Cape Town-based cryptocurrency security specialist Cardware Wallet has launched what it claims is the first digital asset hardware wallet designed and manufactured in South Africa.

Cardware Wallet allows owners of digital assets such as bitcoin and ether to store their private keys on the device, promoting the self-custody of crypto assets – enhancing security.

“About a year ago, we started playing in the space of looking at consumer-based products within the market and there wasn’t a product available that we could say objectively followed security best practices,” said Greg van der Spuy, co-founder and CEO of Cardware Wallet, in an interview with TechCentral. “Also, the price of these units was unbelievably expensive, specifically when looking at addressing the African market.”

Cardware Wallet has launched at a price of US$77 (R1 350), which, according to Van der Spuy, is “multiple times cheaper” than the next-best competitor once shipping costs and import duties are factored in.

The unit is powered via a USB-C port but is configured so that no data can be transferred, minimising the risk of the wallet being hacked physically through the port.

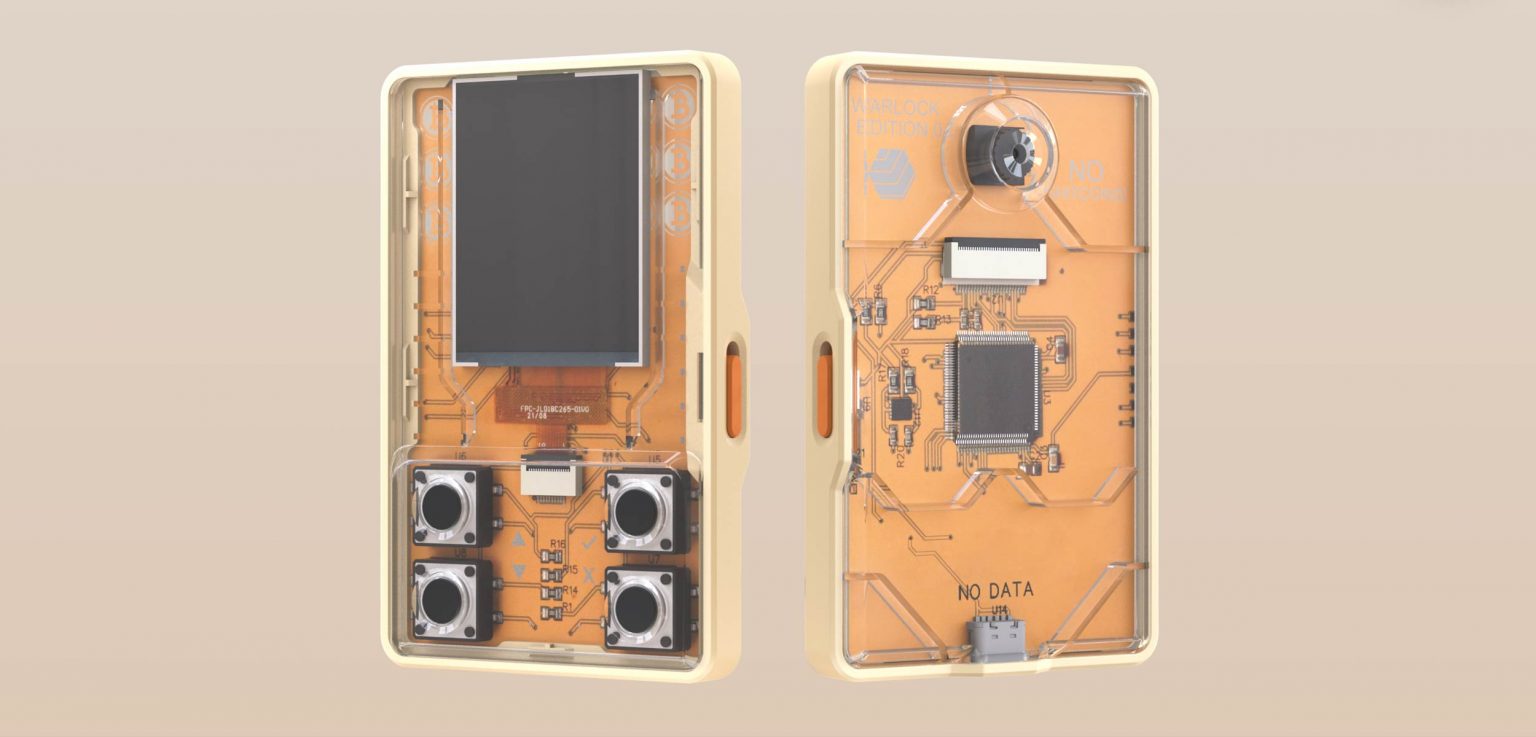

Other than the main processing unit and some buttons, Cardware Wallet relies on a CC EAL6+-certified chip for the generation and storage of private keys. The chip is designed to self-destruct if tampered with physically, rendering the keys inaccessible to the would-be hacker.

According to Van der Spuy, Cardware Wallet aims to build trust in its products through transparency. The ethos is apparent in the transparent design of the wallet itself, whose clear casing allows anyone looking at it to see its circuitry and components within.

Open source

In the same vein, Cardware Wallet is also going to be making all its code open source by publishing it on the company’s GitHub page so that users can verify the company’s claim that the software controlling the wallet is also secure.

“If you have any background on how to build circuits, all you have to do is look on the board and you can see where everything is connected – there is not skullduggery,” said Van der Spuy.

There are two version of the Cardware Wallet device, with one only supporting bitcoin and the other supporting both bitcoin and all digital assets supported by the Ethereum Virtual Machine. These include ether, Avalanche, Optimism and Phantom.

Read: Sars is coming for your crypto assets

Users select the type of transaction they are performing on whichever desktop or mobile interface they prefer, and they then connect the wallet device to sign the transaction, effectively authorising it by authenticating themselves using the private key stored on the wallet.

