going on in South Africa,” says Blue Label co-CEO Brett Levy. “Something is cooking in the South African telco market.”

About 85% of Blue Label’s airtime sales are through informal channels, mainly in rural parts of South Africa. The rest come through formal channels, such as the big supermarket groups.

Levy says the fall in MTN’s market share in the past six to 12 months is “significant”. Though it’s fallen by three percentage points in the past six months, the decline over the past year has been even more precipitous, tumbling from 36%, or seven percentage points.

“That is coming off a very large number,” says Levy.

Cell C appears to have picked up most of MTN’s share.

However, Telkom Mobile is executing better on its strategy by doubling its market share, albeit off a small base, Levy says.

“Cell C, from our point of view, is fighting on the streets. It has become the consumer champion. MTN finds itself in a much more difficult position and has a lot to do in the next 12 months.”

MTN said earlier this month that it is “cautiously optimistic” that it has turned the corner in its South African operation after reporting 400 000 net subscriber additions in July.

For the six months to 30 June 2014, MTN South Africa’s revenue slumped by 7% and its profit margin, measured before interest, tax, depreciation and amortisation, slid by 1,5 percentage points to 33,3%.

Cuts to mobile call termination rates — the fees operators charge each other to carry calls between their networks — also hit the operation hard.

The improvement in net additions in July followed a positive second quarter, where South Africa added 394 000 customers. But this wasn’t enough to counter a decline of 825 000 in the first quarter as consumers opted for other networks.

The Blue Label numbers exclude contract customers, which are more lucrative for the operators, particularly for MTN and Vodacom, which were licensed earlier and so were able to sign up high-spending early adopters.

Levy says South Africa’s telecoms landscape has changed dramatically in the past year. Operators are under enormous margin pressure, but “pricing is coming down to a more reasonable level” and this is “playing into consumers’ hands”, he says.

He adds that the changing landscape is going to play into Blue Label’s strategy. “The greatest asset a network can have in the next 10 years is to have the best distribution channel … and this is how we have set ourselves up.”

The company has spent R92m in the past 12 months to make itself “more relevant in the prepaid space”. This has included getting “foot soldiers” and sales trucks on the streets in both urban and rural areas to sell its prepaid products. — © 2014 NewsCentral Media