Listen to the author read this column:

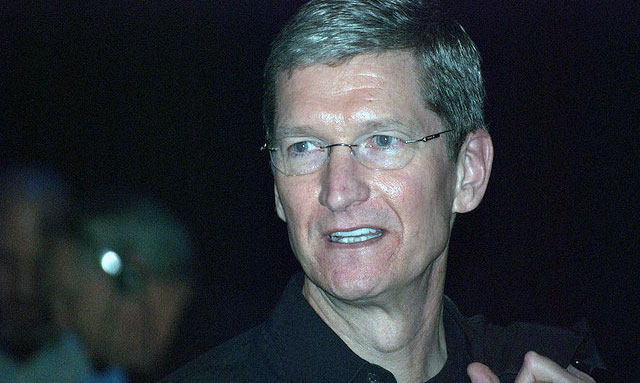

[audio: https://techcentral.co.za/wp-content/audio/columns/dm-col-01022015.mp3] Staggering. That’s the word Apple CEO Tim Cook used in the company’s first-quarter conference call with analysts this week to describe demand for its new smartphone models, the iPhone 6 and iPhone 6 Plus.

Staggering. That’s the word Apple CEO Tim Cook used in the company’s first-quarter conference call with analysts this week to describe demand for its new smartphone models, the iPhone 6 and iPhone 6 Plus.

Staggering is also a great word to describe Apple’s first-quarter numbers more broadly. Breathtaking and mind-boggling are other adjectives that spring to mind.

Not only did Apple beat the consensus profit and revenue forecasts of analysts by a wide margin, it also reported the largest net profit of any public company in history, blowing away previous records set by Gazprom and ExxonMobil (when oil was well north of US$100/barrel).

For every day in its first fiscal quarter, which coincides with the pre-Christmas spending spree, Apple made, on average, $195m (that’s more than R2bn) in net profit. That’s $8m/hour.

Not surprisingly, Apple’s share price surged in the wake of the earnings release. The company’s market valuation has more than doubled since Cook took the reins from Steve Jobs, allaying earlier fears that Jobs’s death would stall the growth momentum of the past decade.

Operating cash flow in the quarter was a remarkable $33,7bn. In the past 12 months, Apple has paid $57bn to shareholders through capital returns. The dividend flow shows no sign of letting up as Apple expanded its gross margin strongly in the quarter to 39,9%, from 37,9% a year ago.

With the Apple Watch, its first new product category to be launched since Jobs died, Cook will be hoping the wearable computer will keep the numbers buoyant.

But there’s also danger lurking in the numbers.

In the first quarter, iPhone sales accounted for a remarkable 68,6% of Apple’s total sales. It’s in danger of becoming a one-product company, with all the attendant risks.

Apple sold a record 74,5m iPhones in the latest three-month period. The smartphone’s contribution to sales has risen from 56,2% in the same quarter a year ago. Apple is now, in effect, a cellphone company.

One bad iPhone release could prove catastrophic for its revenue, profits and share price. It’s not as if consumers don’t have other choices if Apple fumbles a future iPhone release. That it hasn’t done so yet is no predictor that it won’t in future — 10 years ago, no one would have imagined that Nokia, which once dominated the cellular handset business, would fall so hard and so fast.

In Apple’s first quarter, sales growth in other categories was more pedestrian: Mac revenue climbed 9% — still a good performance, to be sure — and services, mainly the App Store, also rose by 9%.

But iPad revenues went backwards, with unit sales down by 18% and revenue down by 22% as consumers snapped up cheaper products from rivals or as existing users shied away from upgrading.

iPod sales are continuing their multiyear decline, cannibalised by smartphones.

Apple’s management team must surely be keenly aware of the need to diversify its revenues away from the iPhone. And Cook and his lieutenants must also surely be hoping that the Apple Watch, when it is launched to consumers in April, will at least kick-start that process.

There is little doubt that Apple’s new wearable computer will be the hottest-selling smartwatch in history. But sales may yet fall short of expectations, at least at first.

For one thing, the device has to be paired at all times with an iPhone, limiting it to a subset of the global market. For another, the Apple Watch does not appear to have caught the imagination of consumers in the same way that the iPhone and iPad did when they were announced.

Of course, one must never discount the power of Apple’s brand or the intensity with which consumers aspire to own the company’s products. There’s a reason it’s the most profitable and valuable company in the world.

But the more the iPhone succeeds, and the longer it takes for Cook to diversify revenues, the greater the risk becomes of Apple turning into a one-trick pony.

- Duncan McLeod is editor of TechCentral. Find him on Twitter

- This column was first published in the Sunday Times