Although various types of crypto wallet exist, hardware wallets like Cardware Wallet are considered most secure. Software wallets, which can be installed on PCs or mobile devices, provide convenience through easy accessibility, but they are vulnerable to malware.

Custodial wallets, usually provided as a service by crypto exchange platforms, are risky in that they rely on the integrity of the third party platform and faith that it will never be hacked. Incidents such as the 2014 breach of Mt Gox, which led to the loss of some 850 000 bitcoins, and the 2022 collapse of FTX, where user funds were mismanaged by the platform’s administrators using access to private keys, have, however, highlighted the flaws in custodial solutions.

Custodial wallets, usually provided as a service by crypto exchange platforms, are risky in that they rely on the integrity of the third party platform and faith that it will never be hacked. Incidents such as the 2014 breach of Mt Gox, which led to the loss of some 850 000 bitcoins, and the 2022 collapse of FTX, where user funds were mismanaged by the platform’s administrators using access to private keys, have, however, highlighted the flaws in custodial solutions.

Paper wallets are generally used as a backup to hardware wallets, ensuring that a user can still access their crypto assets if the hardware device is either lost, stolen or destroyed. This involves writing down the 12- or 24-bit keys to access various assets/platforms. But as Van der Spuy experienced when his geyser burst over a safe keeping his paper backup “secure” in the past, this solution has vulnerabilities, too.

To circumvent these, Cardware Wallet supplies a metal scratch card along with each device to be used as a “paper” backup as the metal is fire and water resistant.

Van der Spuy said Cardware Wallet is also available on a white-label basis so that crypto asset platforms and other third parties can put their own branding on the product and provide it to their customers. He said the company expects to bring the cost of the device down to $39 dollars should it reach scale in the “hundreds of thousands”.

“We build it in South Africa because we want to be completely sure that no international suppliers add malware to their components before shipping them to us. We also want to be sure that the solution is suitable to the local market,” said Van der Spuy. – © 2024 NewsCentral Media

Get breaking news from TechCentral on WhatsApp. Sign up here.